Property Market News

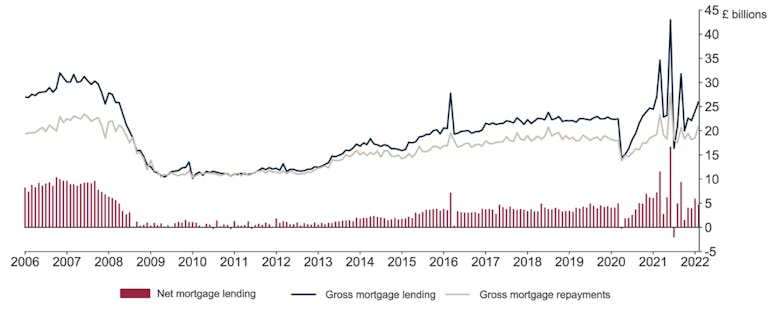

Mortgage lending drops, ‘confirming that the froth has come out of the market’

The average mortgage value was £235,474 in February - a significant 4.6% higher than the previous month, and 10.4% up one the year.

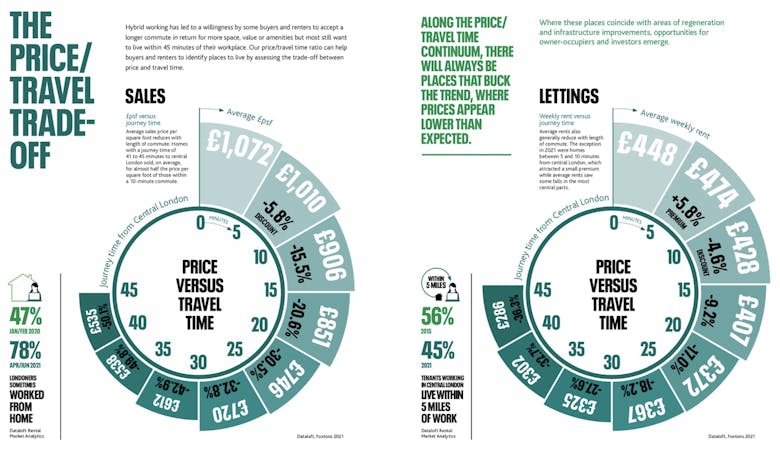

Infography: Charting London’s property market surge

Foxtons saw a drastic surge in demand for homes in London as the Covid-19 pandemic eased; producing a series of charts to illustrate the capital's key property market trends through an extraordinary time.

‘Buyer demand remains unseasonably high’ – Zoopla

It's been a busy start to the year for the property market, with some 30% more sales agreed in Q1 than in pre-pandemic times.

Soaring energy costs will push buyers towards more efficient new-build homes – JLL

The new homes industry has an opportunity to attract a new wave of buyers and tenants looking to save money - and do their best for the climate - says agency

Prime London buyer demand ‘stalls’

One in four prime London property listings has already found a buyer, down slightly compared to Q4 2021.

House-hunters are ‘being driven by fear or frustration’, says buying agency

House-hunters are "being driven by fear or frustration" into the arms of buying agents, says national firm Garrington, as "the degree to which the property market has decoupled from economic reality over…

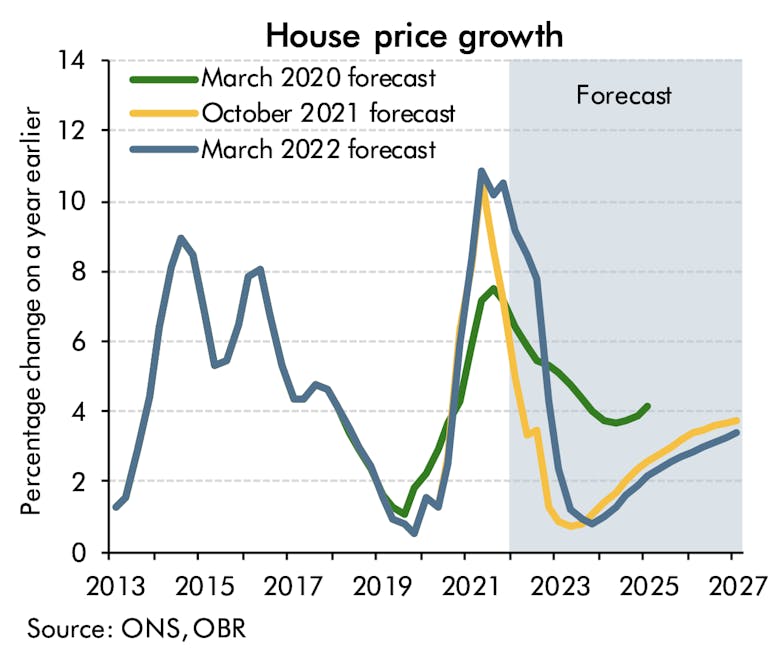

OBR upgrades house price forecast again

Average house prices are likely to rise by 7.4% this year, predicts the Office for Budget Responsibility, and by 15.8% over five years.

