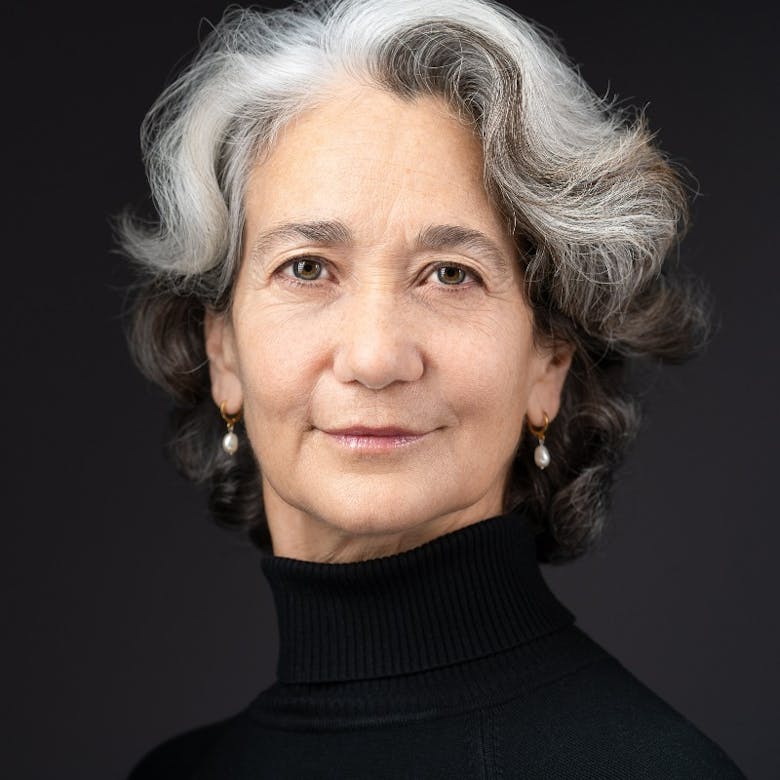

“As an interior designer it is critical to be able to demonstrate a robust understanding of your AML obligations as well as the risks of the business during an HMRC Intervention,” says Rena Neville, Lead Consultant in FCS Compliance’s art division.

Ahead of our free webinar event on Monday, Neville sat down with PrimeResi to discuss her distinguished career fighting fraud in the art market in New York and London, and exploring what interior designers need to know about the UK’s AML regulations…

BOOK NOW: Monday 27th March 2022

AML Compliance Guidance for Interior Designers

Art market AML guidance with Rena Neville of FCS Compliance: Are you bound by the same UK Anti-Money Laundering Regulation as the art market?

- What: Live webinar event

- When: Monday, 27th March 2023, 10:00 – 11:00 GMT

- Where: Online

- Cost: Free

- Find out more: Here

Interview: Rena Neville on fraud in the art world & what interior designers need to know about AML

Before joining FCS, you spent 30 years at leading art auction house Sotheby’s – where you became the firm’s first Global Compliance Director. What was the impetus for the creation of this role?

The impetus for setting up the first art market compliance department at Sotheby’s came about as a recommendation by the Sotheby’s Board of Directors. The recommendation was the culmination of an intensive, global, year-long Internal Review in 1997.

A series of scandalous headlines based on a journalist’s five-year investigation into questionable art and auction world practices led the Sotheby’s Board to conduct the Internal Review. The Board’s recommendation was a bold and forward-thinking move.

You gained your legal qualifications and spent a number of years working in New York; how does the compliance landscape differ between the UK and USA?

The major difference is that the UK fine art market falls squarely within the Money Laundering Regulatory scheme. This isn’t the case in the US. The fine art market there does not fall within the scope of US Money Laundering Regulations, unlike traders of antiquities in the US, who do.

Is criminal finance a growing problem in the art world, or are recent legislation/government clamp-downs improving things?

That’s the million dollar question!

While there is no comprehensive, reliable data on money laundering activity in the art market, the sector was the subject of a global anti-money laundering (AML) report earlier this year. The report was published by the Financial Action Task Force (FATF), the most well respected global, inter-governmental, AML watch dog.

However the FATF Report included only anecdotal data, and just 40 examples of money laundering (ML) in the art market, from approximately 19 countries. Of those examples, over half involved fine art, as opposed to approximately a dozen related to antiquities. Other individual examples mentioned, implicated NFTs (or digital tokens).

Are all interior designers required to comply with UK money laundering regulations?

Not at all. Only certain interior designers, but most especially those transacting in particular works of art, such as paintings, some prints and photographs and sculpture.

What are the key legal/compliance requirements for interior designers acquiring artworks on behalf of clients?

Once the UK Money Laundering Regulations are triggered, interior designers are bound by the Regulations in the same way as other regulated entities, such as bankers or lawyers.

Although the day-to-day requirement is primarily carrying out customer due diligence (CDD), CDD is in fact just one of many key AML compliance obligations, which include such duties as having a written risk assessment, adopting an AML Policy, conducting staff training, following specific record keeping obligations, etc.

What are the potential repercussions for non-compliance?

HMRC have many enforcement weapons in their arsenal, from warning letters to fines and penalties and the most serious of all, criminal prosecution.

HMRC also post publicly on the internet what I call their “name and shame” list that includes those regulated entities who have failed to register, or failed to pass an HMRC Intervention, commonly known as an audit.

Can you talk us through what happens in a typical HMRC “intervention” with an art market intermediary or interior designer over potential money laundering?

A typical HMRC Intervention starts with a phone call or letter, which is followed with an in-person meeting during which HMRC “test” the knowledge of the staff’s understanding of their AML obligations and their implementation of those obligations. These meetings usually last from five to eight hours; and occur within four weeks from the date of first contact.

An atypical inspection? One without warning!

What are some of the less obvious red flags that luxury property professionals and interior designers should look out for, that may signal a client is a compliance risk?

Many in the art market are not attuned to the risks of third party payments or third party deliveries for works of art. The gold standard is to ensure consistency among: the identity of the party named on the invoice, the party from whose bank account payment is made; and the party to whom a work of art is delivered.

You must have dealt with some *interesting* characters and scenarios during your career so far; can you share any stories about when effective compliance thwarted money laundering?

One rather endearing story: we had an art advisor with a very private, wealthy, elegant Swiss collector who was in her 80s. When she was asked to provide her passport, the answer was “Never! then you would know how old I am!”

For another client, we were investigating the ownership of various trusts, that seemed to be connected to a sanctioned Russian individual. His name was nowhere to be found, but with further digging, we realised the settlers were his godchildren.

Do you have any additional tips for interior designers to protect their businesses from dealing with corrupt finance or criminal clients?

Knowing a client personally and having a good feeling about them is sadly not sufficient. My two top tips: make sure you are truly familiar with “red flags” and second, have what we call a “tech tool” to carry out comprehensive scrapes of global data bases – these will alert you to the more obscure red flags.

Our upcoming FCS/PrimeResi webinar (on 27th March) will provide essential training and insights for interior designers and other art market intermediaries on AML and compliance matters; what are some of the frequently-asked questions that you will be addressing?

Do I need to register at all?

If part of the business is subject to the ML Regulations, is the whole business?

When do I actually need to do customer due diligence?

Book your free webinar place now

Check PrimeResi’s new Compliance Hub for more on AML: primeresi.com/resources/compliance-hub