International Markets

Global luxury rental markets ‘stabilise’ after slowdown

Prime rental prices in 16 world cities ticked up again in Q2, reports Knight Frank.

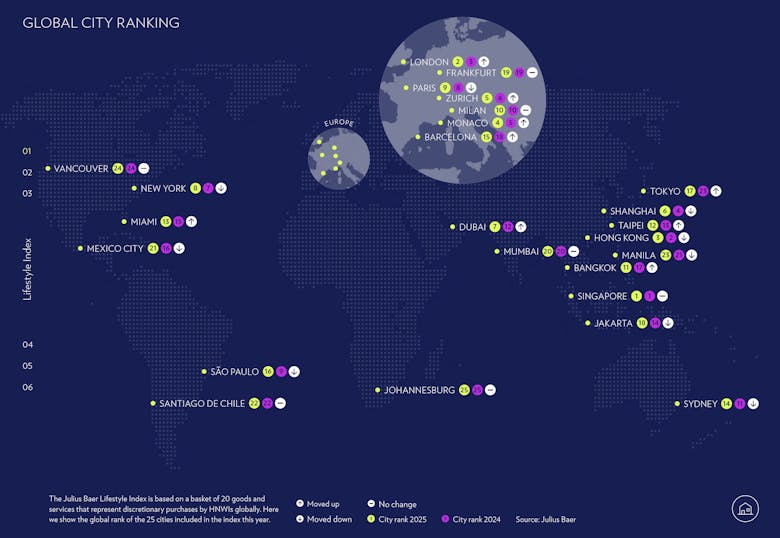

Ranked: The world’s best cities for ‘living well’ in 2025

Swiss bank Julius Baer has analysed the top locations for wealthy folk 'looking to live the good life'.

Property price inflation eases across prime global cities

'Prime markets are taking a collective breath,' says Knight Frank.

Ranked: The cost of buying, owning & selling a $2mn property around the world

New research goes beyond the listing price to reveal the true cost of a high-value residence, from Singapore to London.

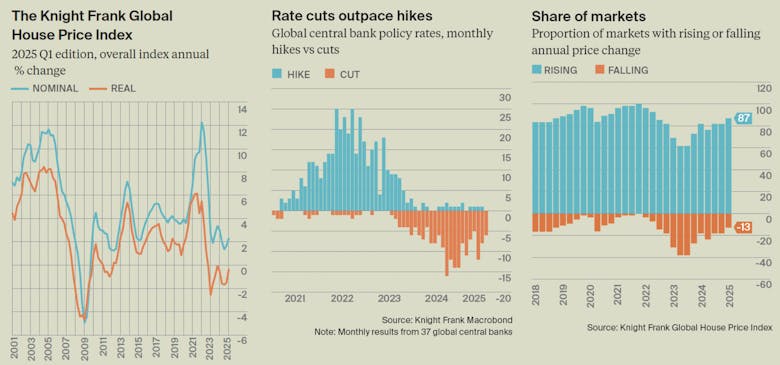

Global house prices tick up but ‘further growth hinges on rate cuts’

87% of international markets tracked by Knight Frank have seen residential values increase in the last year.

From Manhattan to Mayfair via Miami: Where the world’s $30m+ set call home

New research charts the cities with the largest UHNW residential footprints, revealing shifting second-home trends and emerging luxury hotspots.

Push to penalise gazumping & gazundering in Jersey

Proposal aims to 'instil confidence in the housing market for both buyers and sellers.'

Rent inflation outpaces capital growth in prime world cities

60% of global cities tracked by Savills saw property values increase in the first half of the year, led by Tokyo and Berlin, while 77% saw rental prices rise.

Trump mulls scrapping capital gains tax on home sales

Housing market could also be 'unleashed' by lower interest rates, says POTUS.

HNW family offices show ‘ambivalence’ toward real estate investments

UBS has surveyed more than 300 single family offices around the world.

Transatlantic Wealth Moves: How to help US clients buy with confidence

Prime Central London remains a hotspot for HNW American homebuyers - but even short-term ownership brings complex cross-border legal responsibilities, cautions top lawyer Lorna du Sautoy.

Wealth Taxes in Europe: What has worked & what has not

Of 12 OECD countries that operated Wealth Taxes in the 1990s, only three are still in play.