Property Market News

Stock shortage pushes more house-hunters to ‘stop-gap’ rentals

Rental homes are "increasingly being used as a stop-gap by house-hunters faced with a lack of stock to buy," says Hamptons' research chief, Aneisha Beveridge.

Record number of £1m+ sales in London

"Happy holiday for luxury London property", declares Coutts bank, as the prolonged Stamp Duty tax break drives record sales in the capital.

Buyer demand cools as stamp duty holiday tapers

"The overall tone to the market remains firm", says the RICS, with property prices continuing to rise despite a drop in new buyer enquiries.

House prices have risen ten times faster than flat prices since the start of the pandemic

Apartments across Great Britain are looking like good value, says Rightmove, at least when compared to detached houses, which have seen average asking prices rocket over the past 18 months.

UK prime resi prices set to rise 9% this year, but PCL’s bounce ‘has been delayed’

Runaway property price growth in the regions is likely to soften from next year, predicts Savills, while Prime Central London prices are set for a sharp upwards bounce once international travel resumes.

Prime London’s rental market ‘continues its journey back towards normality’

“The see-saw of high supply and low demand is tipping back the other way,” says Knight Frank. “Demand is coming from multiple sources and rental values are getting stronger as a result.”

Coastal homes are selling 20 days quicker than pre-pandemic, as city-to-seaside demand doubles

Rightmove has flagged "a more sustained shift in buyer preference than initially thought" as demand for seaside properties outpaces demand fro city living.

Prime London property sales drop sharply as Stamp Duty holiday unwinds

Annual property price inflation in Prime Central London has picked up to 0.8%; the highest rate since May 2016.

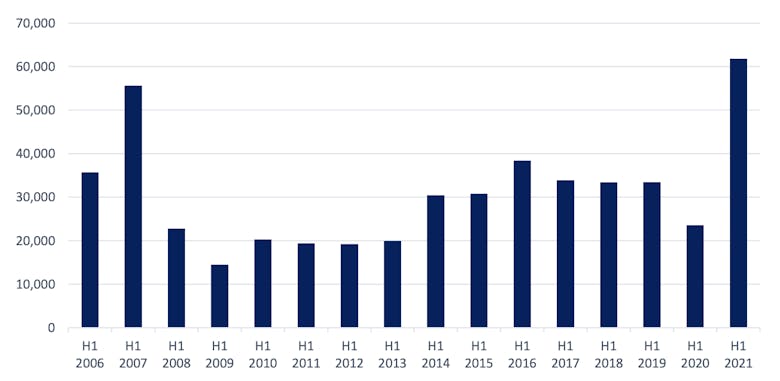

£68.8bn-worth of homes were sold in the first half of this year

London's NW3 is the most valuable postcode of the year so far, with £262.5m-worth of residential property changing hands.

Prime global rents turn a corner as yields drop further

“Rental markets look set to be subdued for the rest of 2021," says Savills as its World Cities rental price index returns to positive growth, but the longer-term outlook is more positive.

Londoners buy a record number of homes outside the capital

London leavers bought 85% more homes outside the capital in the first half of this year than in H1 2019.

Pandemic fuels the ‘broadest global house price boom in two decades’

The annual rate of house price inflation across the OECD group of rich nations hit 9.4% in Q1 2021 - a 30-year high.