Format: Views

AI in Architecture: Understanding the impact & capabilities

In the first of a new series, Andrew Paulson explains how tech's new frontier could transform the traditional processes of architectural design, planning & construction.

Tanya Hasking: Debunking misconceptions around short lets

John D Wood & Co.'s lettings chief busts some myths and talks up the benefits of short-term rental agreements for both landlords and tenants...

We see significant opportunities ahead: Haringtons on prime London & country markets in 2024

One of the UK's longest-standing acquisition firms reports on how buyers are responding to the current economic uncertainty, and a looming general election.

Charlie Ellingworth: On climate change & the coastal property market

Property Vision's co-founder reports on the big themes at play in Britain's seaside hotspots, including the effects of climate change on perceptions of the market & the arrival of a new cohort of buyers...

Tom Bill: Country market warms up as temperatures rise

There are signs of a seasonal pick-up in activity but higher mortgage rates are keeping demand in check, reports Knight Frank's head of UK resi research.

Tenants push back on rent increases as supply builds in prime London

Knight Frank's Tom Bill explores the latest movements in the prime London lettings arena, flagging increased rental supply and 'early signs that more landlords are considering a sale' ahead of the General…

Prime London sees ‘lacklustre’ spring property market bounce

'The outlook isn’t exactly gloomy, but neither does the warmer weather signal lift-off for the market,' says Knight Frank's Tom Bill.

How off-grid living has shifted from hippie to chic

'Off-grid' is no longer the preserve of the tree huggers, says Dorcas George-Jones of Castellum.

JTRE London’s Nigel Fleming: Why Bankside is knocking on the door of traditional PCL

Following a transformation that began 70 years ago, Bankside has become a cultural, commercial & resi hotspot that can compete with any London postcode, writes property development chief...

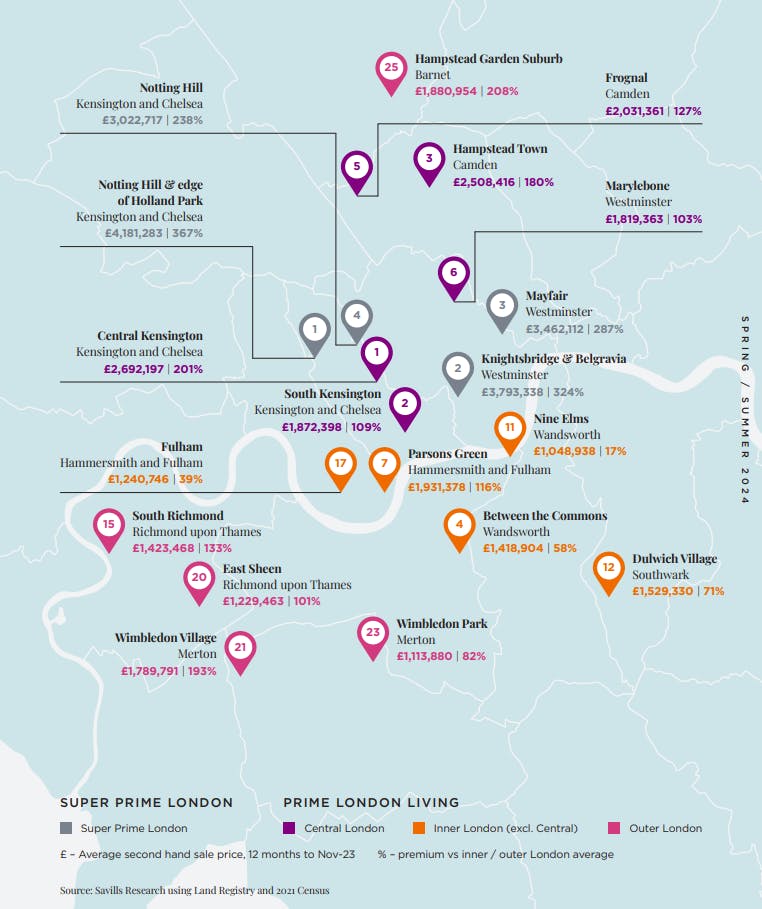

Revealed: London’s ‘most desirable neighbourhoods’

Savills has used socio-economic and health data from the Census alongside house price records to rank the capital's top enclaves for prime and super-prime property buyers.

Jennet Siebrits: Are homeowners right to feel brighter this year?

CBRE's research chief explains what the firm's latest consumer survey tells us about sentiment, spending and savings patterns & expectations for the year ahead.

Tom Bill: Slow recovery for UK housing market as it awaits political & economic clarity

Recent indicators suggest transaction volumes are rising as spring approaches but the pressure on pricing is downwards.