Economics

Housing market ‘on track to better last year despite economic backdrop’

"We’re a long way away from years like 2007 and 2008, when the markets were truly in meltdown and people were staying put," says Adam Day of eXp after checking property transaction volumes through the…

Why building more high-end homes is good for London

"In general, building new market-rate homes makes other housing more affordable," concludes a recent report by the Greater London Authority.

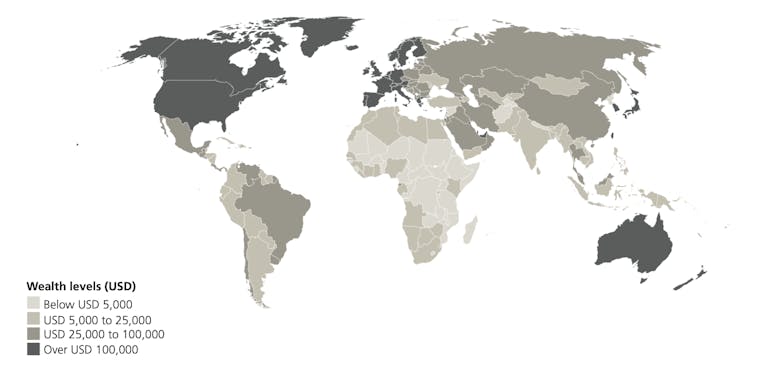

Global wealth has fallen – but is set to rise by 38% over the next five years

World wealth and millionaire numbers declined last year, but economists expect growth to return soon.

Tom Bill: This week’s inflation data holds clues for UK housing

Anyone buying, selling or re-mortgaging should watch the numbers closely on Wednesday, says Knight Frank's head of UK residential research.

Savills: On forecasting in an ever-changing property market

One of the property sector's top research teams pulls back the curtain on the tricky business of making market predictions, as they warn of "some further price adjustments to come."

Property industry reactions: Bank of England hikes base rate again, to 5.25%

Featuring analysis from Chestertons, JLL, Knight Frank, Rightmove, Savills, Zoopla and more.

Abrahmsohn on interest rates: Is the medicine worse than the ailment?

The BoE needs to be wary of double-dosing the patient later this week, warns veteran agent Trevor Abrahmsohn.

‘This is now a buyer’s market’ – Garrington

Slowdown "is not a temporary aberration but looks to be a shift in the UK property market’s landscape for the second half of the year," says top buying agency.

Lloyds reins-in house price slump expectations

Lloyds Banking Group now expects average UK house prices to end 2023 5.6% lower than they started the year, with a 'best case scenario' of -3.3% and a 'severe downside scenario' of -9.3%.

Ollie Marshall: The devil is in the detail

Recent months have been filled with doom & gloom, but there is no sight of the four horsemen of the apocalypse galloping through Sloane Square just yet...

Sunak commits to building 1 million homes as Gove outlines long-term plan for housing

Latest government housebuilding strategy focuses on urban property development to avoid 'concreting over the countryside'.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Rightmove, Savills, the ONS, JLL, TwentyCi, Foxtons & more...