Property Market News

Early signs that ‘escape to the country’ momentum is peaking, says Knight Frank

The pace of country house price growth appears to be slowing - but demand continues to outpace supply by some margin.

Prime London rents soar as stock levels slump by 68%

Those looking to renew a rental agreement or search for a new property ‘may be in for a shock’, warns LonRes…

Demand for ski property jumps, pushing prices in one resort up by 17% in a year

“This year has been an anomaly. We don’t expect this frenetic pace in Swiss resorts to continue," says Kate Everett-Allen in Knight Frank's new Ski Property Report.

Mapped: Which global property markets are most at risk of a bubble?

London property remains overvalued, says UBS, but the UK capital is near the bottom of the bubble-risk table this year.

Chinese house prices dip for the first time in six years

Policy measures imposed to cool a runaway property market appear to be working in China - perhaps too well...

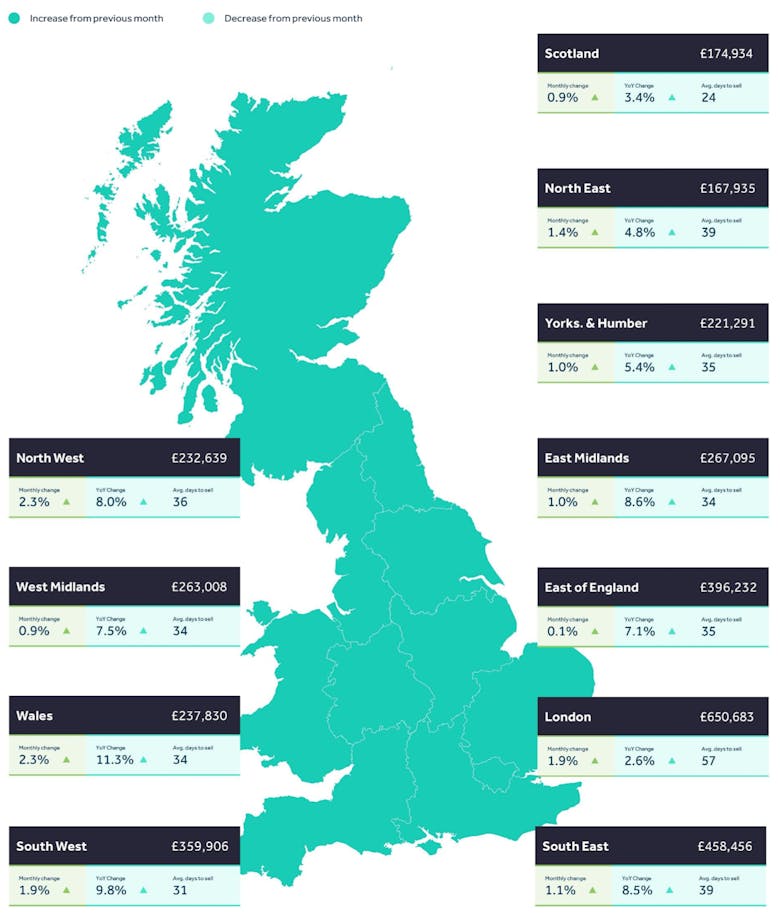

London property prices rise at fastest rate since 2016 – UK HPI

The latest official UK House Price Index tells of 10.6% inflation in the year to August.

‘The property market resembles a half-drunk cappuccino – still hot but the froth has gone’ – Garrington

National buying agency Garrington has updated its look, flexing a new logo (below) and new corporate colours in its latest market update.

‘Full house’ as asking prices hit record highs in every region & market sector

Every region and market sector saw asking prices rise to a record high last month, reports Rightmove; it's the first "full house" since 2007.

Students outpace corporate tenants in rental market ‘sprint’

With supply levels running so low, ‘frustrated’ companies are having to consider outer-lying parts of the capital and alternative options to house their employees, reports Knight Frank.

