Market Index

Seven charts that illustrate the slowing property market

Propertymark's latest survey of estate agents confirms a slowing sales market.

Prime rental price growth ‘stalls’ for first time in three years

The imbalance between rental supply and demand 'continues to unwind', says Savills.

Sales market sees strong start to the year, but ‘it’s important not to get carried away by the outlook for the rest of 2024’

Zoopla recorded a sharp increase in property sales and London buyer demand in the opening weeks of this year.

Pace of London rental growth falls sharply, but agents are still busier than ‘normal’

After years of double-digit growth, Rightmove is predicting a 5% increase for new asking rents outside of London through 2024, and +3% in London.

Non-farmers dominated farm & estate sales in 2023

Around 75,500 acres of agricultural land was marketed for sale in 2023, reports Strutt & Parker, with investors and lifestyle buyers playing a much more active role in the market than in previous years.

Property market ‘is back in gear and gaining traction’ – Garrington

Buying agency flags an 'optimistic yet fragile' outlook for the property market in 2024.

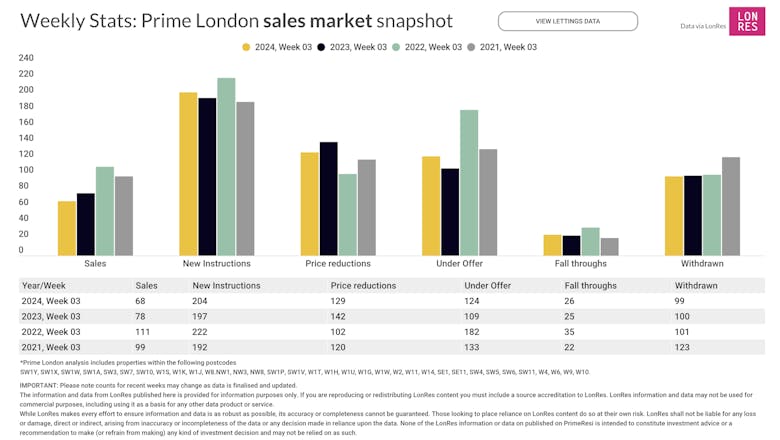

Prime London Property Market Snapshot: Week 03, 2024

Buying activity continues to be slow in prime London, while the rental market is looking a lot cooler than in previous years.

‘Stubborn sellers rewarded’ as gap between asking and sold prices narrows

'The house price crash that so many experts said was an inevitability appears to have been averted,' says Benham and Reeves' boss, adding that 'we fully expect the market to go from strength to strength…

Foxtons reports ‘a strong start to what should be a pivotal year in London lettings’

Demand and supply appear to be rebalancing to more sustainable levels.

Sales market activity ‘continues to improve gradually’ – RICS

'Downward pressure on prices is diminishing,' says the RICS, as surveyors suggest property values will 'remain largely flat' through 2024.

Industry Reactions: Official data reveals UK house prices falling at fastest rate in 12 years

The latest UK House Price Index tells of 'a frosty end to the year', says Jackson-Stops, while buying agency Garrington says November 'was the moment the slowdown turned into a slide'.

Prime London Property Market Snapshot: Week 02, 2024

It has not been a busy start to the year for most of prime London's property market...