Property Market News

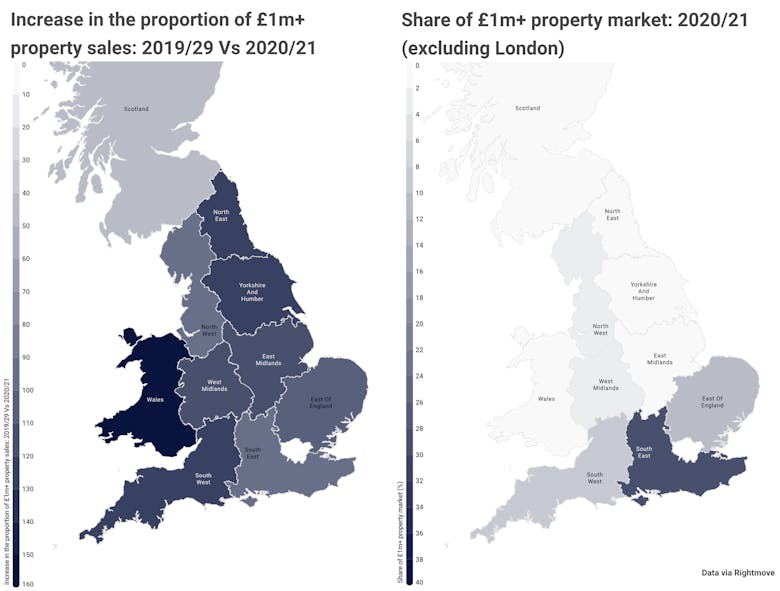

‘London’s overall influence on the prime market has dropped’, says Rightmove, as Scotland becomes Britain’s fastest-moving £1m+ property market

London now accounts for 40.5% of all seven-figure transactions in the UK, down from 47% before the pandemic.

Average rents have increased by 7.4% in the last year

But the total amount of rent paid by tenants across Great Britain has fallen 8% since 2018, says Hamptons.

PCL has ‘turned into a landlord’s market in recent weeks’, as tenant demand surges by 73%

A top estate agency has reported the highest number of new prospective tenant registrations in five years - topping previous records set in June and July this year.

Sales & new listings dip as property market ‘takes a breather’

House prices "are expected to continue to climb higher over the year to come," says the RICS, "albeit the pace of increase is likely to subside somewhat in the months ahead."

Prime London property market ‘shrugs off’ end of stamp duty holiday

"We can confidently predict a strong end to the year," says Knight Frank, "just less frenetic than the first six months."

Rent inflation reaches a decade high as tenant demand jumps by a third

"This unprecedented rate of growth is driven by the post-lockdown reopening of cities, and a return among tenants to the city rental landscape," says Zoopla.

Property prices likely to rise by a third over the next ten years

Using a very long-range crystal ball, insurance website Comparethemarket is predicting that London's average property value will climb by 63% by 2040, with the UK average rising by 58%.

Newmarket tops supply shortage hotspots as home sales surge by 79%

Rightmove has identified which locations are being hardest hit by the ongoing shortage of properties available to buy.

Mortgage approvals fall again, but remain above pre-pandemic levels

UK borrowers repaid £1.4bn of mortgage debt in July; it's only the second time in a decade that the Bank of England's data has shown a net repayment.

‘Acute’ property stock shortage to continue into 2022 – Zoopla

“The post-pandemic ‘reassessment of home’ has further to run," says Zoopla, as the UK's property market faces its "greatest stock shortage since 2015."

Global Property Buyers in 2021: Five key stats & five future trends

Knight Frank's Global Buyer Survey 2021 tracks how the world's affluent property buyers’ priorities, motivations and attitudes are changing.

Rental market gets moving, with demand, supply & rents all rising

"Many renters that have been sitting tight are now looking to move," says Propertymark.