International Markets

Postcard from Toronto: ‘Predicting a fire sale would be premature’

Jeremy Finkelstein of Harvey Kalles Real Estate shares some valuable insights into the Canadian real estate market, highlighting some familiar themes for UK market-watchers...

Philip A. White Jr. of Sotheby’s International Realty on where luxury markets are headed in 2024

'I’ve always said that the high-end leads us out of an economic downturn, and that’s what we see now'

‘Proud to pay more’: Most HNWIs want higher wealth taxes, say millionaires

'The true measure of a society can be found, not just in how it treats its most vulnerable, but in what it asks of its wealthiest members,' say Patriotic Millionaires Marlene Engelhorn and Stefanie Bremer.

Eurozone house prices ‘could be at an inflection point’

Oxford Economics believes house prices across Europe will have seen a peak to-trough decline of around 3% before things turn up.

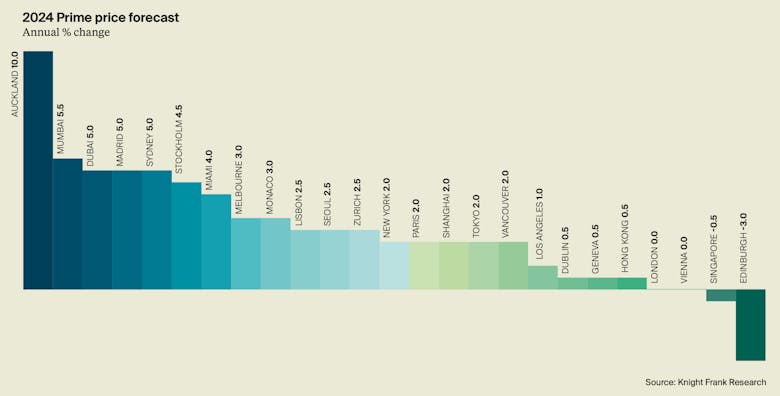

Global city price growth recovers as interest rate cuts loom

'Homeowners are breathing a sigh of relief as interest rates appear poised to decrease in 2024,' says Knight Frank's research chief.

Global housing markets show ‘surprising resilience’ in the face of higher rates

'The resilience of global house prices is surprising in light of rising costs for mortgage borrowers,' says Knight Frank - although resi transaction numbers have tumbled by 15% to 25% in many developed…

Knight Frank upgrades global house price forecasts as ‘some prime buyers appear confident that the worst is now behind us’

'Cautious optimism is emerging as prime buyers consider economic headwinds to be easing,' says Knight Frank, as the property firm raises its outlook for international resi price growth in 2024.

Pace of global property price growth to ease, suggests Reuters poll

'Strong demand and tight supply' will 'overshadow higher interest rates' to push international home values up in the coming year, says Reuters after polling over 100 property market experts.

Ranked: The world’s most expensive cities in 2023

Across the 173 cities analysed by the Economist Intelligence Unit, cost of living prices have risen by an average of 7.4% in the last year.

Postcard from Marbella: Open houses, gated communities & a remarkable transformation

'The Marbella market no longer just follows trends;

Five cities buck global super-prime slowdown

Hong Kong, Dubai, Geneva, Miami & Sydney all saw $10mn-plus sales rise over the last quarter, reports Knight Frank.

London’s super-rich turn to rental homes as ‘rival wealth hubs’ entice billionaire buyers

Fresh analysis by luxury estate agency Beauchamp Estates looks into the wealth and lifestyles of the global super-rich.