International Markets

Ranked: The best locations for ‘executive nomads’ in 2024

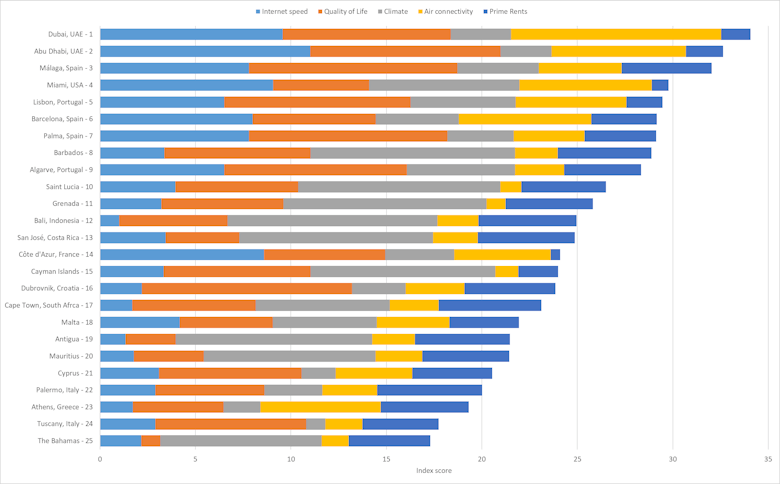

Dubai, Abu Dhabi & Málaga are the best destinations for long-term remote workers, says Savills.

Prime global house price growth ‘is running out of steam’

Knight Frank's latest Prime Global Cities Index came in at +2.6% in Q2 - down from +4.1% in Q1, and under half the five-year average annual growth rate.

How has the UAE’s real estate market been faring in 2024?

Dubai's sales market continues to outperform, but there are concerns over a potential bubble unless supply can keep pace.

London agents toast ‘remarkable’ Saudi Arabian branded resi sales

Sotheby’s International Realty has been showcasing a trio of Saudi Arabian branded residential developments to Middle Eastern buyers in Knightsbridge and Mayfair.

American real estate agents adjust to seismic new commission rules

US broker fees could fall by 30%, suggest analysts as new NAR policies come into play.

Rental price growth ‘stabilises’ in prime global cities

'Even the luxury sector is subject to affordability constraints', says Knight Frank as it heralds 'an end to the substantial upward repricing' of rental markets in key global cities.

Postcard from the Bahamas: Foreign buyers are driving a real estate boom

Michelle Martinborough of Bahamas Realty highlights some of the trends and new developments that 'exemplify the upscale offerings gaining traction' on the Caribbean islands.

Ranked: The best citizenships for global HNWIs

Quality of life trumps financial considerations for most high net worth individuals seeking a second passport.

The View from France: Down but not out in Paris & London

'It sounds odd, but buyers expect a certain amount of craziness in Paris whether it’s a protest or Olympics controversy and investors seem unperturbed by the changes.'

Prime global cities on track for 1.3% house price growth this year

60% of the 30 cities analysed in the Savills Prime Residential World Cities index saw positive capital growth through the first half of 2024, "reflecting a level of relative confidence in the asset class.

Tycoon’s St Tropez mega-deal highlights the French Riviera’s luxury property renaissance

The Côte d’Azur's prime property market has been revived by a flurry of activity from international buyers, as high-value sales recover towards pre-pandemic levels.

Postcard from Marrakech: Sustainability, branded residences & a ‘reverse exodus movement’ from Europe

Jawad El Hassani Sbai talks us through 'a vibrant period of growth and transformation' for the Moroccan property market.