Property Market News

Property market momentum has ‘slowed significantly’

Heat Mapped: The latest index from eSurv continues to report rising house prices - hitting record levels in some locations - but it looks like some heat is coming out of the market...

Prime property prices continue to climb in global cities, despite the pandemic

Knight Frank's Prime Global Cities Index registered 1.6% average growth in the year to Q3.

Strutt & Parker ramps up property price forecasts

Estate agency Strutt & Parker has revised its 2020 forecasts for the UK's property market after a "mini-boom" in transactions in the last few months.

‘What we need from our homes is changing’: How UK property markets are likely to shift in the coming years

Birmingham is tipped to be the strongest regional property market over the next five years, says JLL, as the wider UK market "shows its resilience" despite a tricky-looking 2021.

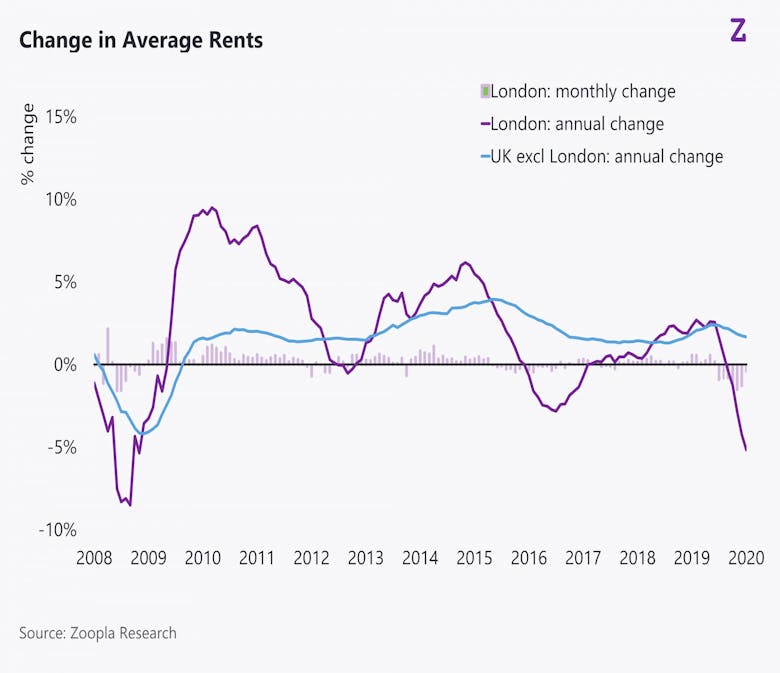

London rents fall to 2014 levels as a two-speed market takes hold

“The split in the rental market caused by Covid-19 has now crystallised and we are seeing the two-speed market firmly entrenched," says Gráinne Gilmore, Zoopla’s Head of Research.

Golden Postcode Opportunity: Is Prime Central London property now cheap?

Just how far have PCL prices fallen since 2014 and how much value does the area offer as an investment in comparison to other assets?

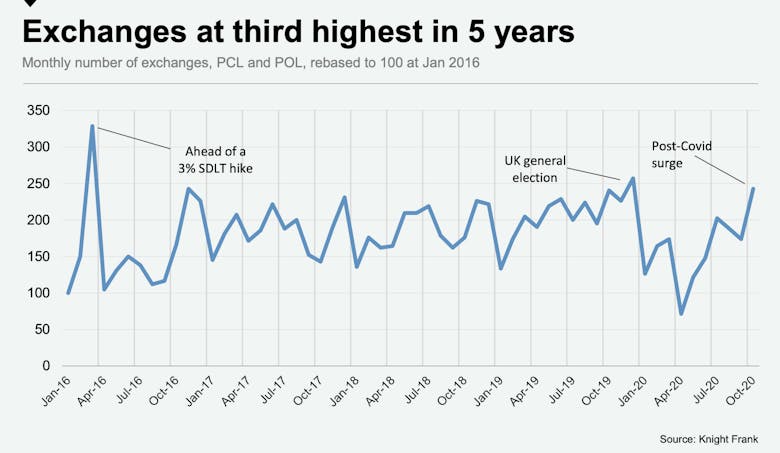

Prime London property exchanges at third-highest level in five years as prices continue to climb

But the majority of October's property exchanges in prime London still originated in deals done before the first national lockdown, says Knight Frank.

What does a second Lockdown in England mean for the housing market?

"It will be difficult to sustain the current [property market] momentum through to the year end," warns Savills' research chief Lucian Cook, as he looks at the potential ramifications of England's second…

Edinburgh property prices hit a record high

“I’ve never seen anything like it," says Edward Douglas-Home, head of Scotland residential at Knight Frank.

Country house price inflation hits a four-year high, ‘driven by a race for space post-lockdown’

“Despite a challenging economic outlook, people’s desire to get on with their lives after years of political uncertainty followed by lockdown has seen the property market continue to defy gravity,"…

Property market to remain open through November lockdown

Government clarifies that "the housing market will remain open throughout this period", with the furlough scheme and mortgage holidays extended.

Housing demand jumped by a third in September to highest level for 16 years – NAEA

The latest market intel from Propertymark tells of rising demand and the highest number of agreed sales per estate agency branch since 2006.