On April 1st 2020, when the UK had been in lockdown for exactly nine days, Tim Hyatt took over the management of Knight Frank’s UK residential business and joined the group executive board. He succeeded Andrew Hay, who had been with the firm for 37 years. PrimeResi caught up with him shortly after the announcement of a third national lockdown to talk team spirit, market trends, future plans – and the agency’s ‘Cobra Room’ equivalent…

As someone who’s been in the agency business since 1991, how does the Coronavirus crisis compare to previous market challenges?

To put it simply, like no other I have ever experienced. The crisis has had a huge impact on our teams, our clients and each of us in a far more personal way than during any other crisis over the last two decades. At the same time, we have adapted to virtual working whilst experiencing some of the strongest conditions in the residential market that we have ever seen.

The crisis has had a huge impact on our teams, our clients and each of us in a far more personal way than during any other crisis over the last two decades

The Global Financial Crisis (GFC) was one fuelled by sub-prime mortgage lending, high levels of household debt and deep-rooted weak spots in the economy. That is not the case now. Unlike the GFC, the UK Government was fast to step in with an unprecedented support package for companies up and down the country. For us as a property firm and independent partnership, this has supported us in retaining our best talent who continue to service our clients.

However, we must be realistic that the true economic impact and damage created by this virus is still yet to be realised. A good barometer of this is what will happen in the City and if there will be widespread job losses as the Government’s Coronavirus Job Retention scheme comes to an end on 31st March. In the GFC, we saw the emergence of the accidental landlord as a result of a dramatic fall in prices in the property market. This left many unable or not prepared to sell at such a loss; however these hard price falls we saw in 2008 are just not the case today.

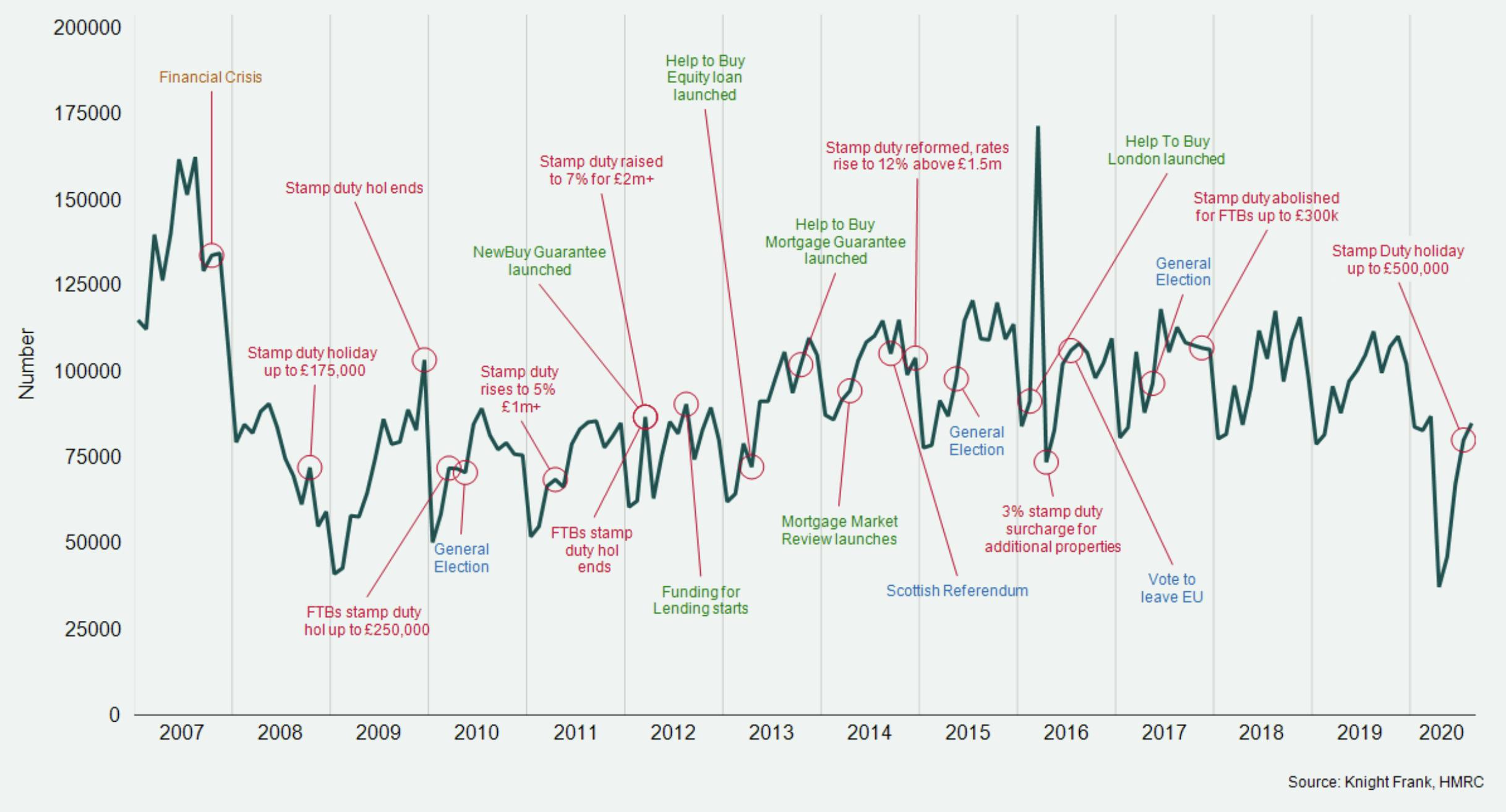

Below is one of my favourite visual aids; a detailed calendar of transactions since 2007. It demonstrates the property market’s resilience over the last decade and how it recovers time and time again.