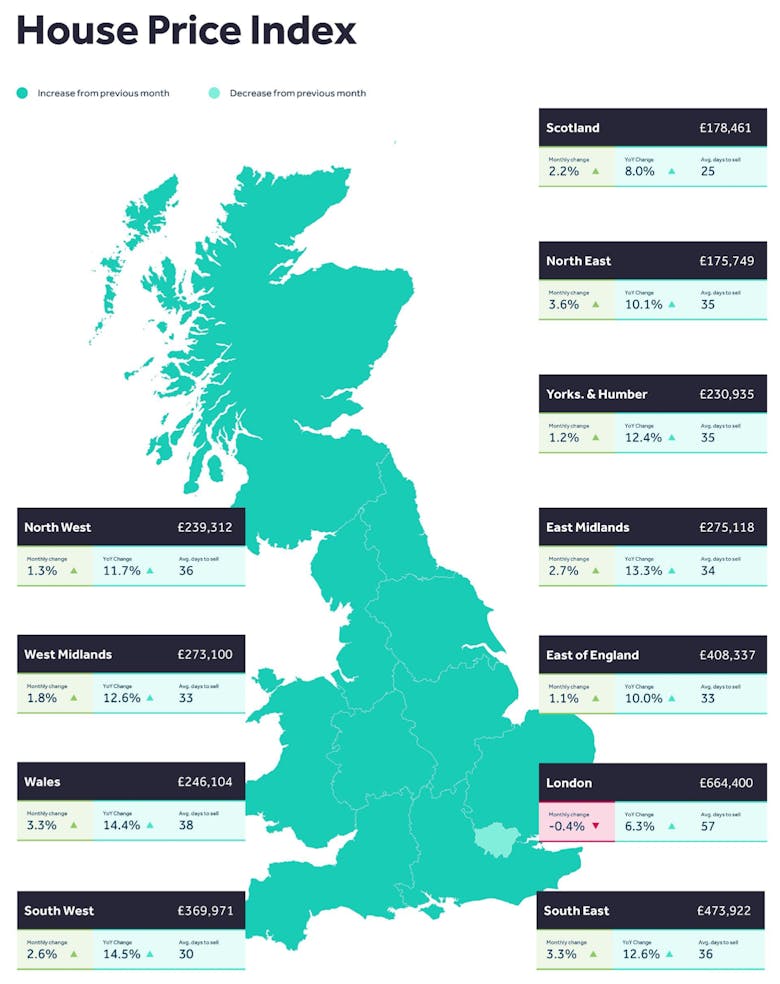

House price inflation eases to +9.6% – UK HPI

The official UK House Price Index tells us that average property prices increased over the year to January; in England to £292,000 (9.4%), in Wales to £206,000 (13.9%), in Scotland to £183,000 (10.

London property is over-valued by ‘as much as 50%’, warns ratings agency

Analysts predict a property market "correction" in and around the capital, as house prices detach from incomes.

‘Best ever spring sellers’ market’ as asking prices hit another record high

Rightmove has recorded the biggest March jump in average asking prices since 2004 - but the portal's top analyst warns "there are headwinds that seem likely to remove the current market froth in the second…

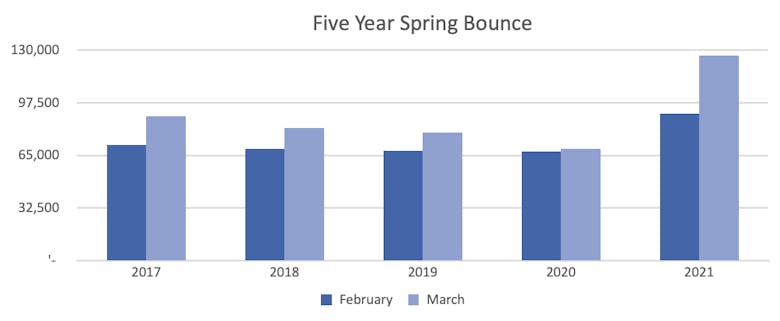

Property transactions leap by 28% in a typical March

The traditional Spring market bounce sees property transaction numbers jump by an average of 28% in March, according to new analysis by Jackson-Stops.

Prime Central London flats offer ‘investment opportunities’ as rental yields jump – LCP

"As the PCL market begins to pick up momentum there is still a degree of discrepancy between the performance of houses and flats," says LCP boss Andrew Weir - "pointing towards the investment opportunities…