Forecasts

London leavers flock back to town, driving up rental prices

"Tenants are returning to the bright lights of the city and this is driving rental growth to record highs," says Aneisha Beveridge of Hamptons.

Prime Central London rents set to rise 10% this year, predicts Strutt & Parker

Strutt & Parker has updated its five-year property market forecasts, anticipating a sharp upturn for central London's lettings market as tenant demand outpaces rental supply.

‘There doesn’t need to be a recession to dampen the mood in the UK housing market’ – Knight Frank

Knight Frank's research team assesses what the Bank of England's slashed forecasts mean for the property market.

‘The risks are rising’: Top analyst warns of a looming property market downturn

"Underlying fundamentals suggest house prices are reasonably priced at current levels," says Neal Hudson, but "the fundamentals may be about to change – potentially quite quickly."

UK house prices likely to fall in 2023 & 2024, predicts Capital Economics

Influential forecasting house expects average property values to drop by 5% overall through 2023 and 2024.

Talking Heads: What’s happening in the prime property market right now, according to top buying agents

Where is all the stock; what will happen to prices; and which areas are buyers flocking to right now?

Slow growth predicted for development land values as building costs climb

"Developers will need to absorb new costs, and tighten margins in order to secure sites in what we expect to continue to be a competitive market," says Savills' head of regional development.

UK house price growth to slow as cost of living bites – Knight Frank

House price inflation is likely to "unwind" back to single figures across the UK, predicts Knight Frank, although Prime Central London is set for higher price growth as global travel resumes.

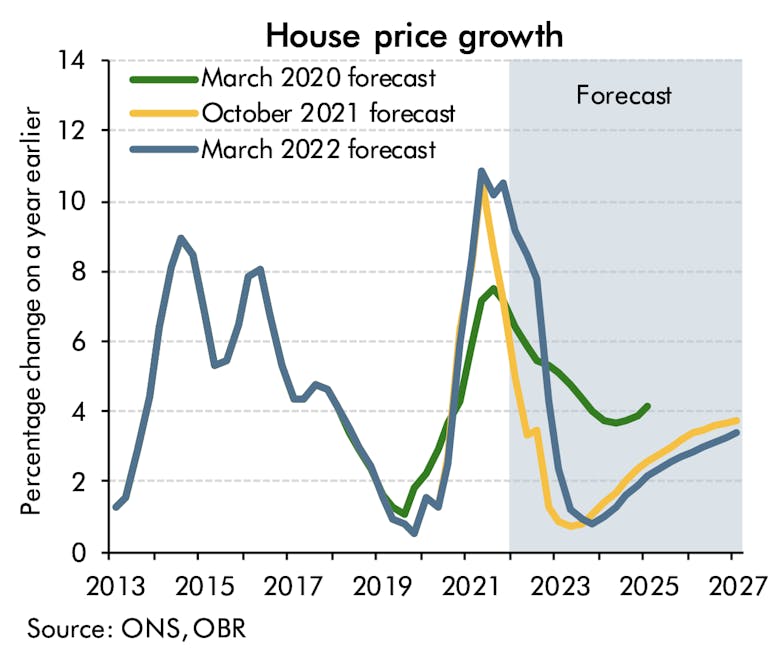

OBR upgrades house price forecast again

Average house prices are likely to rise by 7.4% this year, predicts the Office for Budget Responsibility, and by 15.8% over five years.

Global luxury housing boom to continue, with more subdued price growth

Knight Frank is predicting continued price rises for international luxury property markets in 2022 - although the pace of growth is likely to be significantly lower than 2021's extraordinary performance.

PCL property prices still set to rise up to 10% this year, predicts Strutt & Parker

"We expect to see a very competitive market this year," says Guy Robinson, Head of Residential at Strutt & Parker.