infography

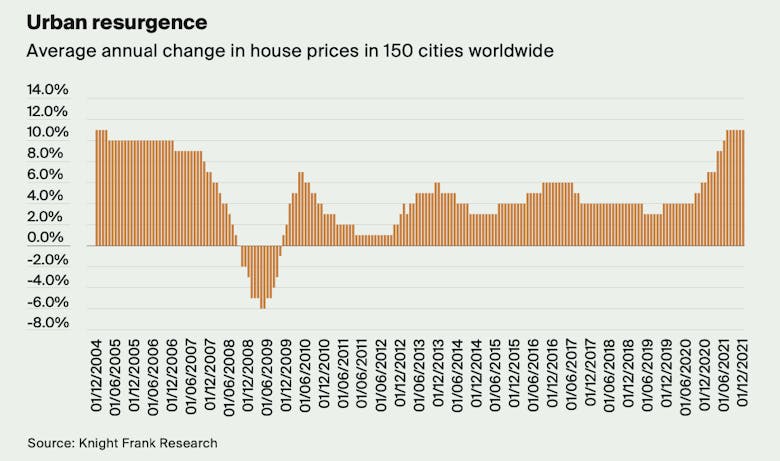

Global cities see highest house price growth in nearly 18 years

44% of global cities saw average house prices surge by more than 10% in 2021.

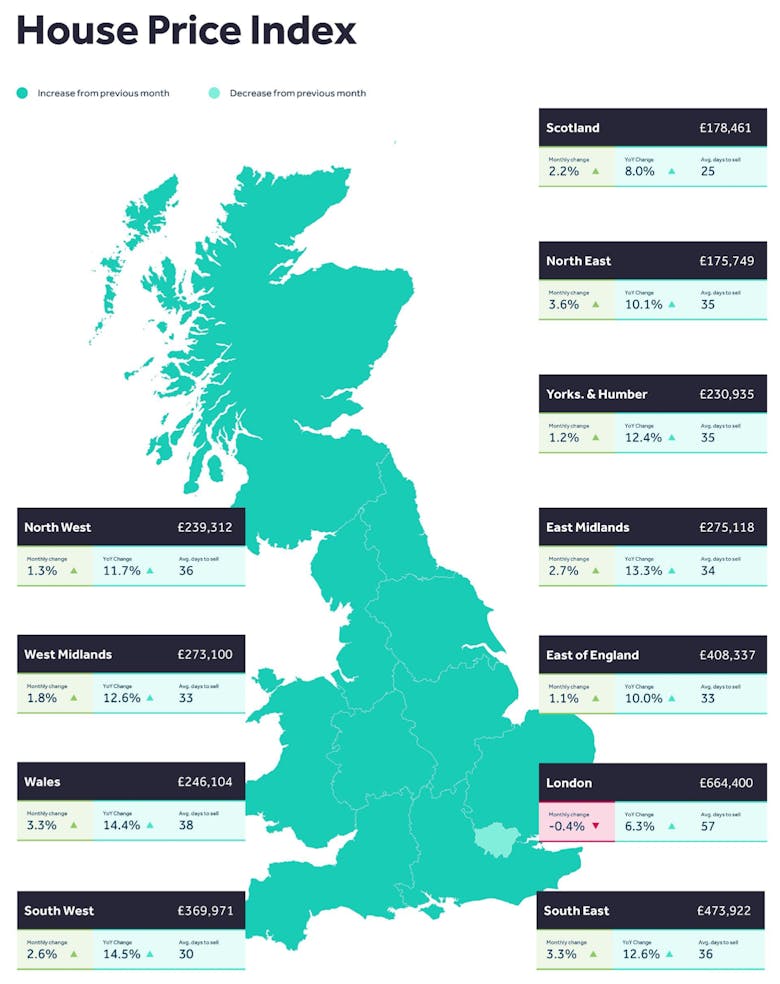

Mapped: Britain’s busiest property markets in 2022 so far

There are currently 172,589 residential properties listed for sale across the UK, according to research by TwentyCi, and another 237,512 homes with sales agreed.

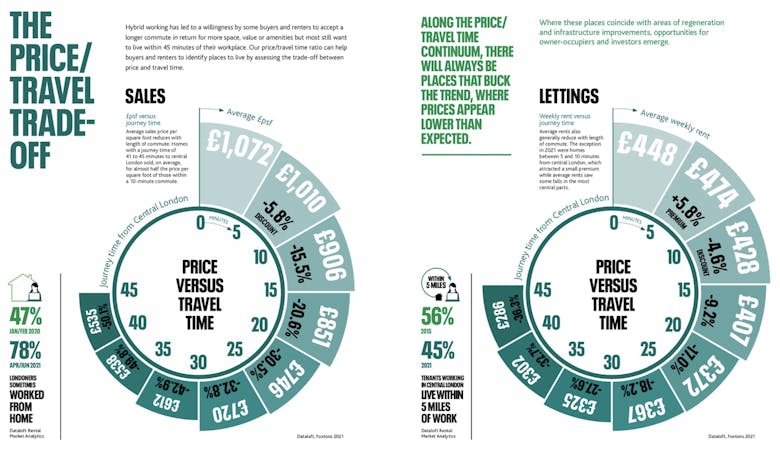

Infography: Charting London’s property market surge

Foxtons saw a drastic surge in demand for homes in London as the Covid-19 pandemic eased; producing a series of charts to illustrate the capital's key property market trends through an extraordinary time.