Where do you foresee the market going from here, and what steps are you taking to prepare the agency for potentially a tough few months ahead?

The Sunday just before I started my new role running the residential business, my kids asked me why I was so busy. I had to explain that for the first time in our 125-year history, I was just about to close down 59 offices across the country.

It has been difficult throughout this period to make any sort of sensible predictions, but what we have done is spend a huge amount of time making sure we look after the best interests of both our employees and clients. Good internal communications have been an essential part of this, making sure everybody is clear on our plans on a day-by-day basis.

Because we are a global firm, we have been very fortunate in being able to learn important lessons from our colleagues around the world. We have had to face the same challenges, but at different times. Their advice and experience has allowed us to continue to trade and operate within this ‘new normal.’ We set up a ‘Cobra Room’ equivalent called the Business Response Board, which at the peak was meeting three times a week to discuss the best interests of our clients and teams.

We set up a ‘Cobra Room’ equivalent called the Business Response Board, which at the peak was meeting three times a week to discuss the best interests of our clients and teams

For now, one of our primary focuses is to take the lessons we have learnt, review all our processes and become as effective as possible. We have a sharp focus on modernising the way we operate through various digital tools.

We are building an investment fund to look at opportunities the virus has created in the world of property, particularly within the digital space. For example, during the summer we trialled a new auctions business, which was a huge success and has now become a more permanent part of our wider offering. We are also setting up a new FCA regulated capital advisory business. Elsewhere, we are looking closely at the world of hybrid estate agency and creating a training academy in order to offer a better service to clients and recruit first class people from outside the property industry.

Coming back from the Christmas break, we have three months until our financial year-end with the biggest pipeline we have ever had. Our focus is ensuring we get as much of this over the line as possible, whilst being conscious of not putting undue pressure on our people or those working with us in alternative business services, such as surveyors and solicitors.

What are the biggest practical challenges being faced by your teams at the moment, and how will the pandemic influence working practices in the industry going forward?

The first major difference in this latest full lockdown is that we’ve been able to stay open. However, as I have said, each of us is starting to experience friends and family coming down with the virus – which we didn’t see in such numbers the first time around.

As an industry I believe we must continue to come together and respect each and every one of the guidelines that have been set out by Government.

By far the biggest practical challenge is our ability to deal with the extraordinary level of demand we continue to see. We are better prepared than during the first lockdown. Our teams have adapted to working remotely and in a different environment. We have spent a great deal of time finessing our style of communication and methodology, using social and digital platforms.

In time, we will begin to see groups of agents operating out of central, regional or city centre hubs. Negotiators will become more agile, roaming across a much wider geographical area or patch

Looking further into the future, I think we will start to see a new form of dynamic working across large-scale agencies. One of the limiting factors to the traditional agency model is that it ties agents to just one place. In time, we will begin to see groups of agents operating out of central, regional or city centre hubs. Negotiators will become more agile, roaming across a much wider geographical area or patch. This will enable cross selling, better communication and ultimately a more diverse and improved service for clients.

How are you maintaining morale and team spirit in these challenging times?

The Christmas holiday did us all the world of good! From a mental health and well-being perspective, the break could not have come sooner. One of the partnership benefits is that the firm closes between 24th December to 4th January, offering the teams the much needed downtime they deserve. I truly believe the firm’s partnership structure and culture means we are the first to support each other – it is part of our DNA.

From my perspective, one real positive from lockdown has been the improved and more regular firm wide communication, I know I am speaking with our teams across the UK on a much more regular basis. We have run a series of entrepreneurial internal webinars helping people to stay connected with everything that is going on in the world of property.

Morale has also been kept high by our teams running online quizzes each week, ‘bake off’ style challenges and one of our office heads has recently told me they are doing virtual team yoga sessions every Tuesday at 5pm! In December, we had a Christmas party at The Comedy Store with 30 socially distanced attendees and a live stream for all teams across the UK. Looking to the immediate future, we will be supporting LandAid Sleep Out, sleeping outside our own homes in the coming weeks.

Lots of our people are parents so embracing an increasingly flexible working model has been key to maintaining morale and loyalty.

Has Knight Frank adapted its marketing strategies – in particular with regard to print and online advertising – in response to the crisis?

