In moments like this, when noise and uncertainty prevail, it’s worth remembering an ancient truth. The proverb “This too shall pass”, which was popularised by Abraham Lincoln, reminds us that both hardship and exuberance are fleeting, and perhaps that our market is better understood through the long lens of history than the short echo of headlines.

London has weathered countless headwinds and yet has always managed to reassert its global relevance.

Politics pervades

While the media narrative around so-called “Wexit” has reached near-frenzy, with as many as 30 news pieces a day on the topic, the reality, as ever, is more nuanced. Yes, there is overwhelming evidence that many have departed these shores, certainly many more than Advani and Summers predicted. Those leaving also represent some of the wealthiest non-doms, who contributed very significant sums to the Exchequer. However, estimates from private banks and leading advisory firms suggest this may represent just 10–20% of the cohort, rather than a wholesale departure as the negative news loop would have you believe.

At the same time, new arrivals continue, with some viewing the incoming FIG regime as more attractive than its predecessor, although the four-year window for income tax and nine-year horizon for inheritance tax remain points of concern respectively (both are too short). There are signs that the Government has been alert to these issues, with early briefings around visa reform and a possible fixed-fee alternative to the current cliff edges. However, the recent welfare policy reversal and growing calls from some MPs for a wealth tax suggest an active insurgency from the Left.

We should all hope that the pragmatic wing of the Labour Party asserts itself over its ideological flank, recognising that the long-term growth they need depends not only on fairness, but on a clear understanding of economic reality and not a preoccupation with the politics of redistribution.

The law of averages

The transition from the long-standing non-dom regime to the new FIG framework was always going to create friction. Early-stage implementation issues, including unresolved questions around disclosure and the absence of a tailored visa route, have compounded this. Coupled with global macro pressures, including US tariff action and an unexpected weakening of the dollar, a slowdown in activity across a discretionary market such as ours was always likely.

However, that slowdown appears less pronounced than we expected, and certainly less dramatic than most media commentary would have you believe.

We recently highlighted the challenge of defining what constitutes a “normal” market after the turbulence of the last decade – an issue that leaves space for distorted narratives and selective comparisons. For this reason, we prefer to focus on long-run averages rather than hand-picked year on year comparisons.

We prefer to focus on long-run averages rather than hand-picked year on year comparisons