‘Best ever spring sellers’ market’ as asking prices hit another record high

Rightmove has recorded the biggest March jump in average asking prices since 2004 - but the portal's top analyst warns "there are headwinds that seem likely to remove the current market froth in the second…

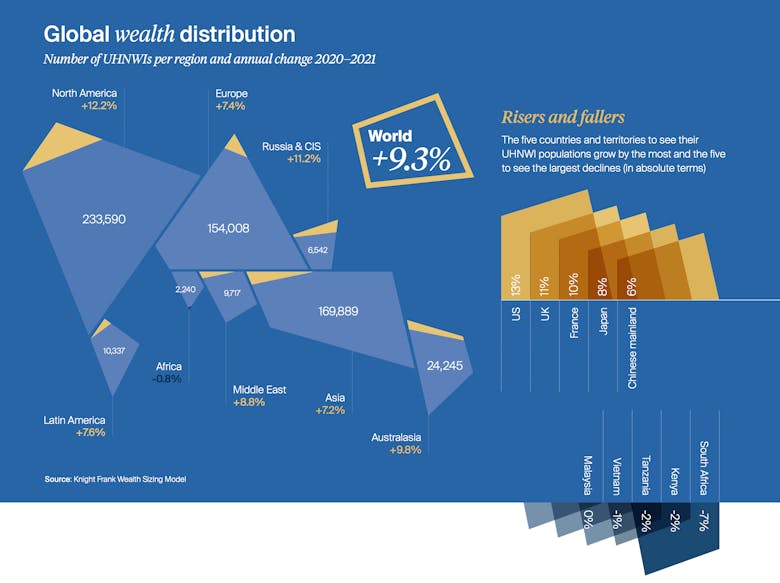

International prime property prices surged in 2021 as ‘luxury homes became the asset class of choice for UHNWIs’

Knight Frank's Prime International Residential Index posted its biggest ever year in 2021, with luxury property prices around the world rising by an average of 8.4%.

Wealth Creation in 2022: Liam Bailey’s 11 key insights

Knight Frank’s Global Head of Research, Liam Bailey, shares his key insights from the 16th edition of the firm's flagship annual publication, The Wealth Report.

Heatmapped: London property prices set to rise 19% in the next five years; rents by 14% – CBRE

CBRE's eighth annual "borough-by-borough" research report tracks property market, demographic and lifestyle trends across the capital.

PCL prices increased by 1.6% in Q4, but remain 11% below their 2015 peak

"The significant recovery in the PCL lettings market, witnessed during Q4 2021, together with the easing of the Covid travel restrictions, could be a precursor of what lies ahead for the sales market in…

‘The outlook for both prices and rents remains a little worrisome’ – RICS

Buyer and tenant demand increased further in January, while the supply of properties for sale and rent continued to fall short.

New Year demand for property up 50% – Zoopla

“There are signs that the imbalance between demand and supply is starting to ease,” says Zoopla in its latest market update.

Prime London is ‘returning towards a pre-pandemic rental market’

London Central Portfolio saw an 11% jump in agreed rents on new tenancies in Q4 2021, "correcting the deep discounts that were granted during the same period in 2020".

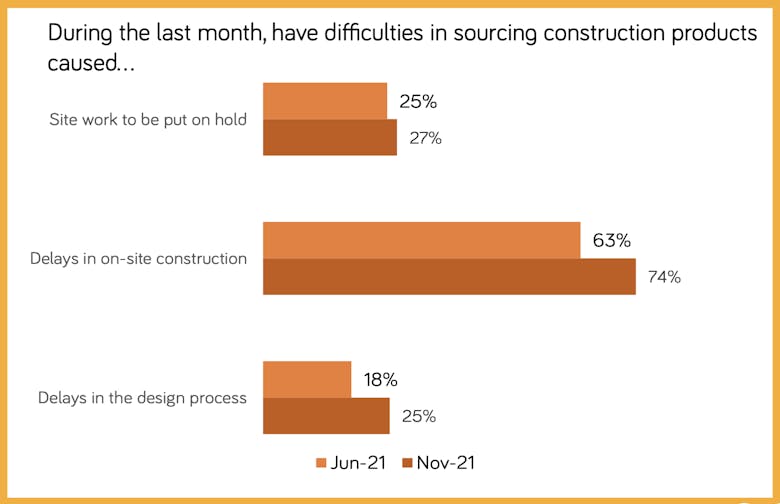

Construction supply issues are worsening, warn architects, ‘making sustainable design more difficult’

"Shortages of [construction] materials remain significant and inflation is gathering pace", according to the latest update from the RIBA.