Finance

Choosing Wisely: How to invest in central London property

What makes for a solid investment in the capital?

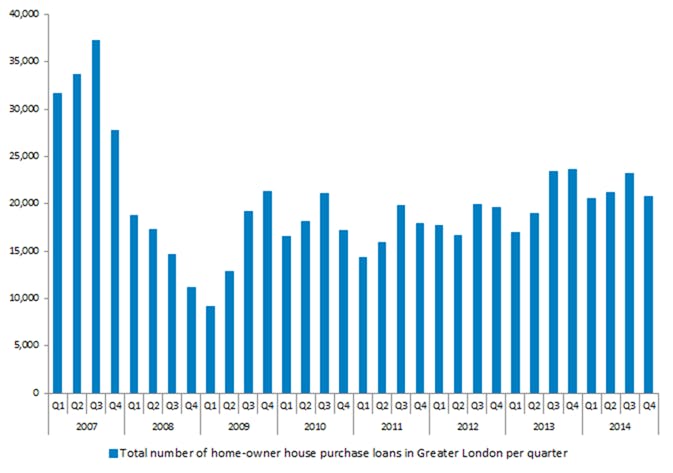

London moving loans drop but remortgages on the rise

The number of remortgages in Greater London tipped up by 10%, with the total value rising by 13%, in Q1;

Required Reading: What happens when an overseas property investment goes wrong?

Before even thinking about the right type of property, overseas investors should spend time finding the right advisors, says professional negligence specialist Elaine Bathers...

Hamptons wraps up prime roadshow in Dubai

Hamptons International is on the last leg of a tri-city tour, showcasing 96 choice cuts from its premium sales register.

Triangle boosts real estate team

Triangle has strengthened its London-based team by hiring a new Head of Asset Management, just a few weeks after snapping up the New Oxford Street Estate for £15.75m.

The New Oxford Street Estate

US buyers £33k worse off than last week as sterling soars

Foreign buyers have seen the cost of buying a property in the UK rocket over the last week, after a Tory election win sent the value of the pound skywards.

Dragonfly ‘turbocharges’ residential refurb finance

Octopus-backed short- and medium-term lender Dragonfly Property Finance has unveiled a "radical overhaul" of its residential refurbishment products.

Omni lends £55m ‘holding bridge’ for super-prime London resi scheme

Christian Candy-backed short term real estate lender Omni Capital has provided a chunky £55m "holding bridge" in advance of proposed development work on residential premises in super-prime central London.

Tory triumph ‘could unleash a pent up multi-million pound wave of Indian investment’

A Conservative majority on Thursday "could unleash a pent up multi-million pound wave of Indian investment into the prime London residential property market," says NW specialist estate agency Rescorp Residential.

Talking Stock: Analysing PCL’s key residential supply trends

The number of dwellings in the Royal Borough has barely altered since 2001 and some of prime central London’s golden postcodes have actually lost stock, according to some eye-opening new research into…

City veterans to launch PCL property fund

A resi investment fund is about to launch on the Alternative Investment Market with plans to build up a central London property portfolio worth £500m.

Countrywide recruits Lloyds man to financial services division

Gert big property group Countrywide plc has hired Lloyds Banking Group's Director of Strategic Partnerships to "develop the growth agenda" of its financial services division.