Sales

Housing market rallies to highest spending level since the Global Financial Crisis

New estimates show the extent to which spending in the housing market has bounced back from the pandemic.

Central London property transactions jump – but buyers remain ‘cautious & price-sensitive’

Winkworth has reported a 48% surge in central London buying activity (15% ahead of the five-year average), but still describes the market as "muted".

‘City centre locations and flats are staging a comeback in the housing market’ – Rightmove

Demand for flats and urban locations are rising at a faster pace than for other types of property.

Crossrail property prices likely to ‘continue to climb’ despite delays

"We expect to see house prices along the Crossrail route continue to climb as its launch approaches," says Marc von Grundherr of Benham and Reeves.

House price inflation rises to highest rate since August 2007 – UK HPI

The annual rate of UK property price inflation climbed to 10.2% in March, according to official data.

April 2021 ‘may well mark the bottom of the prime London housing market’

The capital’s prime housing market has proven ‘remarkably resilient’, reports LonRes, and demand is expected to increase as the capital reawakens...

What’s next for prime markets? Eight factors shaping the top end of the UK’s property market

A year after the pandemic struck, Savills is "optimistic" about the outlook for Britain's prime property markets...

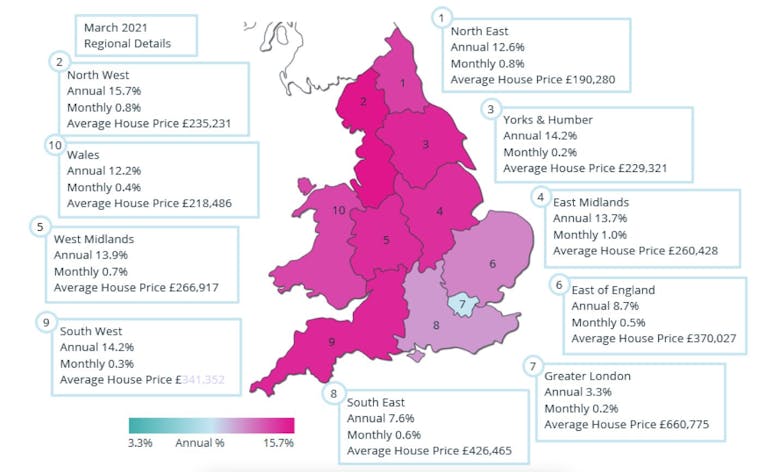

Heatmapped: North West overtakes South West as nation’s hottest property market

Annual price inflation in the North West is now running at 15.7%, reports Acadata.

‘Best & final offers is becoming standard’ for top-tier country homes

“Best and final offers have become much more common place over recent months," say property agents in Devon and Cornwall.

Average asking prices reach another record high

Three regions have seen asking prices climb by more than 10% in the last year-or-so, says Rightmove, while Greater London has seen prices flatline.

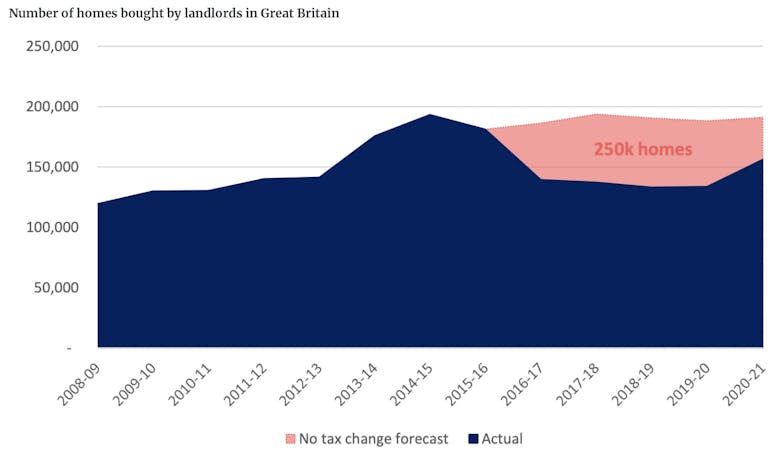

Five years on: How 2016’s tax changes have shrunk the buy-to-let market

“The tax changes introduced from 2016 onwards have undoubtedly taken the heat out of the buy-to-let market," argues Hamptons' research chief Aneisha Beveridge.

Market sentiment has moved from one of cautious optimism to outright positivity – Strutt & Parker

'To think that this activity continues in the midst of a global pandemic is completely astounding', says the national agency, retaining its previous prediction of 5% best-case scenario growth in 2021.