Location: Midlands

Argent makes six new senior appointments

As Roger Madelin, Jim Prower and Tony Giddings move on, King's Cross developer Argent has made some changes to its senior management team.

Superhome Improvements: Ten additions that ‘make a property ultra-prime’

These, according to one firm, are the ten key features that take a property into the ultra-prime league (and help it sell "up to 30% faster").

Number of Londoners leaving the capital hits eight-year high

Londoners bought 63,000 homes outside the capital last year, a chunky increase on 2014's figure of 38,000.

All We Want For Christmas: Deconstructing the perfect festive house

Everyone has their own idea of what makes the ideal Christmas pad, but in our book you need an impressive hallway for receiving guests, a proper cook's kitchen, a bar serving top-notch tipples, an epic…

Georgian Group Architectural Awards 2015: The Winners

The restoration of Belmont House in Lyme Regis, where John Fowles wrote The French Lieutenant’s Woman, Quinlan and Francis Terry Architects' remarkable Kilboy (below), and Capability Brown’s landscape…

Millionaires’ Rows: The 50 most expensive streets in England & Wales, mapped

All but one of the country's 50 most expensive streets are in the South East of England, says Lloyds Bank

Property stock levels slip to record low as new instructions fall again

The number of properties on surveyor’s books reached a new low in November, says the RICS, as prices continue to rise at a "firm pace" and transaction levels stay flat.

Will Government announcement signal rush of council-owned properties for sale?

For developers, changes announced in November's Spending Review signal a huge opportunity.

Grade Union: Understanding listed property owners and the value of heritage

Repair and maintenance on historic buildings in England accounted for 10% of the total value of the construction industry in 2010, and heritage tourism represented 2% of the UK’s GDP in 2011, says Historic England…

Change at the top for St Modwen’s resi operations

St. Modwen, the property developer and regeneration specialist behind New Covent Garden and Wembley Central, has made a couple of changes to its senior residential team.

Savills launches major Edgbaston development site

A prominent prime development opp has come up within a hook shot of Edgbaston cricket ground in Birmingham.

Warwickshire County Cricket Club and the Homes and Communities Agency have brought the 6.

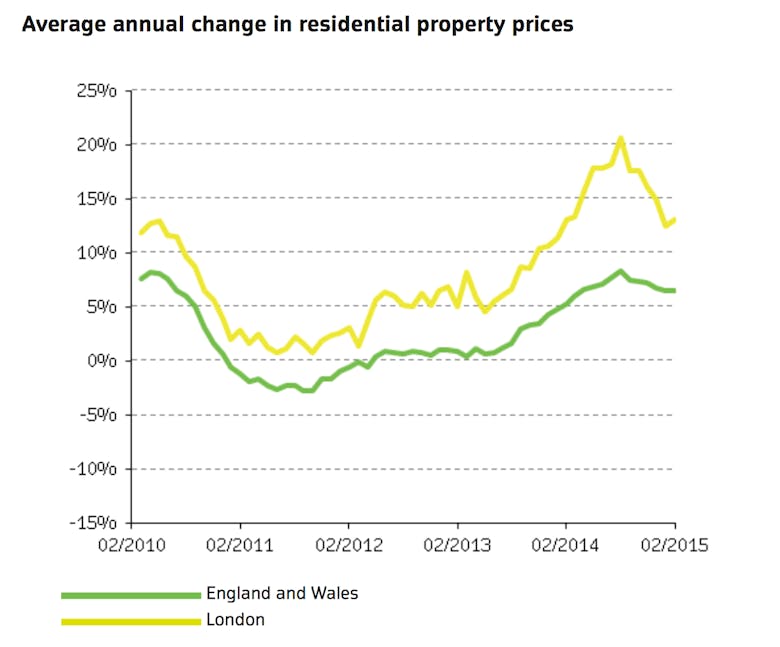

The average London property price tops £500k – Land Registry

Prices across the country nudged up by 0.4% in the last month, while London values increased by 1.