Sales

Mortgage approvals drop as home-movers sit tight

3.6% fewer home-mover mortgages were approved in June compared to the same month last year, according to the latest update from trade body UK Finance

Scotland’s country house market slips for the first time in two years

Knight Frank flags up a change in direction for price growth over the border, along with a big fall in the number of high-end instructions

Battersea Power Station sales ‘are running at £10 million a month’

SW London's £9bn development project seems to be getting back on track, as sales volumes and values climb back to 2017 levels

London’s property downturn has now lasted longer than during the Global Financial Crisis

Annual house price growth in London has been in negative territory for 16 consecutive months, according to the official UK HPI.

London’s new-build market suffers as starts, completions and sales tumble

Construction starts in London totalled just 3,400 units in Q2, according to Molior, well down on last year's quarterly average of 5,800;

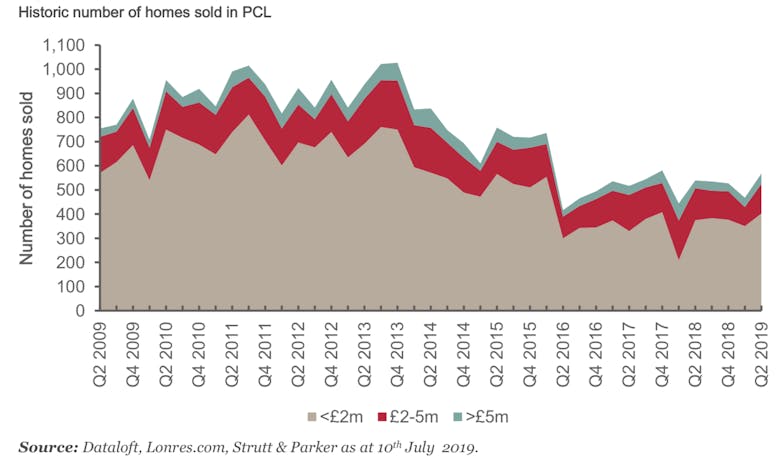

‘Transaction levels indicate that the markets are relatively stable during this time of economic & political uncertainty’ – Strutt & Parker

Transaction volumes in PCL grew by 5.3% from H1 2018 to H1 2019, says Strutt & Parker, driven by a quite dramatic surge in activity under £2m

The Homemover Wave: Understanding consumer behaviour during the moving process

The UK's homemovers spend an extraordinary £12bn each year on consumer goods whilst going through the process, according to new research by TwentyCi;

‘Remarkable’ decline in genuine live/work options across London

Gentrification and Permitted Development have reduced supply levels to a handful of options each year, according to specialist warehouse agency London Lofts

Ranked: Britain’s top towns for student housing investment

"Student housing is the most mature of the UK’s purpose-built rentalised residential markets," says Savills, offering up some First Class opportunities for property developers and investors - but it’s…

The PCL sales market bear run looks to be nearing an end – JLL

Things are 'gradually turning a corner', says the agency, after recording an upturn in transaction levels and instructions, and price declines slowing across London's most expensive postcodes...

Average time taken to sell in England & Wales rises to 60 days

The average period between initial marketing and securing a buyer was a mere 36 days back in 2014...

Surveyors return to pessimism as the property market flatlines – RICS

"The latest RICS results will provide little comfort for the market," says Chief Economist Simon Rubinsohn, "with all the key indicators pretty much flatlining"