Market Index

‘Normal trading conditions’ return to London’s prime rental market

'The meteoric rental value growth seen in recent years has calmed down,' says Knight Frank.

Prime London Property Market Snapshot: Week 49, 2023

16% more sales were agreed in Prime London last week compared to the previous seven days, but 15% fewer than the corresponding week last year...

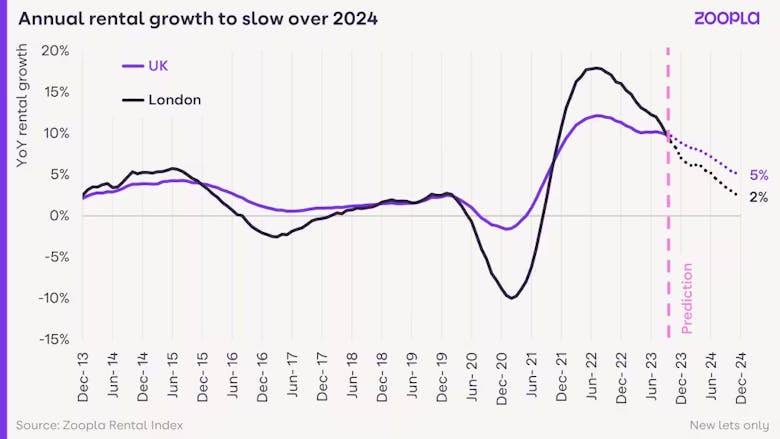

‘Rental growth has now peaked and we expect a major slowdown in 2024’, says Zoopla

'There are signs that the UK rental market will turn in 2024,' says Richard Donnell; 'rents are reaching the maximum affordable price and rental demand is starting to slow.'

Average asking prices to drop 1% in 2024, predicts Rightmove

The property market displayed 'much-better-than-predicted resilience this year,' says Tim Bannister, despite a bigger than usual December dip for new asking prices.

Inner London rents have jumped 13.2% in the last year

Tenants across Great Britain paid a record £85.6bn in rent in 2023, says Hamptons - equivalent to the total value of all homes sold in London last year.

Prime London Property Market Snapshot: Week 48, 2023

Deal numbers are down again in prime London, but sales supply has picked up.

‘Asking prices are still too high’, says Propertymark

Housing market activity is slowing down as seasonal trends re-emerge, says the estate agency trade body.

Mortgage approvals rise as interest rates stabilise

Bank of England data tell of another increase in mortgage approvals, prompting Savills to suggest 'some confidence is beginning to return' to the property market.

Prime London Property Market Snapshot: Week 47, 2023

Deal numbers continue to slide in prime London, but the last week has seen a decent increase in new sales instructions.

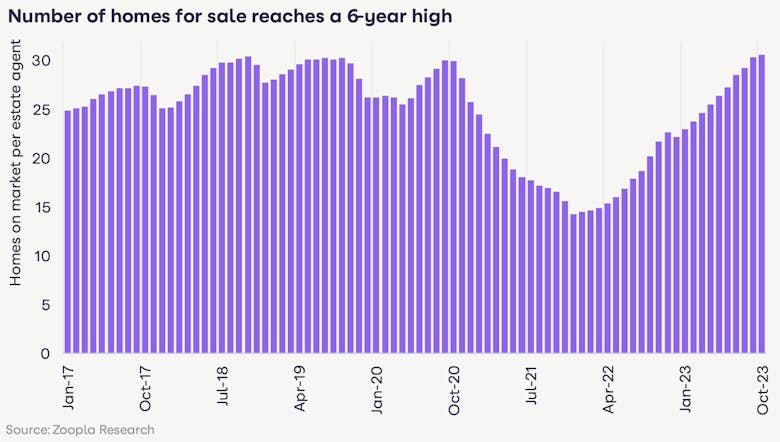

‘These are the best conditions for home buyers for some years’ – Zoopla

Property prices are still falling across most of the UK as supply improves - with buyers in London and the South East securing the biggest asking price discounts.

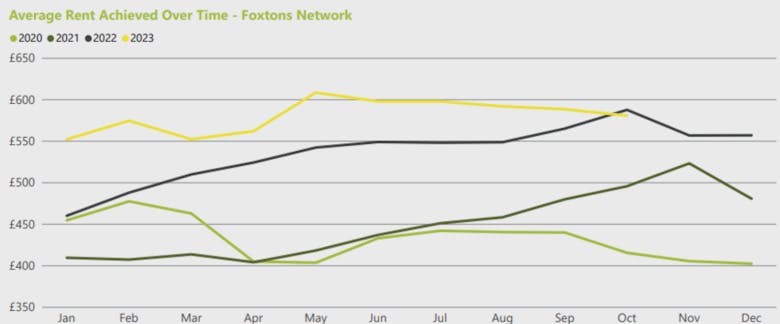

Traditional seasonal trends return to the rental market as ‘landlords remain confident in London’s unfailing appeal’

Tenant demand has fallen sharply in the last month, prompting Foxtons to herald 'a shift towards a more balanced market' in the capital.

Global residential rents tick higher but affordability begins to bite

Slower growth in top-tier rental markets such as New York and Singapore 'points to the likely direction of travel for big city markets,' says Knight Frank.