Location: Australasia

Knight Frank upbeat as activity levels improve

Full year results show 4% rise in turnover but 4.7% fall in pre-tax profits

Golden Week: How much do British agents really know about Chinese buyers?

One in ten think Kim Jong Un is the president of China, according to new survey

Luckiest Number: Chinese investors pay $88,888,888.88 for Sydney scheme

'They just chose these numbers for luck and as it turned out their luck was with them'

Interview: Oona Collins on leadership and success in property

Meet the inspirational executive coach behind some of the biggest names in real estate

‘Probably the best Modern house in the world’ goes up for sale

Modern classic designed by Sydney Opera House architect Jorn Utzon

RIBA appoints new Chief Executive

Alan Vallance steps up from interim to official Chief Exec

Snap Or 12-Dimensional Chess: Which game would you prefer your agent to play?

Legendary agency boss explains why his firm's full-service approach delivers results

Ranked: Spain’s most expensive streets

Hernani Street in San Sebastián named the most expensive city address

Ten projects from one of London’s most creative luxury architecture & design firms

Multidisciplinary practice Studio Indigo has been the creative force behind some of the most innovative, individual and inspiring residential schemes of recent years

Global house prices ‘almost back up to where they were at the start of 2007’

Global house prices are, on average, "almost back up to where they were at the start of 2007" trumpets the International Monetary Fund with its latest index.

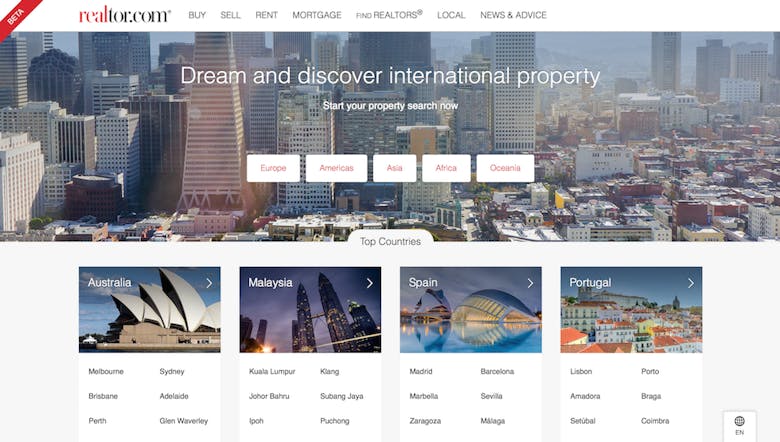

International property portals team up to offer global mega-listing network

International uber-network

Vancouver brings in 15% non-resident tax to put the brakes on the property market

The British Columbia Government in Canada has rubber-stamped a 15% levy on foreign buyers of Vancouver property, in a bid to thwart spiralling house prices - but it's given the industry just eight days'…