Sales

Hong Kong buyers & tenants hone in on London

New visa regulations and the imminent easing of travel restrictions have 'revived London’s appeal as an investment and lifestyle hotspot', says Chestertons

New-build premium put at 29%

Analysis of government figures reveals the areas where average new-build prices are as much as double those of the existing market.

Busiest year for the Prime London market since 2014

The number of properties sold in the first five months of 2021 was the highest total for seven years, reports LonRes, but demand is generally not outstripping supply…

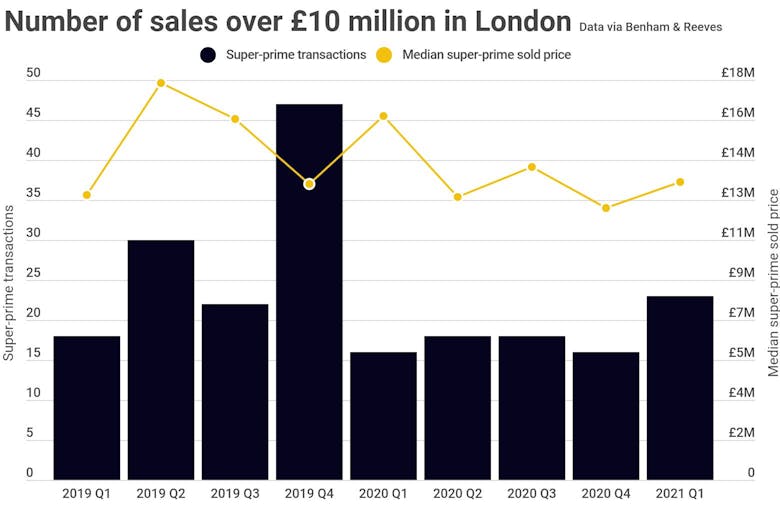

Super-prime recovery: £36.8bn is currently targeting London’s £10m+ property market

Infography: London's super-prime property market in seven charts.

Asking prices hit another record high, but ‘there are early signs of a slowing in the frenetic pace’ of the property market

Asking prices have increased in every region, reports Rightmove, with larger homes seeing the highest rate of property price inflation.

‘Proximity to the pub beats being close to work’: Pandemic leaves ‘a legacy of changed priorities’ amongst prime property buyers

Most affluent property buyers are "undeterred" by the looming end of the Stamp Duty holiday, says Savills, but the pandemic is likely to leave "a legacy of changed priorities" amongst home-buyers.

London super-prime deals jumped by 44% in Q1 – but are still below pre-pandemic levels

“The outlook for the super-prime London market remains fairly positive at present," says Benham and Reeves boss Marc von Grundherr.

House price inflation falls back to +8.9% – UK HPI

April saw UK house price growth slow for the first time since July 2020, according to the official index.

Heatmapped: Prices are rising at a ‘worrying’ rate in some UK regional markets

Over the last twelve months, the average price of a home sold in England and Wales has rocketed by £40,500, or 13.

Buying agency reports rise in ‘negotiation-only’ clients

Stacks says it is increasingly being brought in to handle negotiations once the right property has been identified, especially in complicated country house deals…

London market ‘holds its own’ as sales top £56bn

£56.2bn worth of real estate has been sold across the capital since the start of the pandemic, according to analysis of Land Registry records.

Wary vendors are fuelling an ‘iceberg’ off-market property scene

"Market conditions have remained brisk over the last month," says national buying agency Garrington in its latest market update video, "exacerbated further by the forthcoming phasing out of the Stamp Duty…