Economics

Is this the last property boom? Economists predict ‘the death of house price cycles’

Property markets are surging around the world. But "there are good reasons to think this will mark the last house price boom for the next 30 years," says Capital Economics.

Major property companies enjoy pandemic-induced revenue boom

Property PLCs including Rightmove, Savills, Foxtons, LSL, Connells, Purplebricks, OnTheMarket and Berkeley Group have seen huge increases in revenue compared to corresponding periods in both 2020 and…

Building material costs likely to rise by 10% over the next year

Construction growth - led by the private housing sector - is placing new pressure on labour and supply chains, warns the RICS.

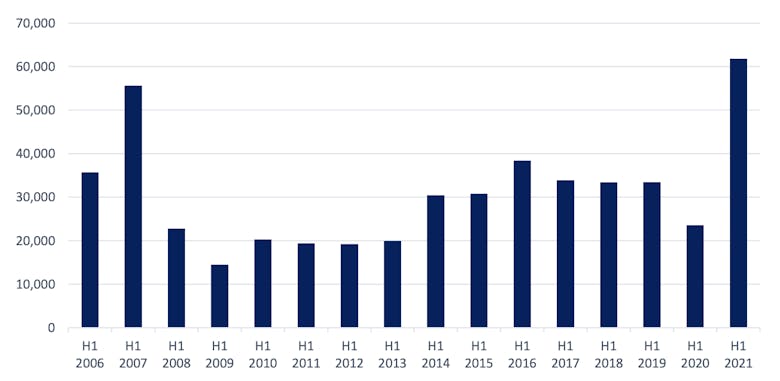

Londoners buy a record number of homes outside the capital

London leavers bought 85% more homes outside the capital in the first half of this year than in H1 2019.

Pandemic fuels the ‘broadest global house price boom in two decades’

The annual rate of house price inflation across the OECD group of rich nations hit 9.4% in Q1 2021 - a 30-year high.

A fifth of homes have seen values rise by more than the average UK salary in the last year

Zoopla estimates that 4.6 million private homes in the UK rose in value by more than £30,500, the average UK salary, in the last year. That's 21% of all privately owned homes in the country.

On the rise of the Eastern city & the Western suburb

Mike Staver explains the sociological factors influencing where people choose to live - and the impact of the unprecedented events of 2020…

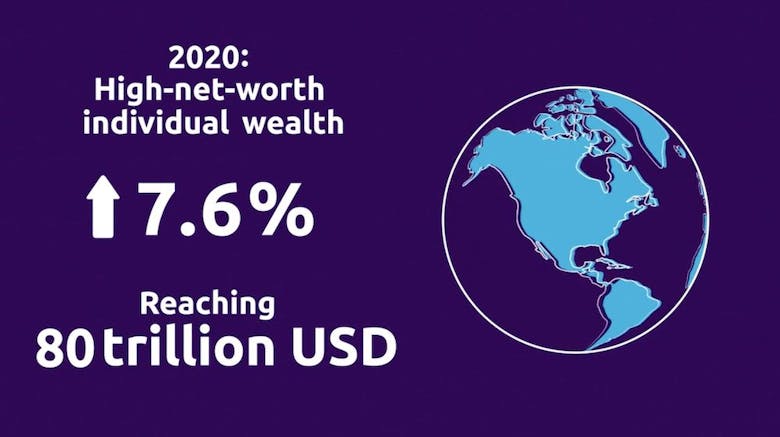

Global HNW population booms, but not in the UK

The global millionaire population grew 6.3% in 2020, surpassing the 20-million bar, while total millionaire wealth grew 7.6% to tickle US$80 trillion.

House prices: Why the risks of a fall are higher than most people think

"The fact that house prices have been rising quickly over the last year makes the market more vulnerable to external shocks to the economy," says Professor Geoff Meen, as he warns "there are numerous…

UK resi market set for first ‘£100 billion summer’

Factors have combined to set up the ‘highest grossing quarter in UK residential market history’, says JLL.

Largely immune: Understanding global wealth trends through the pandemic year

"Wealth creation in 2020 appears to have been completely detached from the economic woes resulting from Covid-19," says the author of Credit Suisse's new Wealth Report.

Global property markets ‘are flashing the kind of bubble warnings’ not seen since 2008, warns Bloomberg

New Zealand, Canada, Sweden, the UK and US are amongst the world's "frothiest" housing markets, according to new analysis, with high price-to-rent and price-to-income ratios.