Property Market News

Global Property Buyers in 2021: Five key stats & five future trends

Knight Frank's Global Buyer Survey 2021 tracks how the world's affluent property buyers’ priorities, motivations and attitudes are changing.

Rental market gets moving, with demand, supply & rents all rising

"Many renters that have been sitting tight are now looking to move," says Propertymark.

Britain’s 19 new million-pound property markets

"The pandemic has left its mark on the UK property market by magnifying existing trends rather than re-writing the rulebook," says Knight Frank, as the firm identifies 19 new £1m+ property markets across…

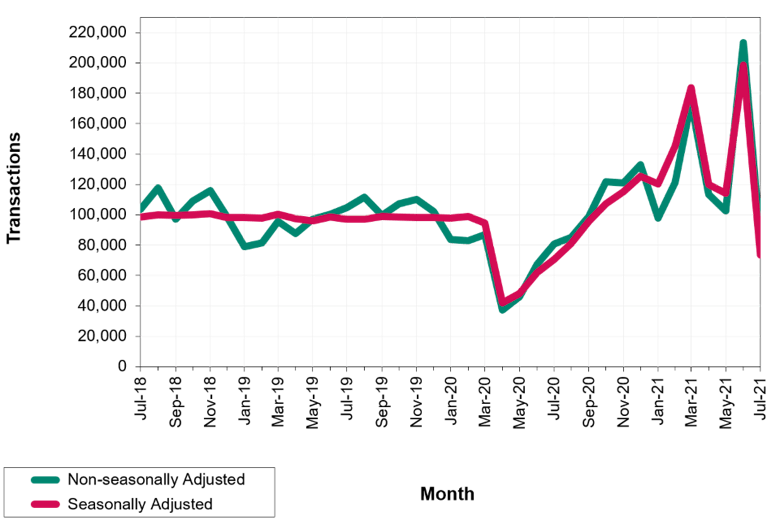

Transaction numbers plunge following Stamp Duty deadline

Official estimates tell of a 63% drop in residential property sales from June to July - but transactions are still running above last year's level.

‘Costly & unnecessary’ Stamp Duty holiday ‘not the main cause of house price boom’ – Resolution Foundation

"Stronger forces" than the temporary tax break have been at play in the housing market over the last year, says an influential think tank - which argues that the UK's Stamp Duty holidays have been "problematic…

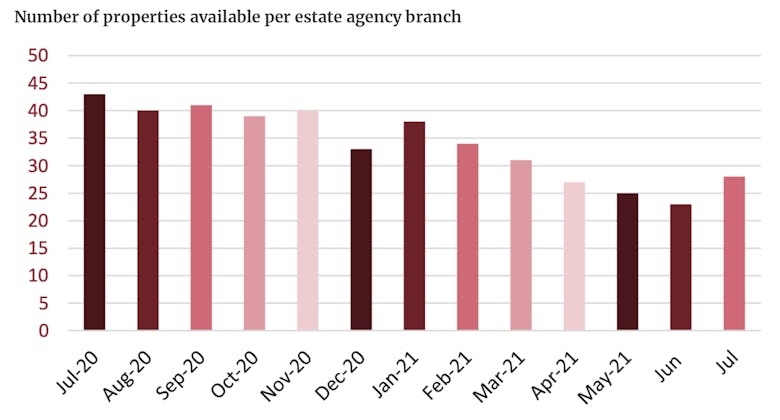

‘Signs of stabilisation’ as property supply picks up

"This month’s slight rebalance of the market is welcome news and a much-needed step in the right direction," says Propertmark's CEO, "with supply of property beginning to increase and the number of homes…

Average property prices leapt 4.5% in the month before the Stamp Duty holiday deadline – UK HPI

The average UK house price increased by 13.2% in the year to June 2021, up from 9.8% in May, according to the latest official UK HPI.

Strutt & Parker doubles UK house price forecast for 2021

“The demand for new ways of living will drive the market for many years to come," says national estate agency Strutt & Parker as it suggests that UK house prices will rise by up to 35% over the next…

‘A calm change of gear’ for the property market as ‘busy conditions look set to continue’ – Garrington

"The property sector has defied expectations and seasonal norms by remaining remarkably busy for the time of year," says buying agency Garrington in the August edition of its video review of the property…

Mapped: Which prime London enclaves have seen the biggest property market shifts since 2019?

Coutts bank has highlighted some prime London locations that have seen notable shifts in property buying activity compared to pre-pandemic times.

Is this the last property boom? Economists predict ‘the death of house price cycles’

Property markets are surging around the world. But "there are good reasons to think this will mark the last house price boom for the next 30 years," says Capital Economics.

Asking prices dip as top-end property markets cool

Asking prices have fallen for the first time this year, driven by declines at the top-end, but Rightmove is predicting an Autumn bounce for the property market.