Mike Boles: Mortgage rates may be rising but borrowing remains attractive

As the cost of living rises at its fastest rate in 30 years and the Bank of England warns that inflation may hit 8 per cent, possibly higher, it’s unsurprising that interest rates are also edging upwards. SPF Private Office's Mike Boles explains what it means for borrowers…

Mike Boles is head of SPF Private Office offering advice on mortgages, insurance and wealth management to high-net-worth individuals and their families around the globe.

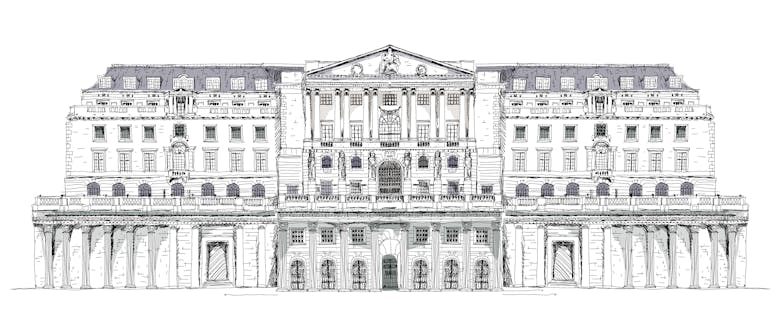

BoE considers withdrawal of mortgage affordability test, as rates set to rise

“Letting people borrow more money looks like a risky move at a time when house prices are sky high and the outlook is uncertain," comments one analyst as the Bank of England opens a consultation on loosening…

BoE raises interest rates to a 13-year high

The Bank of England expects interest rates to climb to around 2.5% by mid-2023.

Mortgage lending stays well-above pre-pandemic norms

The latest Bank of England data show a slight drop in mortgage approvals.

Companies in this article

SPF Private ClientsMost read

Savills launches London-based Spanish desk

Maria Santurio to lead new hub connecting global clients with key markets across Spain.

Fund snaps up Foster + Partners scheme in major Mayfair swoop

The £1.1bn investment play includes a key development site between Barlow Place and Grafton Street, along with a high-profile Grosvenor Square hotel.

A Reflection of Change: Harry Dawes on how PCL agency has evolved

A seasoned London agent reflects on market cycles, career paths and the rise of alternative models.

By Harry Dawes

New leadership for the Savills Private Office

Rory McMullen joins Alex Christian as co-head of the property consultancy's specialist global HNW team.

By PrimeResi

Jennings steps up to lead Chestertons’ resi business

Adam Jennings has been promoted to Head of Residential, in charge of the London estate agency's sales & lettings teams.

By PrimeResi

In Pictures: Canal-side mansion in Little Venice seeks £16.5mn

Grade II listed stonker on Blomfield Road is the complete package, say agents.

‘Our task was to act as both storyteller & swordsmith’: On reuniting two Belgravia townhouses into a grand family home

Tiam Architects walk us through a big project on Chester Row.

By PrimeResi

Anatomy of a market: Prime Central London explained in 10 charts

A data-led look at activity and pricing across the capital's £3mn-plus sector.

Agent showcase marks next sales push at The Lucan

Chelsea’s Marriott-branded residences enter final release with more than half sold.

The main risk for the housing market now is political – Knight Frank

Lower mortgage rates should underpin demand, but this week's by-election outcome may shape sentiment, explains the agency's head of UK resi research Tom Bill.

By Tom Bill

LATEST ARTICLES

Success storeys: Top four development sales launches of last year revealed

Difficult market conditions haven't held these 'landmark' central London schemes back.

Prime property listening: five industry podcasts worth tuning into

Catch up on conversations with resi insiders in PrimeResi's regular round-up, featuring episodes from Knight Frank, Russell Simpson, Strutt & Parker & more...

Prime London Property Market Snapshot: Week 08, 2026

Agreed sales volumes dwindle further.

By PrimeResi

Rightmove reveals its ‘next phase of AI innovation’

Property portal to launch ChatGPT app.

By PrimeResi

Sales listings hit decade high – Zoopla

Rising supply is keeping price inflation in check, reports property portal, as more accessible mortgages bolster mainstream market activity.

By PrimeResi