Property Market News

Knight Frank upgrades global prime price forecasts again

Luxury property price inflation is likely to return to London with gusto next year, predicts the Knight Frank team.

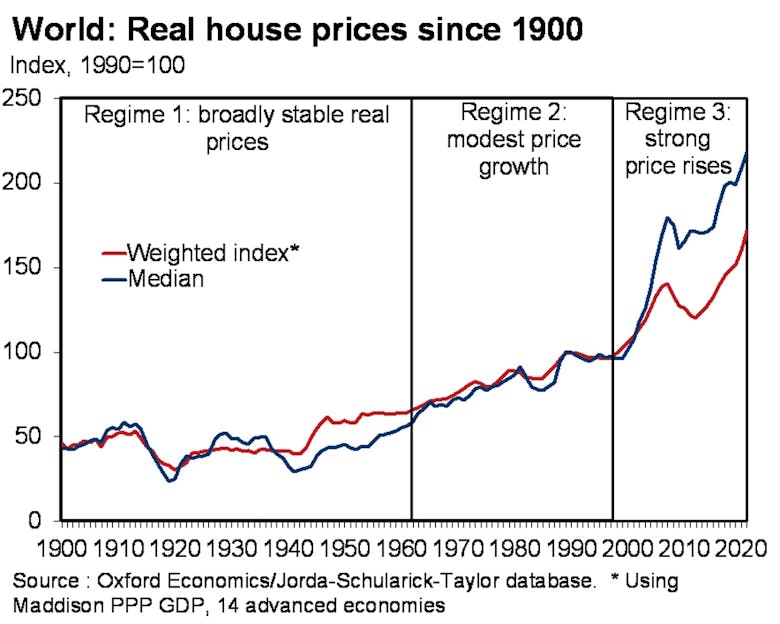

World house prices are ‘overvalued by around 10%’, warn economists

We're in one of the biggest global property booms since 1900, says Oxford Economics, as it warns that "the longer a housing boom continues, the bigger the risk of a large reversal".

Asking prices climb to another record high as the property market sees its busiest ever H1

House prices are being inflated by "frenzied" buying activity and a continued shortage of properties being listed for sale. There's a 225,000 shortfall of homes for sale, estimates Rightmove;

Asking rents hit a record high outside London, as city centres start to recover

Rental properties are finding tenants faster than ever before, reports Rightmove, as record demand pushes price up.

House price inflation picks back up to 10% – UK HPI

London continues to be the UK region with the lowest annual growth, for the sixth consecutive month.

Regional house price movements over the last year ‘are almost a complete reversal of both the 5-year and 10-year trends’ – Garrington

Buying agency Garrington has highlighted how limited the impact of the stepping down of the Stamp Duty holiday has been on property market activity so far.

Most buyers & sellers expect to move within three months – OTM

84% of property sellers expect to sell their home within the next 90 days, according to the inaugural OnTheMarket Sentiment Index, while 75.5% of buyers expect to find their next home within the same timeframe.

Central London rents likely to recover to pre-pandemic levels within a year – Hamptons

Average rents in central London have fallen by 16.

House prices likely to rise further as supply falls again – RICS

Faltering supply continues to underpin house price inflation across the UK, reports the Royal Institute of Chartered Surveyors.

Urban house prices around the world are rising at their fastest rate since 2007

43 of the 150 global cities tracked by Knight Frank have seen prices escalate by more than 10% over the last year, with five above 25%.

FT: The game changers in London’s luxury property market

George Hammond has taken a tour of Christian Candy's 80 Holland Park for the Financial Times, noting that it is "a stark departure" from One Hyde Park, and reflects the shifting tastes of London's super-rich…

Agency bosses praise ‘perfectly timed’ Stamp Duty holiday

"The stamp duty holiday was perfectly timed to enable more people to improve their set up by moving," says Marsh & Parsons.