Location: London

Rising house prices drive planning applications up in London

The volume of planning applications for lofts and extensions in the capital has risen hand-in-hand with house prices, notes Landmark Lofts, with Richmond-upon-Thames coming out on top with the highest…

Global luxury property prices now 46% up on 2009’s low-point

Global prime residential property prices increased by 3.9% in the year to March 2015, according to Knight Frank's index, with North America and Australia pulling up the rest of the world.

Omni lends £55m ‘holding bridge’ for super-prime London resi scheme

Christian Candy-backed short term real estate lender Omni Capital has provided a chunky £55m "holding bridge" in advance of proposed development work on residential premises in super-prime central London.

Election Special: The prime property industry holds its breath

We don't need Jon Snow to tell us which way the property industry's election swingometer is headed;

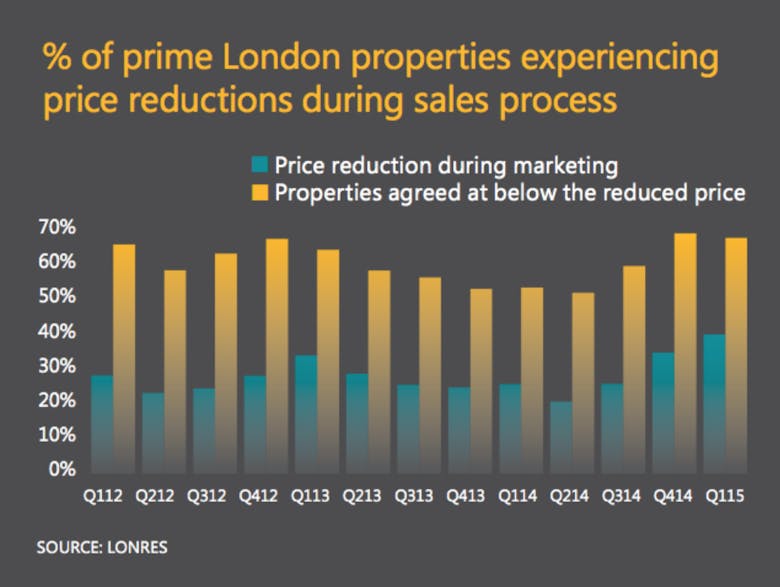

Property Price Wars: Prime London buyers haggling average £178k off asking

While the market remains subdued, both as a result of extensive price rises over 2014 and it being an election year, realistic pricing of properties is crucial, as these findings by Lonres clearly demonstrate...

Estate agents limber up for 10k charity race

After the runaway success of the first "London Estate Agents 10k Race" last year, Housing for Women has announced details of this year's event, which is aiming to raise £20k to help provide accommodation…

‘Pent up demand’ building in PCL as election nears – Knight Frank

Prime central London's property market - especially the £2m+ segment - has been in lockdown for the last month, says Knight Frank, as annual price growth hits a five year low and both vendors and househunters…

PCL rents rise faster than house prices – Knight Frank

Rents in prime central London saw their biggest increase in six months in April, rising by 0.5% to take a values increased by 0.5% in April, annual growth to 4.1% - a four-year high.

That +0.

Survival of the Fittings: On London’s luxury lettings market

Prime central London rents have risen year-on-year, but levels of tenant demand are falling on all but the highest quality and best presented properties, says Lucy Morton...

Oxford and Cambridge outperform as Londoners capitalise on house price gap

Uncertainty may be ruling the roost in London’s housing market, but it's a different story in other parts of the country, notes top buying agency Garrington.

Duty Bound: On the aftermath of Osborne’s SDLT reforms

Historically, SDLT rate changes have corrected themselves in the market through a natural process of adjustment;

Bricking It: Election outcomes & the UK property market

Cutting through the proverbial, Beauchamp Estates has distilled the four most probable scenarios we can expect to see emerge from Thursday's General Election, and predicted how each will impact the…