High inflation ‘lures investors back to buy-to-let’

Buy-to-let investors were behind 13.9% of homes sales across Great Britain in Q1 2022, says Hamptons - the highest proportion at this time of year since Stamp Duty changes in 2016.

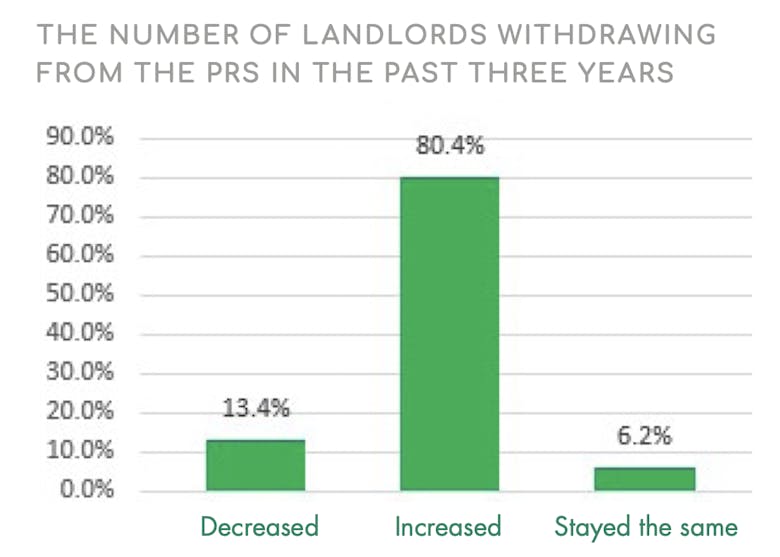

Private rental stock has dropped by half since 2019 as landlords exit the market

Estate agency branches had an average of 15.6 properties available to rent in March this year, says Propertymark, down from 30.4 in March 2019.

‘Most competitive rental market ever’ drives record rental price inflation

Average asking rents have risen by over 20% in Central London over the last year, and by 11% outside of the capital.

Buy-to-let incorporations reach an all-time high as tax changes bite

The latest Hamptons index tells us that the national rate of rental price inflation ticked up sharply towards the end of 2020. The annual rate jumped from 1.4% in October to 4.1% in December.

Most read

Fund snaps up Foster + Partners scheme in major Mayfair swoop

The £1.1bn investment play includes a key development site between Barlow Place and Grafton Street, along with a high-profile Grosvenor Square hotel.

New leadership for the Savills Private Office

Rory McMullen joins Alex Christian as co-head of the property consultancy's specialist global HNW team.

By PrimeResi

Interview: Inside Strutt & Parker’s big bet on a ‘hybrid’ broker model

Exclusive: Sales chief Claire Reynolds explains how the agency's new brokerage will operate alongside traditional offices, what the move could unlock, and what it says about the industry’s evolution.

Jennings steps up to lead Chestertons’ resi business

Adam Jennings has been promoted to Head of Residential, in charge of the London estate agency's sales & lettings teams.

By PrimeResi

Forbes Gilbert-Green lands Property Vision veteran Connell

Seasoned London buying agent joins boutique property advisory firm after two decades at PV.

St James’s Square trophy emerges from five-year ultra-luxe overhaul

Developer Henigman says freehold Lutyens mansion offers 'rare, generational opportunity to own one of the world’s finest residences'.

In Pictures: Canal-side mansion in Little Venice seeks £16.5mn

Grade II listed stonker on Blomfield Road is the complete package, say agents.

Success storeys: Top four development sales launches of last year revealed

Difficult market conditions haven't held these 'landmark' central London schemes back.

Property prices are already ‘bunching’ around new mansion tax thresholds

'Some sellers are adjusting asking prices downwards,' reports big agency, as pricing strategies adapt to keep properties below the £2mn mark.

By PrimeResi

Anatomy of a market: Prime Central London explained in 10 charts

A data-led look at activity and pricing across the capital's £3mn-plus sector.

LATEST ARTICLES

Interview: Inside Strutt & Parker’s big bet on a ‘hybrid’ broker model

Exclusive: Sales chief Claire Reynolds explains how the agency's new brokerage will operate alongside traditional offices, what the move could unlock, and what it says about the industry’s evolution.

Industry reacts as UK resi transactions show early-year slowdown

Volumes were 5% below the five-year average in January as Budget implications continued to reverberate - but analysts expect activity will recover in the coming months.

In Pictures: ‘World-renowned’ Scottish estate seeks £67mn

Tulchan is one of the great Highland estates. 'The opportunity it offers is unmatched in Scotland today,' says Savills.

By PrimeResi

Weekly Showcase: Ten featured prime resi listings

PrimeResi's regular stock check, powered by LonRes

Rightmove profits rise 9% as agents spend more

Property portal reports 'strong operational & financial performance' in 2025 - but the Plc could soon fall out of the FTSE 100.

By PrimeResi