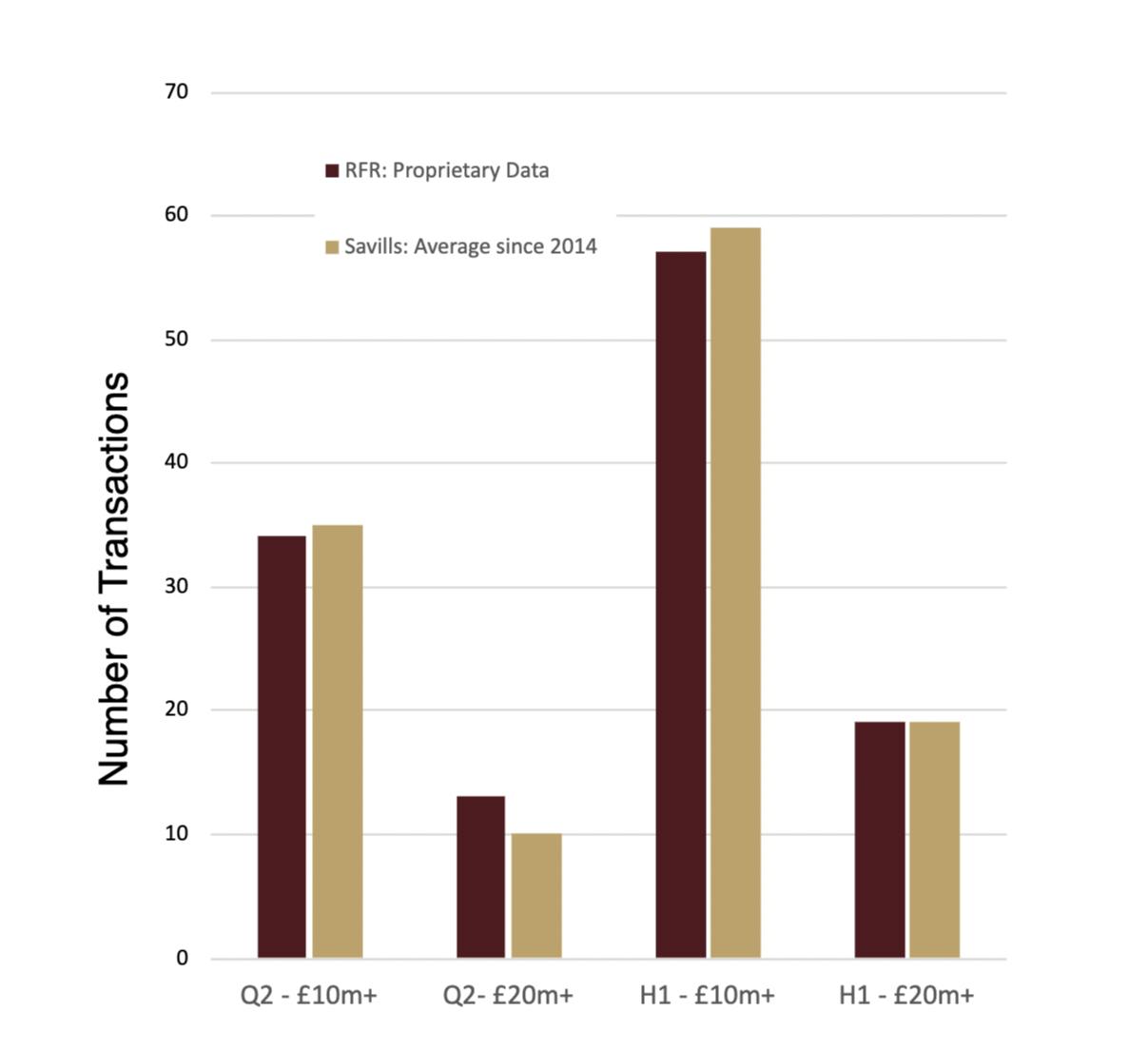

When we take our own live proprietary data for transactions in Q2 and H1 and compare it to the long run averages (taken from Savills research data), transaction volumes in the prime London market remain broadly in line with historical norms.

To put this into figures, in Q2 we tracked:

- ~ 34 transactions over £10m compared to a 12-year Q2 average of 35

- ~ 13 transactions over £20m compared to a 12-year Q2 average of 10. This represented the second-highest Q2 figure since 2014 (although this may be slightly skewed by quieter Q1 data at this level)

In H1 we tracked:

- ~57 transactions over £10m compared to a 12-year H1 average of 59

- ~ 19 transactions over £20m which matched exactly the 12-year H1 average

This suggests a market performing broadly in line with the long-term averages, although clearly subdued on the post pandemic highs. To give this visual context, the Q2 and H1 figures are in RFR colours below with the twelve year averages in yellow. There really isn’t much between them:

Based on our data, domestic, European and US buyers continue to dominate the market, but we are also now seeing a steady increase in buyers from the Gulf States. One such buyer from Saudi Arabia recently commented to us that, amongst his peers, there is a perception that now could represent the bottom of the market for London. I didn’t affirm his view but merely noted John Galbraith’s famous line that “there are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know”.

Buyers continue to favour houses over apartments, with houses making up more than 70% of the £10m+ transactions in Q2

Buyers continue to favour houses over apartments, with houses making up more than 70% of the £10m+ transactions in Q2. Again, the vast majority of properties that traded in H1 were in good condition or turnkey condition, continuing a trend that began in 2020 during ‘lockdown’. We continue to see a herd mentality, with competitive bidding for the best properties and a return of gazumping on at least 3 high value transactions in Q2. On one apartment we were involved in in Holland Park, the property went to sealed bids with six bidders competing above the asking price.

Quality underpins liquidity

Ultimately the market remains highly segmented, with the best properties trading (often competitively) while compromised properties struggle with liquidity.

Much of the commentary in circulation from our peers around discounting, in our opinion, misrepresents the market. Where price adjustments occur, they often reflect a correction to a previously inflated asking price, rather than evidence of a market in precipitous decline. Opportunities do exist, particularly for properties requiring complex or capital-intensive projects, but most of our clients remain focused on acquiring homes, not projects. We continue to warn those chasing discounts that often the discount is illusory, and the property is fundamentally compromised.

Like in other illiquid asset classes, from fine art to private capital, quality remains the primary determinant of liquidity and value.

Reframe the policy

If the UK Government can address the treatment of inheritance tax and introduce a visa that coheres with the new FIG regime (and, critically, supports its broader growth objectives), there remains a credible path for many recent departures to return. For some, the distinction between resident and non-resident is only a matter of counting extra days and it is clear that for the most part those departing are not in any hurry to sell their London homes. For others, the experience of living overseas may prove that the grass is not always greener (or as soft!).

Whilst in Lisbon last week meeting a client, we spoke with an investment banker who had left London in 2016 – in his words, “a casualty of Brexit”. He has since lived in Amsterdam, Frankfurt and Dubai, yet reflected openly that “none of them are London.” After nearly two decades in our city, the sentiment from him and his family was unmistakable: they miss it.

London remains a truly exceptional city – one of the few truly global capitals. It offers a scale, depth and connectivity few other cities can replicate and it should continue to attract global families and their capital. But, if the tax framework (particularly inheritance tax on worldwide assets) remains uncompetitive or overly aggressive, and the visa position is not made more accessible, the UK risks deterring not only inward investment, but long-term settlement. The consequence is not abstract: it will be measurable and damaging.

The Government should not lose sight of the fact that London and its ecosystems contribute close to a quarter of UK GDP

The Government should not lose sight of the fact that London and its ecosystems contribute close to a quarter of UK GDP. It is one of the top two global cities by every meaningful metric. That status is not immutable and it is not our God given right. History, and the 1970s in particular, make that clear.

Final thought: trees of the future

Warren Buffett once observed that “someone is sitting in the shade today because someone planted a tree a long time ago.” Many of our international clients have a prior connection to London — they studied here, worked here early in their careers, or spent formative time in the city. Those ties endure. As wealth accumulates, the instinct to return to our city deepens.

It is a long-term connection that London cannot afford to erode. Protecting the strength of our education system — a key global draw — and ensuring we continue to attract and encourage the best talent are not abstract policy choices. They are directly relevant to the capital, people and advocacy that will underpin London’s pre-eminence for decades to come.