Property Market News

Zoopla predicts ‘a windfall for the market’ in Q1 2021 as transactions complete

House prices are up 2.6% on the year, according to Zoopla, but buyer demand is beginning to cool.

£1m+ house sales are ‘outpacing the market’, says Rightmove

Sales activity in the £1m+ property market "is soaring as wealthier buyers make moves to bigger houses or new locations", according to Britain's biggest property portal.

‘Every home sold means more jobs protected’: Sunak lauds the rallying housing market

Residential property transactions jumped by 15.6% in August, following a 14.5% rise in July, prompting Chancellor Rishi Sunak to trumpet a triumph for the Treasury's Stamp Duty holiday policy.

Upsizers boost larger home prices to a record high

Agreed sales of detached 4+ bedroom houses more than doubled from August 2019 to August 2020 (+104%), reports Rightmove. Sales of other three- or four-bedroom homes were up by 55%.

‘A lot of players are ending up in hotels’: Footballers struggle to score top-end rental homes

A shortage of £15k+ per month listings means that some Premiership footballers have been unable to find homes to rent as the new season starts, says Knight Frank.

High-end homebuyers ‘ditch flats for detached homes in lifestyle 360’

Sales of £5m+ detached houses have fallen far less than similarly-priced apartments since the Spring Covid-19 lockdown, suggests data mined by Enness Global Mortgages.

Students return to bolster Prime Central London’s rental market

Domestic and international students account for a quarter of all Dexters' tenant applications in central London, rising to well over two-thirds in some educational enclaves;

More renters are looking to the Home Counties for a quieter life

The UK’s new rental hotspots are in quieter locations further from from traditional commuter hubs, says Rightmove.

Ranked: Which areas are seeing the biggest price reductions?

Estate agency comparison website GetAgent has checked the major property portals to see where asking prices have been cut by more than 15%.

CEBR predicts 14% fall for UK house prices next year

Economists warn of a "significant fall" for house prices as wider economic turmoil catches up with the property market.

‘Renters have joined homeowners in the race for space by rushing to the suburbs’ – Hamptons

Hamptons has seen a rise in the number of renters moving out of London in search of more space.

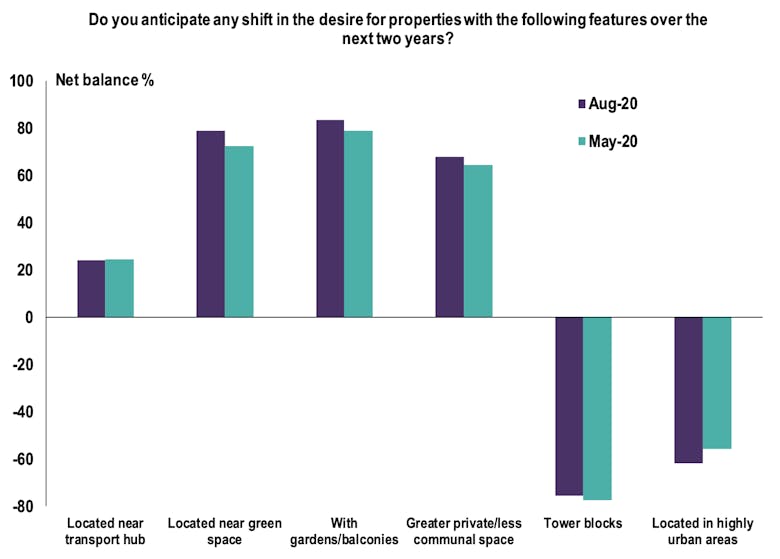

UK house prices hit a four-year high as demand for outside space continues to climb

"The latest RICS survey provides firm evidence of a strong uplift in activity in the housing market which should help support the wider economy gain traction over the coming months," says RICS' Chief Economist…