Property Market News

Prime London sales dipped in April, but are set to bounce back sharply

“The dip in sales in April is temporary,” says Knight Frank, as the number of offers accepted in Prime London spikes.

Prime property sellers ‘prioritise a quick sale rather than hold out for a higher price’ – Coutts

Prime London properties are selling faster than last year, but prices continue to fall.

The housing market has ‘decoupled from traditional economic theory’

"Across all sectors of the market, the trend is a uniform one," says national buying agency Garrington in its latest monthly property market review: "Lack of property for sale, unsatiable demand and rising…

Prime global cities see fastest rate of property price inflation since 2017

The rate of luxury home price growth continues to accelerate in cities around the world, says Knight Frank, but some of the biggest metropolises are seeing prices soften.

Top-end country house prices have soared by 16% in the last year

Country homes valued at £5m+ saw average prices surge by 7.3% in Q1, taking the annual rate of price inflation to a blistering 15.8%.

Mortgage approvals jump 13%

Net mortgage lending reached an all-time high in March.

Stamp Duty data shows surge in £500k+ property sales

Just over a third (36%) of residential transactions were liable for SDLT in the opening three months of this year, compared to two-thirds (67%) in the same period in 2020.

Ranked: Britain’s property price inflation hotspots

Rightmove has done some more analysis of the "frenetic" housing market, identifying which locations have seen the highest rates of price growth in the last year, and revealing that around a quarter of…

New York & London: The race to recover

As London and New York begin to look beyond the pandemic, luxury property insiders from both sides of the Atlantic weigh in on what may be in store for our cities and their property markets in the coming…

How much space does $10k rent in prime global cities?

Hong Kong is still the most expensive city in the world to rent a luxury property, says Knight Frank, despite the pandemic and political headwinds.

‘Celebrity’ homes can command a 10% price premium, claims agency

"There has been a significant sea-change in celebrity attitudes towards collaborating with agents instructed to market their properties," says a top North London estate agency.

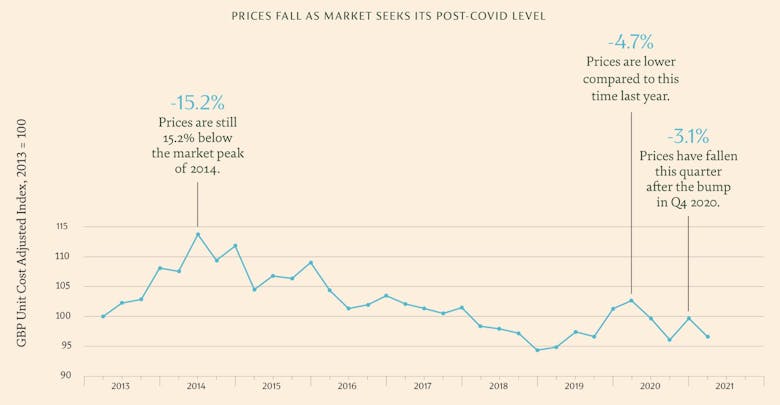

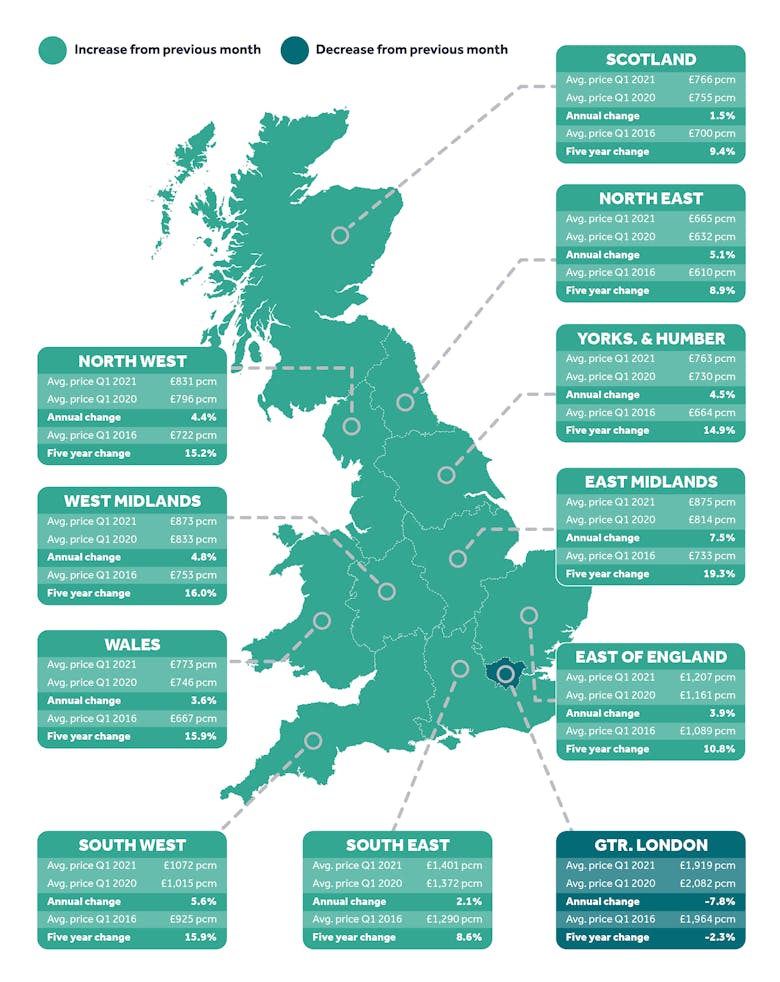

Most of London has seen rental values fall over the last five years

London is the only GB region where average asking rents are lower now than they were five years ago, reports Rightmove.