Buyers broke numerous cryptocurrency records in 2021, and 2022 looks bright, writes Sotheby’s International Realty in its latest Luxury Outlook report.

“There is an upward trend of people using digital assets to buy luxury goods,” says Max Dilendorf, partner, Dilendorf Law Firm, who specializes in structuring real estate transactions using cryptocurrencies. “We represent a lot of clients in these transactions as lawyers and escrow agents.”

While Dilendorf recognizes that some sellers may be hesitant to take bitcoin or other cryptocurrencies by virtue of how new they are, “by accepting bitcoin for real estate or any other luxury good, you increase your chance of selling,” he says.

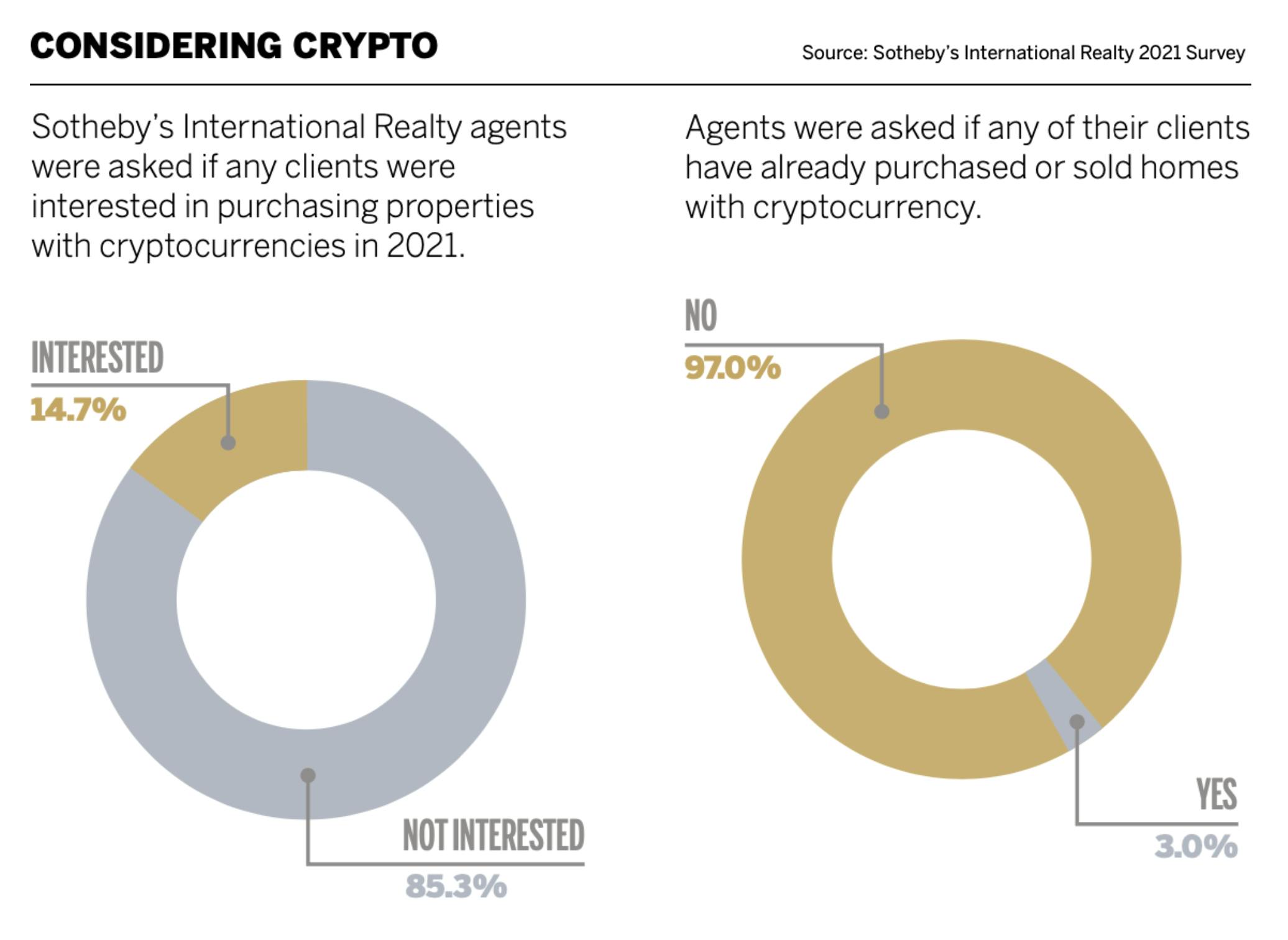

In May, a Miami penthouse made headlines when it sold for the equivalent of US$22.5 million in cryptocurrency. In September, the property hit the market again with some renovations and a US$28 million price tag. Again, the realtors would accept cryptocurrency. But one reason this particular deal made headlines is that at the moment, it’s rare.

