Mortgage lending rises back above pre-pandemic levels

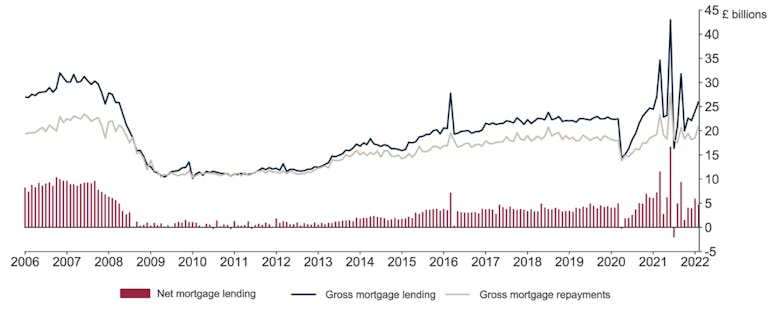

Net borrowing of mortgage debt by individuals increased to £7.4bn in May from £4.2bn in April, according to the Bank of England's Money & Credit data. This is above the pre-pandemic average of £4.3bn in the 12 months up to February 2020.

Mortgage lending stays well-above pre-pandemic norms

The latest Bank of England data show a slight drop in mortgage approvals.

Mortgage approvals slip but remain above pre-pandemic levels

“After the roller-coaster ride of the stamp duty holiday, activity levels in the UK housing market will feel tame by comparison in the final months of this year," says Knight Frank research chief Tom…

By PrimeResi

Mortgage lending drops, ‘confirming that the froth has come out of the market’

The average mortgage value was £235,474 in February - a significant 4.6% higher than the previous month, and 10.4% up one the year.

Most read

IWD2026: Prime resi industry leaders on the moments that changed everything

To mark International Women’s Day, senior figures from across the sector reflect on the decisions, risks & pivots that shaped their lives & careers - from ‘sliding doors’ moments to leaps of faith.

The New 2% Club: Jamie Hope on pricing in Prime Central London’s leaner market

The era of the ‘comfortable 10% cushion’ is over, says boutique agency boss - today’s market rewards accuracy, not optimism.

By Jamie Hope

High-profile private members club seeks Branded Residences Director

Soho House reveals it is 'launching a new Branded Residences vertical.'

By PrimeResi

Super-prime rental deals surge in London

£5,000-per-week-plus tenancies up 8% year-on-year as internationally mobile tenants prioritise flexibility.

Tom Bill: How the Middle East conflict could affect the UK housing market

Rising energy prices and shifting rate expectations could reshape mortgage costs and buyer sentiment, explains Knight Frank’s head of UK resi research.

By Tom Bill

Banking heavyweight flags postcode divergence across Prime London market

Buying conditions are ‘favourable’, says Investec, as analysis points to opportunity across three key districts.

In Pictures: One of London’s oldest houses comes to market

Rare 17th-century survivor just off the Strand recently returned to resi use.

Top-end country agency lines up £80mn of stock as selling season starts early

The Private Office founder Trevor Kearney cites 'quiet confidence' as some very high-end Surrey residences are brought to market.

Big-brand agency franchise in PCL goes up for sale

Winkworth is seeking an 'entrepreneurial property expert' to take over the established hub in one of the capital’s top HNW hotspots.

These three buyer profiles are driving Prime London demand in 2026

Tenants, repatriates and pied-à-terre buyers have come to the fore as hefty transaction costs stall traditional upsizers, reports Eccord's Jo Eccles.

By Jo Eccles

LATEST ARTICLES

Ranked: Britain’s most expensive streets in 2026

Rightmove's analysis is based on asking prices, and only includes addresses with at least five open-market listings in January.

By PrimeResi

Connells deal delivers major listings boost for OnTheMarket

Nearly 100,000 properties from the UK’s largest estate agency group headed to the CoStar-owned portal.

Interview: Michael S. Liebowitz on Douglas Elliman’s global push – and what brokers need to know about today’s UHNW clients

The US brokerage chief on what American and European markets can learn from each other, choosing the right local partners and London’s role as a global hub.

D&G adds new central London partner

Lettings specialist Sharlotte Cooper previously ranked among Hamptons’ top performers.

Rupert des Forges: ‘London is becoming a dip-in, dip-out city for the super-rich’

'The capital might not be [UHNWI's] full-time base any more,' says Knight Frank veteran, 'but it is still an anchor for social & business life.'

By PrimeResi