Location: United Kingdom

‘A sense of momentum’ returns to London’s super-prime market

"A sense of momentum is returning" to London's £10m+ super-prime property market, says Knight Frank, despite deal numbers tumbling in 2015.

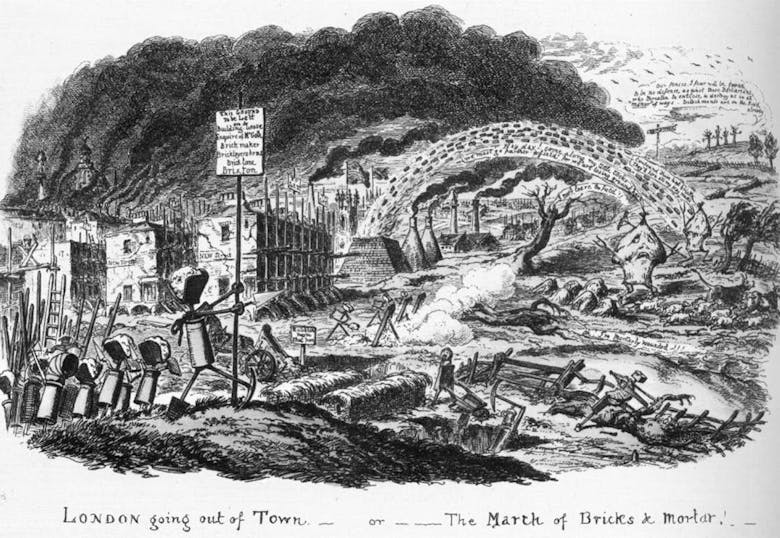

The Consultation is Over: A view of the London property market post-April

As the Government decides whether to press on with the proposals announced in November's Autumn Statement, David Hannah paints a bleak picture of the capital under the cosh of higher stamp duty costs...

Green light for Crown Estate scheme in Wiltshire

The Crown Estate's plans for a major new scheme in Marlborough have been given the thumbs-up by Wiltshire Council.

Qatari Diar & Canary Wharf Group unveil next phase of Southbank Place

Canary Wharf Group and Qatari Diar are gearing up to launch the next tranche of units at Southbank Place, their £1.3 billion transformation of the 5.2-acre Shell Centre site.

One-beds ‘leading the way’ in Prime London

One-beds are pretty much driving the sales and lettings markets in Prime London at the moment, according to the latest stats from Marsh & Parsons.

This type of stock recorded a 3.

Lutti gets the go-ahead for £17m Great Portland Street scheme

Residential design / development firm Lutti has won planning permission for a mixed-use scheme with eight apartments on Great Portland Street, W1.

Zoopla Property Group upsizes to new HQ

Zoopla Property Group, the owner of Zoopla, uSwitch and PrimeLocation, has just signed a lease for a new headquarters next to Tower Bridge.

TWCL debuts Palace View scheme

A new development overlooking the Archbishop of Canterbury’s London gaff has hit the market today.

UK stamp duty revenues suffer as Osborne throttles the golden goose

With the Institute for Fiscal Studies now warning that the Government will struggle to meet its target of balancing the books by 2019-20, Knight Frank has taken a proper look at how the new stamp duty…

Investor buys up entire development in Waterloo

A Chinese investor has swooped on a luxury mixed-use scheme in London's Waterloo, picking up all nine resi units and two floors of commercial space for £15m.

Retirement lender launches specialist HNW equity release service

Bower Retirement has a launched a specialist arm - which it's claiming as an industry first - to deal with demand for high net worth equity release, focusing on £1m+ mortgage-free homes.

Coldwell Banker amps up the search for 100 UK franchisees

High-end American real estate juggernaut Coldwell Banker is officially rolling into Blighty in just a few weeks' time, and is already souping up its search for additional franchisees to "become an estate…