Tom Bill: Prime London’s sales market proves resilient as supply builds

Buyer demand is running a third above the five-year average in prime London, says Knight Frank's research head, while the supply of homes available to buy is up 16%.

Tom Bill is Head of UK Residential Research, producing reports that include Knight Frank’s flagship Prime Central London indices, the Super Prime London Insight and the London Residential Review. He has written detailed reports on London sub-markets and contributes to The Wealth Report and Global Cities report. Tom, a former Bloomberg and Reuters property journalist, is a regular media contributor on the London property market and has presented at events in Europe and the Middle East.

Tom Bill on what 2021 could bring for the UK property market

Tax changes and the withdrawal of support measures mean the post-Covid ‘normal’ will only begin to emerge later next year, writes Knight Frank's Head of UK Residential Research.

By Tom Bill

Tom Bill: Caution matches optimism in froth-free UK housing market

The last few months are hardly a useful barometer for the future of the market, writes Knight Frank's UK resi research chief, but buyers & sellers appear to be reactivating their plans as relative economic…

By Tom Bill

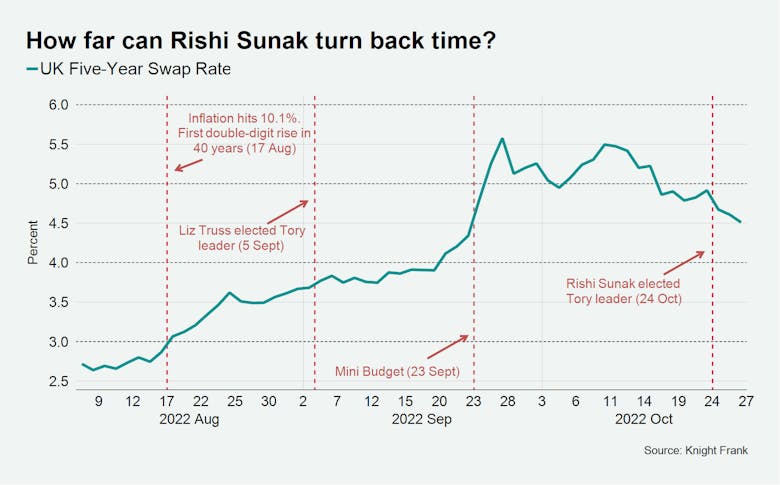

Tom Bill: What Rishi Sunak means for the UK property market

'How far the new PM can wind back the clock is a significant question for the UK housing market.'

By Tom Bill

Companies in this article

Knight FrankMost read

OB Private scales up with senior hires & new brokerage arm

Six new recruits arrive - including an established team from Chestertons - as PCL agency rolls out broker platform alongside employed structure.

Ex-Savills director joins Moveli

Upper-market brokerage continues to scale its national agent network.

Savills appoints new lettings heads in Surrey

Agency strengthens Cobham and Guildford teams as regulation reshapes the rental landscape.

House Collective adds Hamptons veteran as London expansion gathers pace

Alister Shaw and Paul Davis bolster boutique firm’s West and North London teams.

Grant J Bates Property installs new lettings boss

Ex-Hamptons associate director to spearhead prime lettings push at fast-growing luxury brokerage.

Talking Heads: How a cyber-attack put the PCL property sector in limbo

PrimeResi hears from some of the capital's top property brokers, lawyers & developers, about how November's IT hack exposed a fragile planning system, put transactions on ice, and continues to cause 'havoc'…

By PrimeResi

‘A celebration of craft, materiality & artistic expression’: Inside The Whiteley’s latest design collaboration

With more than three-quarters of apartments now sold, the Bayswater landmark unveils another 'Designer Collection' apartment, created by Irish interiors maven Maoliosa Murray.

By PrimeResi

Cohort agrees £20mn loan against £56mn Mayfair home

Big-ticket refinancing was agreed in only three weeks.

By PrimeResi

Strutt & Parker launches broker team to ‘super-charge’ prime London business

Exclusive: After six months building a crack team of PCL brokers, sales chief Claire Reynolds has unveiled a new 'hybrid' operating model that promises to 'redefine agency' in the capital.

By PrimeResi

In Pictures: Rare Connaught Square townhouse hits the market at £6.5mn

Agency debuts Grade II listed residence on high-profile W2 garden square.

LATEST ARTICLES

Buyer picks up rare project on Belgravia’s Chester Square

Unmod townhouse on arguably the neighbourhood's classiest garden square sold off a £11.95mn guide.

Super-prime dealmaker Schiller joins Harding Green

Former Hamptons associate director has made the move from DDRE Global.

Dubai luxury scheme sells out on launch after 3,000-broker preview

DIFC Zabeel District’s first resi development fully sold as city's market momentum continues.

Buyer enquiries & viewings rebounded last month, says Chestertons

Major London player reports enquiries were up 96% month-on-month, though activity still trails January 2025.

Ex-Savills & JLL duo take on Winkworth franchise in north London

Seasoned operators acquire Crouch End outpost & eye expansion.