In Bucharest, Monica Barbu, CEO, Romania Sotheby’s International Realty, is representing a seller who will accept cryptocurrency for the sale of a pop art–themed penthouse. It’s the first luxury property in their office to be made available for purchase by bitcoin, she says.

Barbu says the seller may consider other forms of cryptocurrency, but the preference is bitcoin, since the seller is invested in it already.

In New York City, the seller of a limestone mansion located half a block away from Central Park will accept cryptocurrency. Cathy Taub, senior global real estate advisor, Sotheby’s International Realty–East Side Manhattan Brokerage, represents the seller and said it wouldn’t be the first time her clients have dealt in cryptocurrency.

“Generally, in my experience, sellers who accept crypto think of bitcoin and certain other crypto as digital gold. They have a concern about inflation eating away at their fiat cash,” Taub says. “Given the immense global interest in crypto, there’s no doubt in my mind that it will become increasingly popular as ‘consideration’ for real estate.”

Potential upsides & downsides

As a medium of exchange, cryptocurrency has benefits. It can be useful for buyers who need to initiate international exchanges and who want to avoid traditional banking fees. Compared with standard wire transfers, cryptocurrency transaction costs are lower. On the other hand, when two American parties conduct a transaction using a digital asset, the buyer will pay capital-gains taxes, Dilendorf explains.

“Under the U.S. tax code, bitcoin is considered property, and so is real estate. It isn’t a cash payment, so it’s a barter where you’re exchanging one type of asset for another type of asset. Both assets have tax rates, so it’s not convenient from a tax perspective,” Dilendorf explains.

Some buyers may also be hesitant to part with their bitcoin—hoping it may go up in value.

“When bitcoin was US$65,000, we were getting a lot of interest from clients who wanted to buy real estate or yachts through crypto,” Dilendorf says. “If bitcoin breaks US$80,000 or US$100,000, I would expect a lot of people to complete these types of transactions.” Early adopters of bitcoin could see that valuation as an excellent time to liquidate and invest in luxury goods or other assets. (In the first three quarters of 2021, bitcoin ranged from US$29,413.29 to US$64,899 per coin.)

A group of researchers at global bank Standard Chartered forecast values will continue to increase, and bitcoin could reach US$100,000 by early 2022. “As a medium of exchange, bitcoin may become the dominant peer-to-peer payment method for the global unbanked in a future cashless world,” Geoffrey Kendrick, head of crypto research, Standard Chartered, said in a statement.

Still, regulatory compliance presents an added layer of complexity. “When you make a payment with bitcoin or Ethereum, and the seller accepts it, the seller becomes a minibank,” Dilendorf says. Sellers must complete a KYC—a “know your customer” or “know your client”—check and anti-money-laundering check.

“You can think of this as a title check on a bitcoin. You can see how and where this bitcoin was traded. If the order came from a sanctioned jurisdiction like Iran, it could raise questions,” Dilendorf says. “Naturally, many sellers aren’t equipped to accept bitcoin.”

Thus, Dilendorf says most transactions have involved converting bitcoin into cash to expedite the process of buying real estate, green cards through the EB-5 program, yachts, and art.

Bitcoin and Ethereum, the two most common cryptocurrencies used for luxury purchases, are already regulated with the U.S. Securities and Exchange Commission, and as such, there’s more certainty in terms of regulations, Dilendorf says.

In 2022, more businesses could set up in-house support for cryptocurrency sales, or accept mix-and-match currencies for luxury goods, as buyers and sellers alike become more open to it.

For now, Dilendorf says he asks every real estate agent he works with in New York City why they aren’t listing prices in bitcoin. “It’s a marketing pitch, and if someone wants to pay in bitcoin, it doesn’t cost anything to the seller. Why not price it in bitcoin?” he says.

This article appears in Sotheby’s International Realty’s Luxury Outlook 2022. Read the full report here

In this article

Companies

UK Sotheby's International RealtyMain image: A home for sale on the Upper West Side of Manhattan accepts cryptocurrency as payment (image via Sotheby’s International Realty - East Side Manhattan Brokerage)