Property Market News

Feeble Autumn price bounce as vendors hold back

Rightmove reports a 13.5% year-on-year drop in new property listings, with October's traditional price bounce coming at just +0.6% - the lowest monthly rise at this time of year since 2008.

‘Buyers & sellers recalibrate and try to second-guess what’s coming next’

"Much like the weather over the last month, the property market has become increasingly unpredictable," says national buying agency Garrington in its monthly top-line review of market machinations.

Asking rents jump to record highs in London & around the country

Nearly a quarter of landlords are planning to cut their property portfolios in spite of record asking rents, says Rightmove

Prime London property transactions jump 14%; instructions up 9% – but prices fall

New LonRes data for Q3 tells of a markedly busier Summer compared to last year in prime London - although the market above £5m remains subdued

Average time to sell jumps as the property market freeze continues

Two separate analyses tell us that homes are taking longer to find a buyer now compared to a year ago

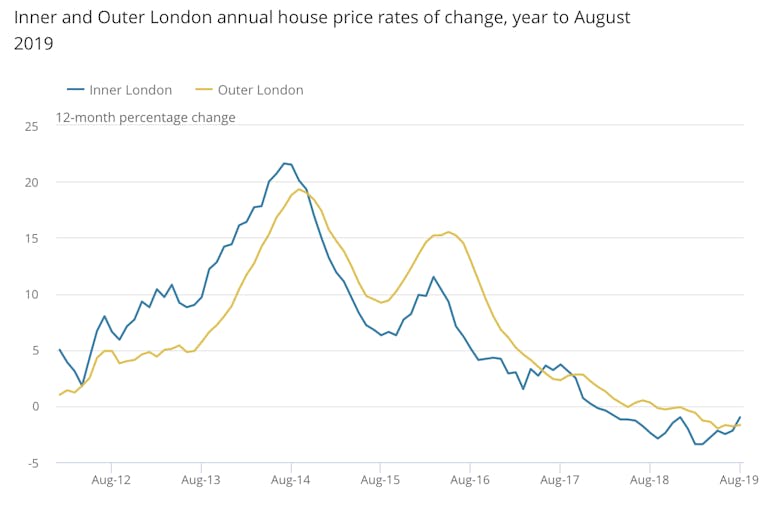

UK property price growth picks up; Inner London shows signs of recovery – UK HPI

The annual rate of UK house price growth has climbed to +1.3%, according to official data.

New-build homes now account for over a third of London’s super-prime property sales

Resilient demand in the face of uncertainty has boosted new developments' £10m+ market share from 18% to 34% in the last two years, reports Knight Frank, as the super-rich prioritise security and hotel-grade…

‘Slow & steady’ property market persists as exchanges nudge up but new instructions dip

First-time buyers have boosted transaction volumes, reports TwentyCI

‘Accidental landlord’ numbers fall for the first time in five years

Next year's tax changes are pushing some landlords to sell up before April, says Hamptons International

Xi’an & Budapest outperform as global cities see property price growth moderate

The average annual rate of property price inflation across the 150 cities tracked by Knight Frank's Global Cities Index has fallen from 6.7% in 2016 to 3.5% in 2019

Buyers & sellers hold back as uncertainty continues to frustrate the property market

"There are good reasons for thinking the latest dip in both buyer enquiries and vendor instructions is a response to the endless wrangling about Brexit," says the RICS Chief Economist

Investors are piling-in to bulk-buy prime London apartments

Buying agency Ludgrove has noted a 55% increase in demand in the second half of 2019 from funds and family offices looking to bulk-buy residential apartments in prime London.