House prices surge even as political volatility rises

A general election rather than a Tory party leadership vote would have an impact on the housing market, writes Knight Frank's Tom Bill - but that feels unlikely this year.

Tom Bill is Head of UK Residential Research, producing reports that include Knight Frank’s flagship Prime Central London indices, the Super Prime London Insight and the London Residential Review. He has written detailed reports on London sub-markets and contributes to The Wealth Report and Global Cities report. Tom, a former Bloomberg and Reuters property journalist, is a regular media contributor on the London property market and has presented at events in Europe and the Middle East.

Tom Bill on what 2021 could bring for the UK property market

Tax changes and the withdrawal of support measures mean the post-Covid ‘normal’ will only begin to emerge later next year, writes Knight Frank's Head of UK Residential Research.

By Tom Bill

House prices: Why the risks of a fall are higher than most people think

"The fact that house prices have been rising quickly over the last year makes the market more vulnerable to external shocks to the economy," says Professor Geoff Meen, as he warns "there are numerous…

By Geoff Meen

Economists predict ‘a slow recovery in activity, but a relatively benign outcome for house prices’

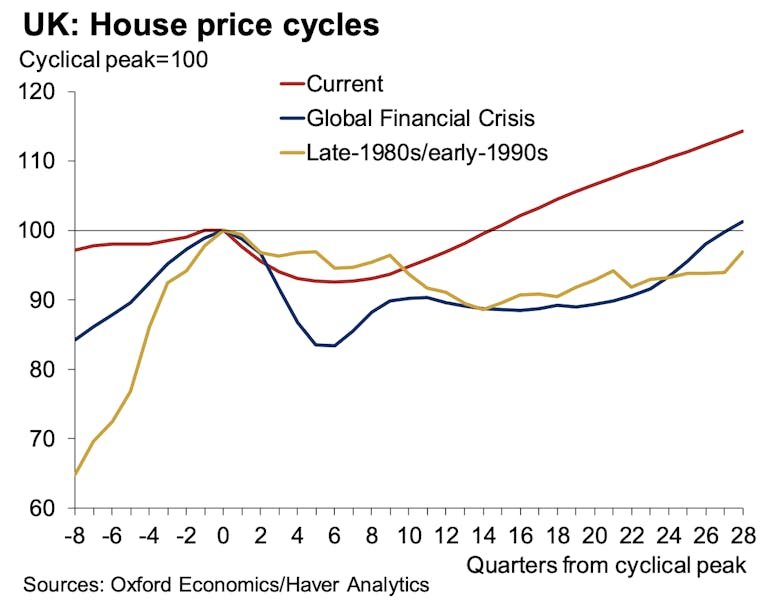

House prices are likely to fall by 7% as a result of Covid-19, predicts Oxford Economics - but the risks are "heavily skewed" towards much, much bigger price falls of almost 40%...

By PrimeResi

Companies in this article

Knight FrankMost read

IWD2026: Prime resi industry leaders on the moments that changed everything

To mark International Women’s Day, senior figures from across the sector reflect on the decisions, risks & pivots that shaped their lives & careers - from ‘sliding doors’ moments to leaps of faith.

The New 2% Club: Jamie Hope on pricing in Prime Central London’s leaner market

The era of the ‘comfortable 10% cushion’ is over, says boutique agency boss - today’s market rewards accuracy, not optimism.

By Jamie Hope

High-profile private members club seeks Branded Residences Director

Soho House reveals it is 'launching a new Branded Residences vertical.'

By PrimeResi

Super-prime rental deals surge in London

£5,000-per-week-plus tenancies up 8% year-on-year as internationally mobile tenants prioritise flexibility.

Tom Bill: How the Middle East conflict could affect the UK housing market

Rising energy prices and shifting rate expectations could reshape mortgage costs and buyer sentiment, explains Knight Frank’s head of UK resi research.

By Tom Bill

Banking heavyweight flags postcode divergence across Prime London market

Buying conditions are ‘favourable’, says Investec, as analysis points to opportunity across three key districts.

In Pictures: One of London’s oldest houses comes to market

Rare 17th-century survivor just off the Strand recently returned to resi use.

Top-end country agency lines up £80mn of stock as selling season starts early

The Private Office founder Trevor Kearney cites 'quiet confidence' as some very high-end Surrey residences are brought to market.

Big-brand agency franchise in PCL goes up for sale

Winkworth is seeking an 'entrepreneurial property expert' to take over the established hub in one of the capital’s top HNW hotspots.

These three buyer profiles are driving Prime London demand in 2026

Tenants, repatriates and pied-à-terre buyers have come to the fore as hefty transaction costs stall traditional upsizers, reports Eccord's Jo Eccles.

By Jo Eccles

LATEST ARTICLES

Interview: Michael S. Liebowitz on Douglas Elliman’s global push – and what brokers need to know about today’s UHNW clients

The US brokerage chief on what American and European markets can learn from each other, choosing the right local partners and London’s role as a global hub.

Ranked: Britain’s most expensive streets in 2026

Rightmove's analysis is based on asking prices, and only includes addresses with at least five open-market listings in January.

By PrimeResi

Connells deal delivers major listings boost for OnTheMarket

Nearly 100,000 properties from the UK’s largest estate agency group headed to the CoStar-owned portal.

D&G adds new central London partner

Lettings specialist Sharlotte Cooper previously ranked among Hamptons’ top performers.

Rupert des Forges: ‘London is becoming a dip-in, dip-out city for the super-rich’

'The capital might not be [UHNWI's] full-time base any more,' says Knight Frank veteran, 'but it is still an anchor for social & business life.'

By PrimeResi