Property Market News

‘Renters have joined homeowners in the race for space by rushing to the suburbs’ – Hamptons

Hamptons has seen a rise in the number of renters moving out of London in search of more space.

UK house prices hit a four-year high as demand for outside space continues to climb

"The latest RICS survey provides firm evidence of a strong uplift in activity in the housing market which should help support the wider economy gain traction over the coming months," says RICS' Chief Economist…

Scotland’s property market ‘has gone from zero to full ahead in the blink of an eye’

"In Scotland, the opportunity to re-think lifestyle choices has been catalysed by an extraordinary alignment of supply and demand," says DM Hall.

More countries see house prices begin to fall

The average house price across 56 countries and territories increased by 4.7% in the year to 30th June, reports Knight Frank, in a Global House Price Index that "offers a glimpse into the impact of Covid-19.

Transaction numbers likely to end the year 15% down, predicts Knight Frank

"This does not feel like a re-run of 2008/09 for the UK property market," says Knight Frank, as it forecasts minimal property price drops against a complex economic backdrop.

Speedy home-sales pick up as Stamp Duty holiday boosts the market

One in seven homes listed since the Stamp Duty holiday was announced in July sold within a week, says Rightmove, up from one in ten during the same time last year.

Offers accepted hit an all-time high in London during August

Another report on the post-lockdown Summer buying flurry, as Knight Frank reports "few signs of the high levels of demand we’re been experiencing since the market reopened abating."

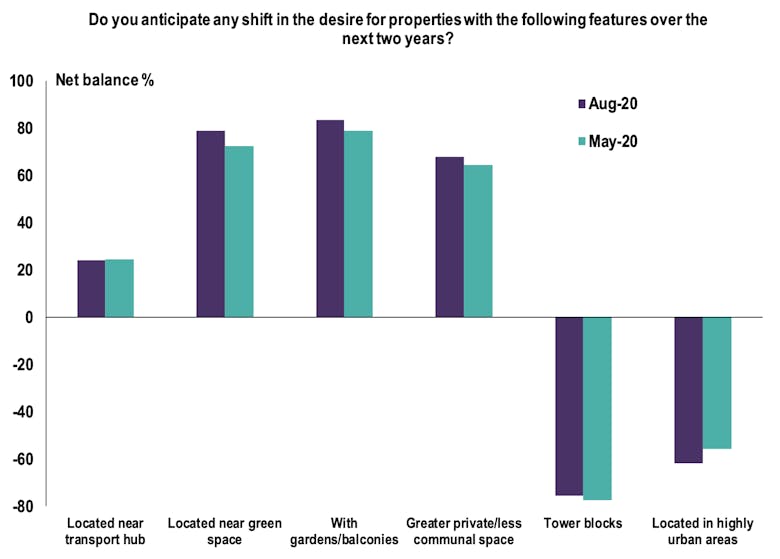

‘Covid-19 has increased the desire to move home, with more space the key driver’ for prime buyers

The latest Savills buyer survey reveals "a greater urgency in the desire to move home", allowing the top-end estate agency to predict that the current surge in buying activity will continue beyond the…

Slim pickings for buyers as lenders cull mortgage products

A typical buyer with a 10% deposit currently has a limited choice of around 60 mortgage products, according to Moneyfacts - down from 779 at the start of March.

Mapped: Britain’s hottest property sales markets

375 of the 378 local authorities across the UK saw more agreed sales this Summer than last, says Savills, with both London's commuter zone and more rural locations seeing sharp rises in property market…

Average house prices nudged up by 0.3% in May – UK HPI

The average UK house price increased by 2.9% over the year to May 2020, up from 2.7% in April, according to the latest official UK HPI update.

Rental viewings ‘hit a ten-year high’ in August

A late student flurry, a glut of stock, and falling rental prices boosted lettings market activity in August, reports Knight Frank.