infography

‘Demand for rental properties across London is strong & momentum is building’ – Foxtons

23% more tenants registered with the London estate agency in the first half of this year compared to last, but the firm listed 6% fewer homes to rent...

Rental growth returns to prime London

Q2 saw the first increase in prime London's average rental value since September 2015, says Savills, while Knight Frank reports a "notable strengthening" of demand for prime London rental properties

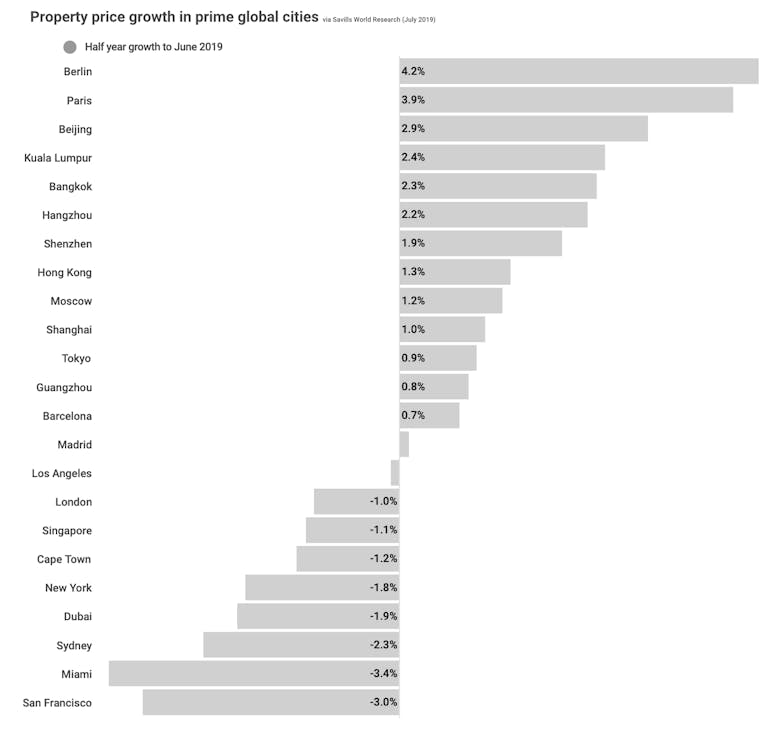

Berlin & Paris lead price growth as global prime resi markets slow

Average per square foot values in global prime cities trickled up by just 0.7% in the last year, says Savills. This compares to an annual increase of 5.1% in the year to June 2018...

Mapped: East & North-West boroughs drive London’s new housing pipeline growth

Planning and development activity in the capital has 'remained stoic' in the face of uncertainty, says Kinleigh Folkard & Hayward

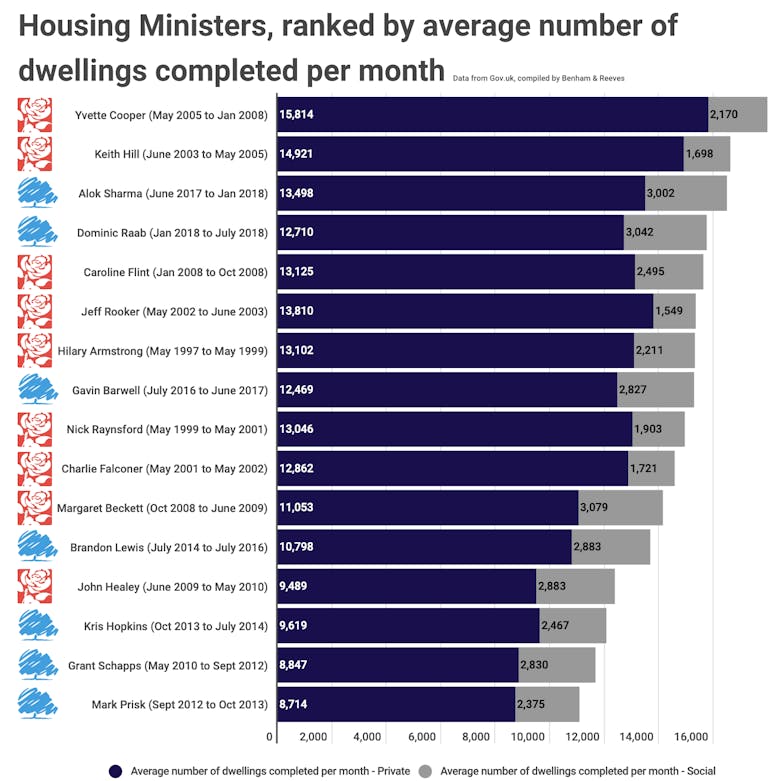

British Housing Ministers, ranked by their track record of delivering new homes

There have been 17 different Housing Ministers in the last 20 years, but who delivered the most new homes?

New buyer interest rises for the first time since November 2016

The UK property market appears to be stabilising, says the Royal Institute of Chartered Surveyors

World’s wealthiest take a financial hit, ending seven years of growth

The world's wealthiest individuals lost 3% of their combined net worth in 2018; Britain's HNW set lost 6%

Prime London sees a ‘surprise return of competitive bidding & even a few sealed bids’

But sentiment remains 'fragile' as political uncertainty continues to put the brakes on prime residential property markets, says Savills

Infography: PCL property has outperformed other assets over the last 30 years

A £100 investment in PCL property in 1989 would now be worth £575, according to Knight Frank's sums, while the same stake in the FTSE 100 or Gold would be worth £351 and £338 respectively

73% of buy-to-let investors still think the sector is the best long-term investment

83% of investors say it is either unlikely or very unlikely that they will sell their buy-to-let property within the next year, with the majority (58%) staying put for five years

Charting the price of a top 1% home across the UK

'The difference in the cost of the top 1% of homes by region just might come as a surprise,' says Savills' research chief Lucian Cook

More than one in ten British adults own multiple properties, claims report

11.2% of the population owns more than one property, says the Resolution Foundation.