Market Index

Edinburgh house price growth turns negative for the first time in over a decade

Knight Frank expects Edinburgh's average property value to drop 10% over the next 18 months.

Sales market ‘continuing to lose ground’ while rentals remain hectic – RICS

July's survey of surveyors yields 'concerning' insights on both sales and lettings markets across the UK.

Lettings supply rises in Prime London as sales market stutters

“We are starting to see a noticeable shift in stock from the sales markets to the lettings market as owners are not able to sell for the asking price,” says Knight Frank.

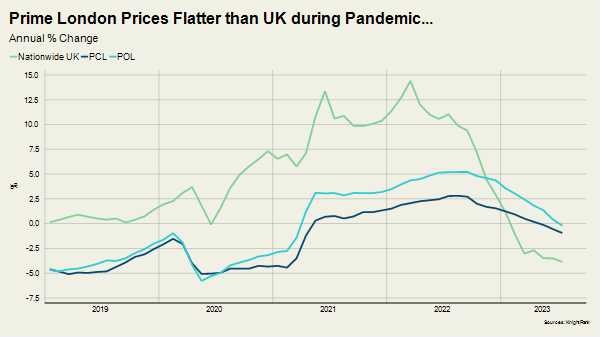

Prime London sales market slows by less than the rest of the UK

Prime Central London property prices fell 0.9% in the year to July, according to Knight Frank's last index - which was the largest drop since April 2021. Prime Outer London saw a 0.

Prime London property sellers are willing ‘to let properties go cheaply’ – Coutts

38% of prime London property listings have had their asking price reduced, which Coutts bank says "demonstrates the continued willingness of sellers to let properties go cheaply and take the income available,…

‘This is now a buyer’s market’ – Garrington

Slowdown "is not a temporary aberration but looks to be a shift in the UK property market’s landscape for the second half of the year," says top buying agency.

Southern England ‘bears brunt of house price falls’ as buyer demand drops – Zoopla

Zoopla expects average UK property prices to be 5% lower by the end of the year - but that would still be 15% higher than pre-pandemic levels.

Renter competition remains high as London enters ‘peak letting season’

The latest Foxtons data tells of a traditional Summertime surge of activity in the rental market.

Resi development land values fall, but market activity is ‘picking up slowly’

'Some of the major housebuilders are cautiously returning to the land market,' says Savills - although 'many are still largely out of the market.'

Average asking rents are now a third higher than before than pandemic – Rightmove

"Despite quickly rising prices, rental homes are continuing to let at speed and many landlords are still being met with long queues of prospective tenants wanting to view and rent their property," says…

‘No sign yet of fundamental change in market conditions’ – Propertymark

'It is clear that a core portion of the country are still looking to get moving and are not put off by current conditions,' says Propertymark.

Industry Reactions: UK HPI shows no change for the average house price in May

The annual rate of property price growth slowed from +3.2% in April to +1.9% in May, according to the UK's official House Price Index.