The Market

‘House price inflation is losing momentum fast’ as home-buyer demand plunges 44% – Zoopla

"A widespread repricing of housing underway," says Zoopla, as buyer demand sinks and more vendors cut asking prices.

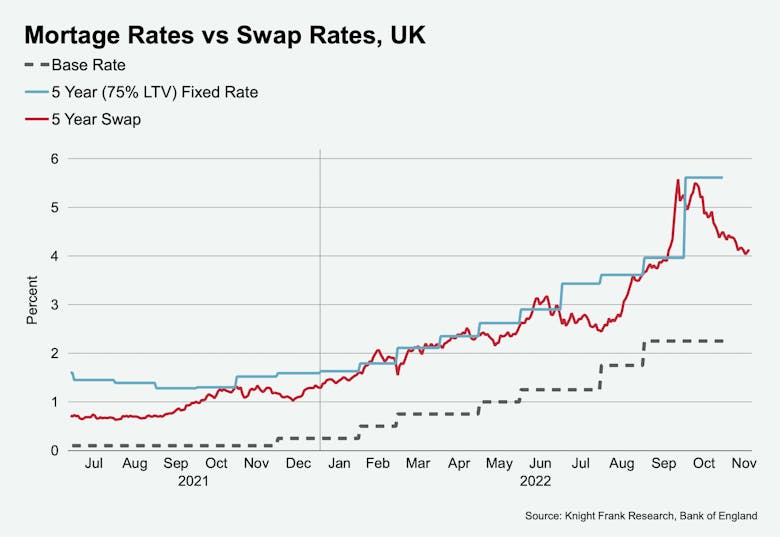

Mapped: The markets most insulated from rising mortgage costs

Prime property markets are relatively insulated from mortgage rate hikes, says Knight Frank - but transaction numbers are still likely to drop-off in the coming years as the wider housing market cools.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Knight Frank, Rightmove, LSL, Savills & more...

Calculating the prime coastal village premium

The average value of prime property in the UK's coastal villages has soared by over 26% since early 2020.

‘The most competitive rental market on record’: Tenant demand climbs as would-be buyers hold fire

Demand for rental homes is rising as some would-be buyers pause to see what happens with mortgage rates in the new year, says Rightmove.

Market-watchers agree house prices will fall – but by how much?

A raft of influential property market-watchers have torn-up their house price forecasts, now anticipating a particularly rough year ahead for the housing sector as the wider economy struggles.

FT: Why prime property buyers are sticking to central London

Property journalist Hugo Cox highlights the enduring appeal of Prime Central London compared to Nine Elms.

The Music Has Stopped: On the end of the cheap money era

There are going to be some incredibly good investment opportunities in the months and years ahead, suggests James Wyatt.

How well is the housebuilding sector placed to cope in the event of a downturn?

While development volumes are likely to be disrupted over the next 18 months with lower levels of activity, Savills expects continued demand for new homes and therefore development land in the medium to…

House purchase mortgage approvals on track to fall by 13%

'We expect to see mortgage approvals for house purchases take a notable dip come the end of this year,' says Octane Capital after checking BoE data.

PCL boundary has shifted, says west London agency

Finlay Brewer suggests the prime villages of Brook Green, Brackenbury and Askew should be reclassified, following a rise in the number of wealthy families moving in from Kensington & Chelsea...

What the Autumn Statement means for the UK property market

Financial markets have been calmer since Jeremy Hunt took to the floor, but the reversal of Kwasi Kwarteng’s stamp duty cut highlighted a paradox, writes Tom Bill.