When the pandemic struck and England went into its first lockdown, we had to review our entire strategy, as we were essentially closed for business. For the first time, the firm began producing a daily research announcement for our customers and clients – offering a snapshot into all matters concerning UK and global housing trends. I personally launched a weekly update too, as we felt our clients would be hungry for information, as we all were.

We also moved a lot more into digital, vs print, as we knew printed news circulations were set to fall. Email has become an even more important channel for us, as has the phone and indeed video. Our teams were quick to adapt to online video tours, Instagram lives and webinars. We entered the world of podcasts and created “At Home With” and “Intelligence Talks”, I would encourage anyone reading this to have a listen.

In the spring we unveiled our brand campaign focused on the firm’s core principle – partnership. This has been rolled out as a fully integrated campaign across print and online.

We have led with our key positioning, stating: “Today, it’s not an estate agent you need. It’s a partner in property.” This plays to our reputation of nurturing long-standing relationships and providing support for customers throughout every element of their property journey.

We are neither beholden to shareholders, nor have any structural debt

Partnership is our key differentiator – it’s what sets us apart. We are neither beholden to shareholders, nor have any structural debt. Internally, we are accountable to each other as fellow partners, and externally only to our customers and clients. This makes us fully focused on the quality and impartiality of the advice we provide.

Portals and agents have been reporting a huge surge in demand for larger properties with gardens post-lockdown; do you see these kind of trends continuing and are there any others we should be keeping an eye out for?

From the market reopening in England (13th May) to the year end, new prospective buyers registering with Knight Frank were up 59% versus the five-year average. We also saw a record-breaking number of offers accepted in the Country business in 2020.

Homes with high speed broadband, self-contained offices, or planning permission to build one, and off street parking are at the top of most buyer’s current priorities. In central London we have also seen properties with easy access to the super cycle highways proving popular.

How effective is the off-market route proving right now? Roughly what proportion of vendors are specifying their homes are kept off the portals and open listings, and what are you advising clients who are unsure as to whether to test the market at the moment?

Off-market sales still remain in the small minority. However, if you are looking at the top end of the country house and London markets, it seems to be the way forward at the moment. At this level there are very few buyers, therefore a good agent should be able to hand pick them. This process works, but might not get the client the very best price, as you may miss certain purchasers by keeping the property under the radar.

The off-market sales process is a great stress test on pricing, market conditions and presentation; it allows us to go back to our clients with very clear feedback. Our market leading database allows us to offer our clients a discrete off market solution, if it is in their interest. However, we do not want to rely solely on it, phase two should always be an open market approach.

We are urging all are clients to be as prepared as possible before they commit to buy, sell or let. For instance, find a way to have your CDD checks in place, secure a mortgage in principle, get copies of tenancy agreements and instruct a solicitor that will act at a pace. Work out how the relative saving on stamp duty at the moment will affect your sale price. It is also worth speaking with your local authority to see how long searches will take.

With a significant uptick in applicants, especially in the country market, buyer’s ability to act at pace will pay dividends.

The Government decided to loosen restrictions on the housing market before many other sectors, underlining its importance to the wider economy; in your opinion, how could policymakers build momentum from here, and make sure the market functions in a healthy manner going forward?

Streamlining the UK’s conveyancing process would have a positive impact on the market. Covid-19 has caused significant issues at Local Authority level – there are situations where deals have fallen through because it has taken up to three months just to get a search completed. Anything that can be done here would be greatly welcomed by the industry. Potentially, this could be an opportunity to outsource certain processes to other businesses.

International buyers have been hugely important to the London market in recent years, accounting for 55% of sales in PCL in the second half of last year; with travel restrictions likely to remain for the foreseeable, how will this impact on the prime sector, and the way in which new developments are launched?

Today, international buyers find themselves in a favourable position if buying in Dollars or any currencies pegged to the Dollar. Recently, we have seen demand for UK property rising among overseas buyers as the Pound continues to come under pressure. In many cases there is a sizable, currency-led discount to be had.

There are two types of international buyer; those looking for a UK base for either business or schooling their children, and the second a more speculative investor.

What cannot be taken away from London is its leading educational institutions, the fact that it is a centre for business, finance and more widely, the UK’s world renowned legal system and highly transparent property market. As well as this, London has world class travel infrastructure and is highly connected for when restrictions are lifted. I am confident that all of these will stand the test of time and remain key drivers for international investment.

Out of necessity, technology played a huge role in the marketing and selling/letting of properties in 2020; which innovations/methods do you foresee having a lasting impact beyond the pandemic?

No doubt virtual viewings have been a success; the technology has improved no end. Internally at Knight Frank, we have invested in a new in-house sales system that has made a significant improvement to our efficiency and ability to refer business around the firm. What we have developed helps us to seamlessly cross-sell and collaborate for the betterment of our clients.

What is the best piece of advice you’ve received during your career?

A few stick out:

- Never look behind you, always look ahead

- There’s nothing you can do about yesterday, but there certainly is something you can do about tomorrow

- Never have an opinion when selling a product

- A sale is a transfer of enthusiasm