Forecasts

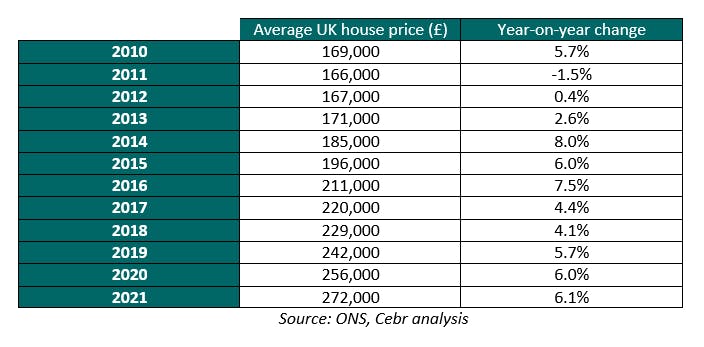

UK prices to keep on rising despite Brexit jitters – CEBR

Research unit forecasts two years of sub 5% growth before a pick up in 2019

UK house price growth likely to slow to 3.5% in 2017

London will pick up in the second half of the year, says Lancaster University's Housing Market Observatory

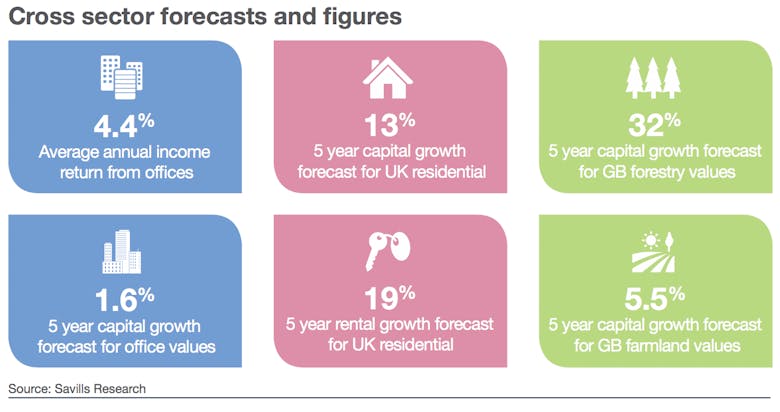

Best Guesses: A selection of five-year property price forecasts

What's in store for house price inflation in PCL and across the country?

Central London property prices to drop by 5% in 2017 – Rightmove

UK-wide and outer London prices to nudge up as the inner capital's "price bubble continues to deflate"

UK house prices to nudge up by 2% next year, but London likely to fall – Reuters

London property prices to dip by 0.5% in 2017, according to a poll of economists, estate agents and brokers

Lucian Cook’s six key themes for the resi property sector in 2017 and beyond

"Expect the unexpected" says Savills, but "life in the property world goes on" despite 2016's series of seismic shocks

FORECAST: ‘Remarkably resilient’ property market to see price growth slow to 6.5% in 2017 – Chestertons

Agency's five-year predictions indicate that prime London is about to pick up again

FORECAST: ‘Significantly lower transaction levels’ but prime markets to out-perform over five years

No price correction predicted, although "there is no precedent for the current market" says Savills research chief

FORECAST: PCL property prices could be 12% down by 2020, while UK-wide values soar 24%

Strutt & Parker hedges five-year market predictions for Prime Central London with best case/worst case scenarios

FORECAST: UK to see 11% fall in transactions next year – JLL

Housing market to be 'more subdued' over the next 2-3 years as Brexit negotiations dominate proceedings; most of the price declines in PCL have now 'washed through', says the firm

‘Meagre growth’ of the UHNW population, but wealth expected to grow by 9% a year

The richest 0.004% of the world's population controls 12% of total global wealth

‘Worst forecasts appear to have been avoided’ as activity levels rise in prime central London

Prices struggling - especially in Chelsea - but interesting things are happening on the ground, reports Knight Frank