Property Market News

PCL property prices rise as the market ‘picks up where it left off’ at the end of 2019

Prime Central London has seen annual property price growth for the first time since before the EU Referendum, reports Knight Frank.

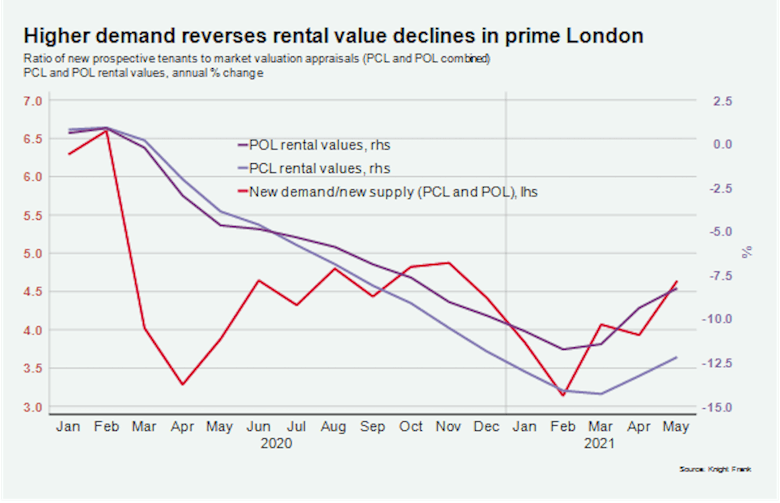

‘More balance is returning’ to prime London’s rental market

Rising tenant demand is helping to reverse pandemic-induced rental value declines in Prime London, reports Knight Frank.

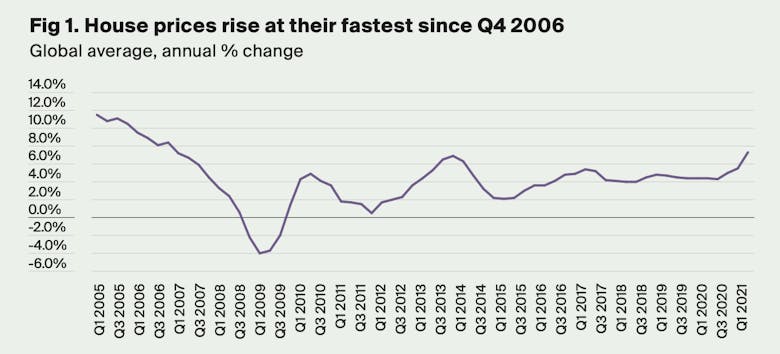

Global house prices rise at their fastest rate since 2006

Knight Frank's Global House Price Index tells of a 7.3% average increase across 56 tracked countries in the year to Q1 2021.

Mortgage borrowing falls from a record high, but approvals rise

The Bank of England reports that net mortgage borrowing fell from a record £11.5 billion in March to £3.3 billion in April.

Prime property stock shortage looms across Europe

“The strong sales rates we’ve seen in the last 12 months have been driven almost entirely by domestic buyers," says Knight Frank;

Ranked: Britain’s most expensive seaside towns

Salcombe tops this year's list, with an average property price of over £950k. The average house price in a British seaside town has jumped by 10% over the past 12 months...

Property market set for busiest year since 2007, on track for over 1.5 million residential transactions

Zoopla expects the total value of homes sold in the UK to reach £461 billion this year; that's 46% more than in 2020, and 68% more than in 2019...

Properties sold above asking price reach an all-time high as demand continues to outpace supply

There are 16 buyers for every available property on the market, according to Propertymark.

Affluent home-buyer demand has shifted, but which trends will endure?

"Mega estates are making a comeback," says American property giant Coldwell Banker. "Gardens and backyard settings are being re-envisioned. Luxury medical concierges are the next big wellness trend.

Housing market rallies to highest spending level since the Global Financial Crisis

New estimates show the extent to which spending in the housing market has bounced back from the pandemic.

Beyond the eco-conscious affluent: Is there a green premium for new homes?

Consumer sentiment is increasing towards more sustainable "green" homes, say Lucy Greenwood & Patrick Eve of Savills, but only larger homes achieve a "green" premium.

Central London property transactions jump – but buyers remain ‘cautious & price-sensitive’

Winkworth has reported a 48% surge in central London buying activity (15% ahead of the five-year average), but still describes the market as "muted".