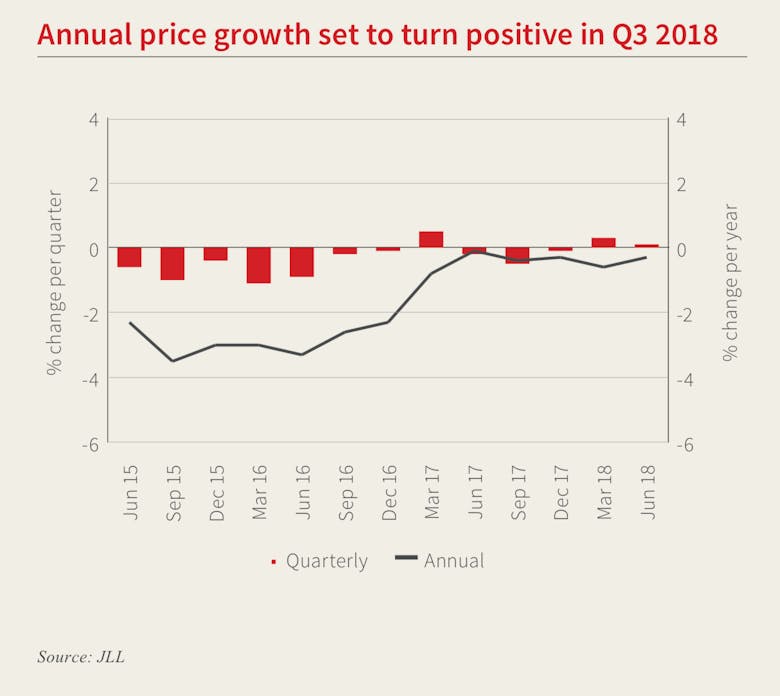

How does PCL’s recent volatility compare to previous ‘adjustments’?

Prices fell by 7.9% between the last peak in August 2015 and February 2017, but let's not forget the 24% decline recorded between 2008 and 2009, and the 21% correction in the early 90s...

What buyers want now: Top town & country buying agents compare notes on post-lockdown demand trends

Two top buying agents - one focused on prime London, and one on prime country houses - reveal what is on their clients' most-wanted lists.

By PrimeResi

Property transactions to plummet by 38% this year, predicts Knight Frank, but PCL prices are set to surge in 2021

Over half-a-million property sales will be "lost" due to the Coronavirus lockdown, predicts Knight Frank, but prices are likely to "recover sharply" once restrictions are lifted.

By PrimeResi

PCL sales market ‘recovers some poise’

Transaction levels are still on the low side and upper-end prices continue to adjust downwards, but the worst appears to be behind us, says JLL

By PrimeResi

Companies in this article

Knight FrankMost read

IWD2026: Prime resi industry leaders on the moments that changed everything

To mark International Women’s Day, senior figures from across the sector reflect on the decisions, risks & pivots that shaped their lives & careers - from ‘sliding doors’ moments to leaps of faith.

The New 2% Club: Jamie Hope on pricing in Prime Central London’s leaner market

The era of the ‘comfortable 10% cushion’ is over, says boutique agency boss - today’s market rewards accuracy, not optimism.

By Jamie Hope

High-profile private members club seeks Branded Residences Director

Soho House reveals it is 'launching a new Branded Residences vertical.'

By PrimeResi

Super-prime rental deals surge in London

£5,000-per-week-plus tenancies up 8% year-on-year as internationally mobile tenants prioritise flexibility.

Tom Bill: How the Middle East conflict could affect the UK housing market

Rising energy prices and shifting rate expectations could reshape mortgage costs and buyer sentiment, explains Knight Frank’s head of UK resi research.

By Tom Bill

Banking heavyweight flags postcode divergence across Prime London market

Buying conditions are ‘favourable’, says Investec, as analysis points to opportunity across three key districts.

In Pictures: One of London’s oldest houses comes to market

Rare 17th-century survivor just off the Strand recently returned to resi use.

Top-end country agency lines up £80mn of stock as selling season starts early

The Private Office founder Trevor Kearney cites 'quiet confidence' as some very high-end Surrey residences are brought to market.

Big-brand agency franchise in PCL goes up for sale

Winkworth is seeking an 'entrepreneurial property expert' to take over the established hub in one of the capital’s top HNW hotspots.

These three buyer profiles are driving Prime London demand in 2026

Tenants, repatriates and pied-à-terre buyers have come to the fore as hefty transaction costs stall traditional upsizers, reports Eccord's Jo Eccles.

By Jo Eccles

LATEST ARTICLES

Ranked: Britain’s most expensive streets in 2026

Rightmove's analysis is based on asking prices, and only includes addresses with at least five open-market listings in January.

By PrimeResi

Connells deal delivers major listings boost for OnTheMarket

Nearly 100,000 properties from the UK’s largest estate agency group headed to the CoStar-owned portal.

Interview: Michael S. Liebowitz on Douglas Elliman’s global push – and what brokers need to know about today’s UHNW clients

The US brokerage chief on what American and European markets can learn from each other, choosing the right local partners and London’s role as a global hub.

D&G adds new central London partner

Lettings specialist Sharlotte Cooper previously ranked among Hamptons’ top performers.

Rupert des Forges: ‘London is becoming a dip-in, dip-out city for the super-rich’

'The capital might not be [UHNWI's] full-time base any more,' says Knight Frank veteran, 'but it is still an anchor for social & business life.'

By PrimeResi