Property Market News

Anatomy of a market: Prime Central London explained in 10 charts

A data-led look at activity and pricing across the capital's £3mn-plus sector.

Prime London sales market limps into 2026 as demand stalls & supply builds

LonRes data shows record listings, falling transaction volumes - and values continuing to adjust.

Average PCL price per sq ft at lowest level since 2012

Rising supply and dwindling demand are keeping values under pressure in the capital's most exclusive postcodes, reports LonRes.

High-end sales surge in London amid post-Budget clarity

Latest data shows £5mn-plus exchanges jumped 29% in Q4, although prices continued to slide across the capital's top postcodes.

London Super-Prime Market Survey: What changed in 2025 – and what lies ahead in 2026

Non-dom exits, international bargain hunters and a raft of trophy listings reshaped the £15m-plus sector over the last 12 months, reports Beauchamp Estates,

Prime London buyers resurface after Budget clarity – but vendors beat a retreat

Property sales spiked as uncertainty lifted in November, according to LonRes, though supply-side trends point to a cautious year-end.

Savills reports big jump in country house sales; expects ‘busier-than-usual’ year-end

The agency transacted on over £120mn-worth of prime country homes in November - 66% more than in the same month in 2024.

Super-prime sales slow in key HNW hubs as politics, taxes & tight supply bite

Survey of 12 global markets shows a 21% Q3 drop in $10mn-plus deals - led by sharper falls in New York and London - but the overall 12-month tally is still the strongest since 2021.

‘Below average for the time of year, but not chronically so’: How the prime London sales market is really faring pre-Budget

Values, new instructions and sales have all been falling, reports LonRes - but the stark comparisons say more about last year than the current state of play.

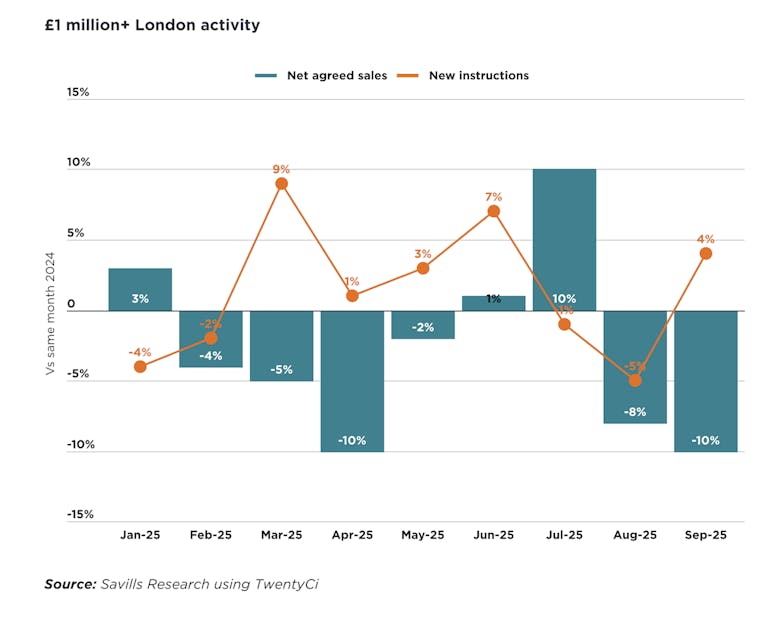

Kensington crowned London’s high-value sales hotspot – Savills data

W8 outshines Chelsea & Belgravia for the first time in five years, as domestic demand shifts the PCL landscape.

Prime rental markets hold firm as regulatory changes loom

PCL values post largest quarterly uptick since September 2023; landlords expected to stay cautious as Renters’ Rights Bill nears enactment.

Market Snapshot: Prime London, Q3 2025

Three key charts reveal what's happening on the ground ahead of a critical period for the capital's property market.