Economics

UHNW Attitudes in 2023: Ten key insights from top wealth managers

Four in ten ultra-high-net-worth individuals grew their wealth in 2022, according to Knight Frank's latest research, despite a year of ‘Permacrisis’.

Tom Bill: ‘Taking the right mortgage at the right time could prove more fruitful than waiting for prices to bottom out’

Track the mortgage market not house price data to get the timing right in 2023, says KF's head of UK resi research.

Why are there so few homes to rent? Zoopla’s research chief explains…

'The UK's private rental market is going through a period of rationalisation and consolidation after more than a decade of very rapid growth up until 2016,' says Richard Donnell.

Tom Bill: The ‘great recalculation’ will have to wait until 2023

Rarely has the current state of the UK property market been such a poor guide for what happens next, says Knight Frank's research chief.

‘A very different market’ is emerging as we head into the new year – Garrington

A 'widespread repricing' is underway as home-buyer demand falls away, reports buying agency.

What’s in store for prime property prices?

Rising mortgage rates and economic uncertainty are expected to put downward pressure on house prices and transactions over the next 12 months or so, but Savills is forecasting prices will increase over…

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, ONS, Propertymark, OnTheMarket, Knight Frank, UBS & more...

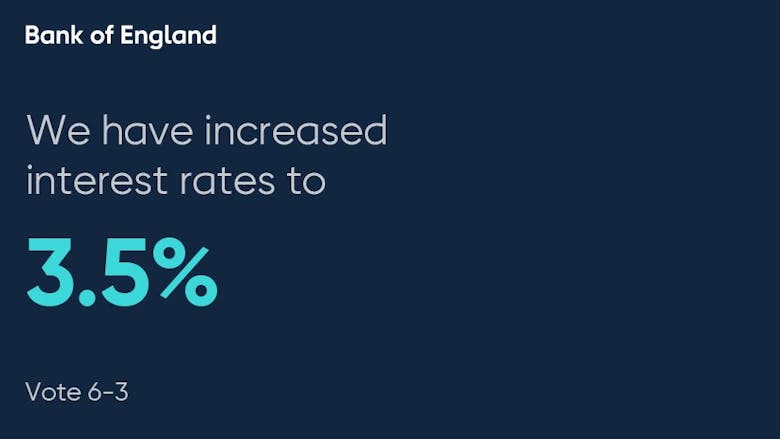

BoE bumps interest rates up again, to 3.5%

Interest rates continue to climb as the BoE attempts to bring CPI inflation down.

Global real estate markets slow as interest rates climb

'Real estate returns have slowed, and transaction activity has fallen as some deals agreed at prices prior to the slowdown have been aborted,' says UBS.

Nicky Stevenson: ‘A very different year beckons’ in 2023

'Although the reputation of the UK suffered damage in the autumn, the stability afforded in recent weeks will do much to restore confidence,' says Fine & Country chief Nicky Stevenson, as she reflects…

Tom Bill: Don’t read too much into current UK housing market data

KF's UK resi research chief explains why we are unlikely to see much clarity on the longer-term trajectory for house prices until March next year...

Economists predict ‘at least 10%’ slump for UK & US house prices next year

Credit Suisse has reiterated its prediction of a significant correction for global house prices.