Property Market News

Stamp Duty holiday deadline is ‘not a dealbreaker for most buyers’, as vaccine set to boost the property market next year

The Stamp Duty holiday "is not a dealbreaker for most buyers (especially at the top end)", says Savills, after surveying 1,300 prime property buyers and sellers.

Ranked: Prime London’s most price-reduced areas

21% of £3m+ sales listings in prime London areas have had their initial asking price reduced; Maida Vale is the most discounted enclave...

Average time to sell a home jumps to 141 days

In 2019, it took an average of 129 days from a listing first appearing on a property portal to the transaction completing. That's jumped to 141 days in 2020.

Only one in five people expect UK house prices to fall next year

A recent survey has also found that British buyers are more likely to put forward a lower offer than asking price compared to their European counterparts.

‘London is better positioned than its main competitors to come out of Covid well’: Northacre’s chief on the resilience of London’s luxury property market

"London is better positioned than its main competitors to come out of Covid well," argues Northacre's CEO, Niccolò Barattieri di San Pietro, as he suggests that "lockdown highlighted the greatest pleasure…

FT: Search for splendid isolation drives prime home sales boom

The ultra rich seek to turn holiday homes and private islands into more permanent bases for working and studying, writes James Pickford in the Financial Times.

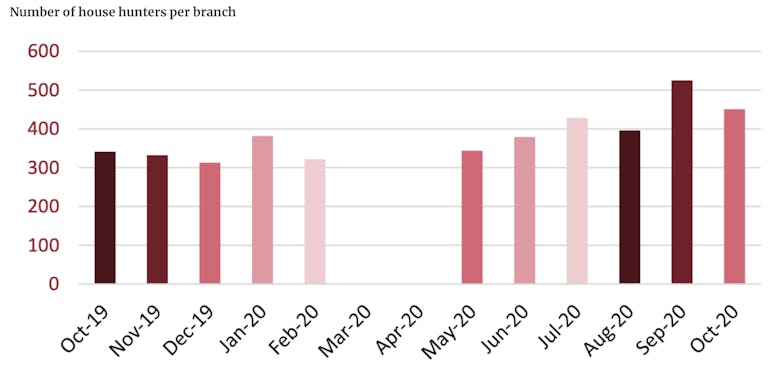

Infography: A deep dive into Prime Central London’s pandemic property market

Savills' Lucian Cook and Frances Clacy examine transaction activity, prices, buyer demand and international activity in London’s prime central property markets...

How prime London’s property market is staging its latest comeback

Lucian Cook examines the historical and global factors that have defined the Prime Central London property market, the current conditions that are transforming the landscape, and what a post-Coronavirus…

Ranked: Britain’s top 10 seaside property price hotspots

Mumbles in Wales, Camber in East Sussex and Fowey in Cornwall are Britain’s top coastal price hotspots, according to Rightmove.

OBR slashes five-year house price inflation forecast by 17%

Average property prices are likely to be 17% lower after five years than was predicted in March, before the pandemic hit, says the Office for Budget Responsibility.

Most prime global cities are likely to see property prices increase in 2021 – Knight Frank

Prime property markets around the world have proven "largely resilient" in the face of this year's happenings, reports Knight Frank.