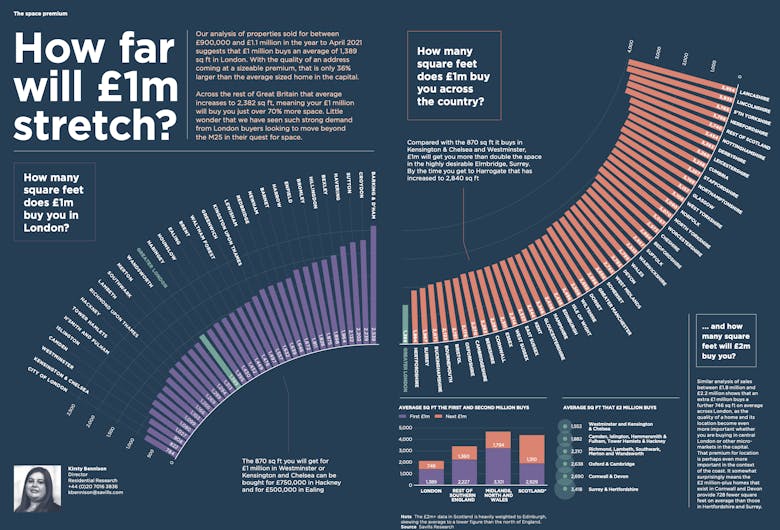

Infography: How far will £1m stretch in & out of London?

London's average £1m home is only a third (36%) bigger than the overall average-sized home in the capital, says Savills. Buyers would get an average of 70% more space if they looked beyond the M25.

The Great Recalibration: Is the rebalancing of London and regional property markets here to stay?

The number of £1m+ homes outside of London grew by 95,500 in the 18 months to June 2021, while in London, they rose by less than a fifth of that figure.

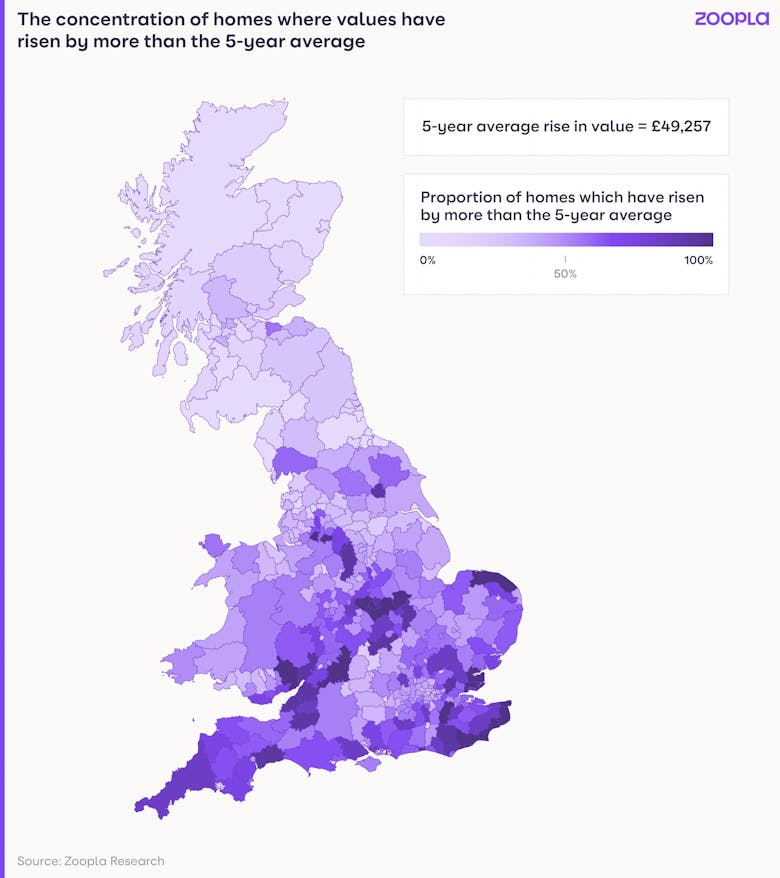

The total value of British homes has climbed by £1.6 trillion in the last five years

A sharp acceleration in property price inflation means that the combined value of British homes has climbed by £550 billion (a third of the total five-year increase) in just the last 12 months, according…