Market Index

Tom Bill: Prime London market resilient despite rising mortgage costs

'The economic mood has darkened but the market is far from grinding to a halt,' says Knight Frank's research chief, Tom Bill - although 'the air continued to slowly come out of the prime London property…

Property price cuts on the rise as higher mortgage rates ‘hit buying power by up to 20%’

The average asking price discount has climbed to 3.8%, says Zoopla, as one in six vendors accept offers at least 10% below their initial asking price.

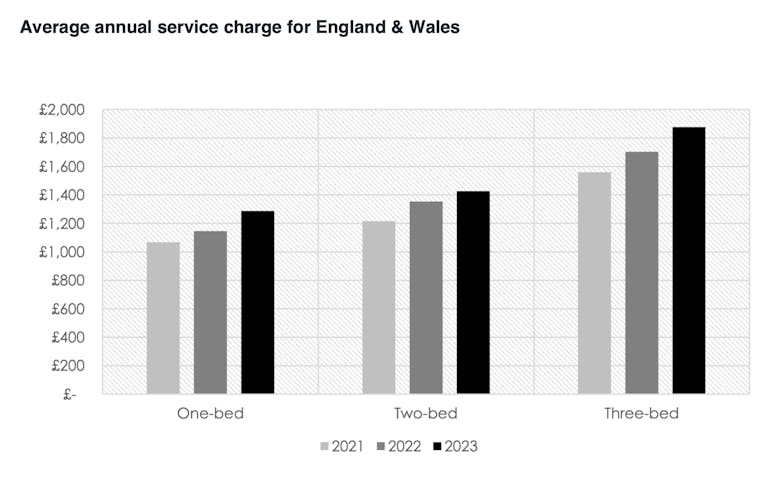

Property service charges have risen by an average of 52% in the last five years

Service charges surged as improved fire safety measures were introduced in the wake of the 2017 Grenfell Tower tragedy.

‘The property market looks set to remain a deal makers market’, says buying agency

Garrington rounds-up some of the big property market indicators and indices to give a buyers-eye overview of the market in June.

Annual house price growth slowed to 3.5% in April – UK HPI

London continues to have the lowest rate of annual house price growth of any UK region - but the capital saw a 2.1% jump in sold prices from March to April.

‘The belated spring price bounce has quickly turned into an earlier than usual summer slowdown’ – Rightmove

Property portal still expects average asking prices to end 2023 2% lower than they started they started the year.

Prime global rents climb to record highs, but the pace of growth is easing

Singapore and London have seen the biggest prime rental price increases over the last year, according to Knight Frank's latest city index.

London leads rental market deceleration

The blistering pace of rental price growth has cooled in the last month, reports Hamptons.

‘Storm clouds are gathering’ for the property market, warn surveyors

Surveyors are reporting a 'less downbeat pessimistic trend' - but the spectre of more interest rate rises means the market may chill further.

Larger homes are taking ‘considerably longer’ to sell

'One of the early underlying trends of 2023 and a direct effect of higher mortgage rates has been strengthening demand for smaller homes,' says Hamptons, as the housing market slows down.

Mortgage approvals have fallen by 26% in the last year

Mortgage lending has dropped to the lowest level on record, if the period since the onset of the Covid-19 pandemic is excluded.

Industry Reactions: Property transactions plunge by nearly a third

HMRC has reported a 'particularly large' drop in residential property transactions from March to April.