International Markets

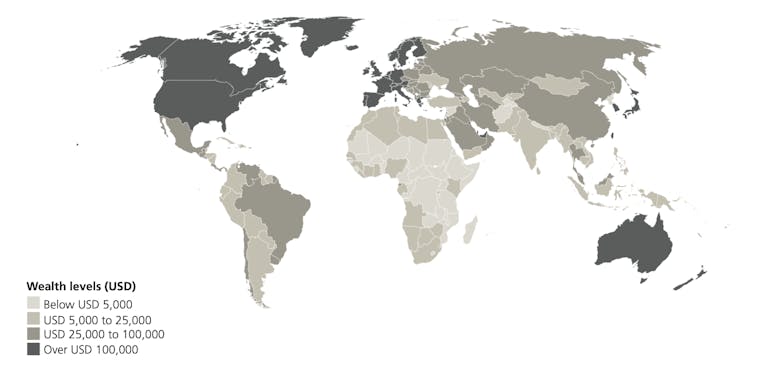

Global wealth has fallen – but is set to rise by 38% over the next five years

World wealth and millionaire numbers declined last year, but economists expect growth to return soon.

Dubai ‘on track’ for busiest-ever residential property year

Agents report "less fevered" price growth in the Emirate despite a record tally of residential property sales so far this year.

Knight Frank heralds ‘relative resilience’ as it cuts global prime resi forecasts

After a challenging run of economic strife and escalating interest rates, Knight Frank's research team has revisited property market predictions for 26 prime global cities in 2023 and 2024.

Ranked: Which overseas owners hold the most UK property?

Hong Kongers own the biggest property portfolios of any foreign nationals across England and Wales, according to some recent research - with an estimated £10.

Ranked: The world’s top 60 second-home hotspots

One location is 'the clear leader' for second-home owners, says Savills after scouring the world for the best places to own a luxury holiday property.

Why Ibiza is back on the map for foreign property buyers

Regional election results mean foreign buyer restrictions have been put on the backburner in the popular Balearic island, notes Knight Frank's Kate Everett-Allen.

Scarcity of stock fuels global prime residential rental price growth

'We expect rents to continue to outperform capital values for the remainder of 2023 and in the medium-term,' says the head of Savills World Research.

Prime resi price growth slows across global cities

Dubai takes the lead for prime residential capital value growth in the latest Savills index.

Economists predict ‘mild house price correction’ across Eurozone

European house prices fell again in Q1 2023, but at a slower pace than in Q4 2022.

Global house prices rise at slowest pace since 2015

Knight Frank's latest Global House Price Index slowed to +3.6% in the 12 months to Q1 2023, down from 5.7% in the previous quarter.

Manhattan’s luxury market in summer surge

The city's high-end market has been on a tear of late.

The price of living well: New research ranks the most expensive cities for HNWIs

'Living well' is now more affordable in European cities than in American and Asian counterparts, says Swiss bank Julius Baer.