Property Market News

‘Well & truly on the rebound’: Property prices rise & discounts drop in Prime Central London

“The market for properties worth £1 million or more in London is well and truly on the rebound, having been in the doldrums over recent years,” says Coutts’ CEO, Peter Flavel.

New Year demand for property up 50% – Zoopla

“There are signs that the imbalance between demand and supply is starting to ease,” says Zoopla in its latest market update.

Prime London is ‘returning towards a pre-pandemic rental market’

London Central Portfolio saw an 11% jump in agreed rents on new tenancies in Q4 2021, "correcting the deep discounts that were granted during the same period in 2020".

Chain-free properties sell for 11% more than entangled homes

New research estimates a sizeable price premium for property sales that are not reliant o other transactions...

Stamp Duty receipts jump to deliver record year for HMRC

SDLT & ATED raised £5bn more last year than in the previous period.

Secret Agents: Quiet listings & off-market property deals have soared in the last year

More than 135,000 homes were sold without ever appearing on a property portal or being publicly advertised in 2021, according to new data, while a quarter of £1m+ sales in London were off-market deals.

‘Prime residential cities are expected to remain a safe haven in 2022’ – Savills

Savills' research team is predicting another strong year for property markets in prime global cities, with Miami and Berlin set for the highest rates of price growth in 2022.

Post-Christmas supply builds as Omicron uncertainty fades

The lifting of restrictions this week could see the supply of property re-build and normal house price economics return, says Tom Bill.

House price & rental growth to continue outpacing wage inflation, warns the RICS

Buyer demand continues to outpace the supply of homes available to buy.

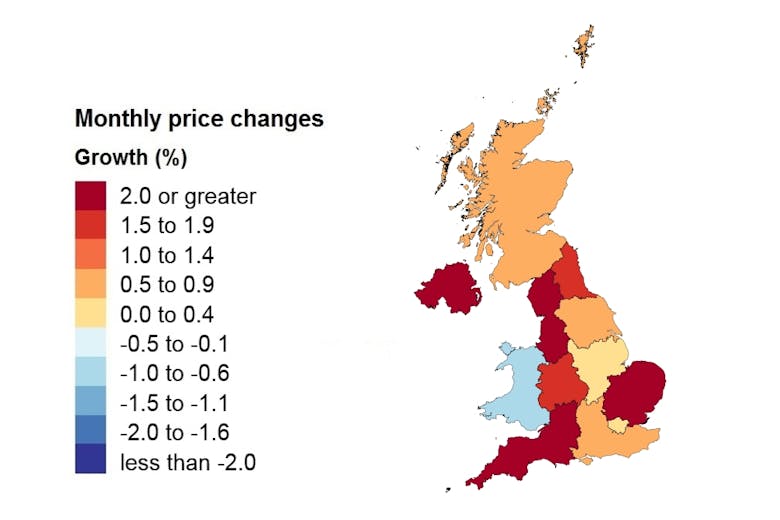

UK property prices increased by 10% in the last year – official data

London continues to be the region with the lowest property price inflation rate, according to the latest UK HPI: +0.2% in November and+5.1% for the year.

Ranked: London’s busiest property markets

3.3% of private homes in London changed hands in a 12 month periods, with eight boroughs seeing more than one in every 25 homes sell.